ECB cheat sheet: Difficult to pull away from the Fed

The European Central Bank looks set to deliver at least two more hikes in this cycle. EUR swap forwards roughly agree with our forecast but EUR rates can only de-couple from their USD equivalents for so long. We see some downside risks for EUR/USD ahead of a 25bp compromise hike by the ECB this week, especially after the FOMC risk event.

No clear mispricing at the front-end of the EUR curve

Assuming the upcoming inflation data and Bank Lending Survey (BLS) don’t give more ammunition to the hawks, the 25bp ‘compromise hike’ shifts the focus to how long the current hiking cycle will go on. We think one more hike after this week’s, but markets are open to a further additional hike, presumably in July. From there, the curve implies pressure on the ECB to reverse these hikes will build pretty much immediately, likely due to Federal Reserve rate cut expectations. This is where the greatest difference with our own view lies. The end of the Fed’s own hiking cycle and the rise in EUR/USD (see next section) certainly lessens the pressure on the ECB to keep hiking past the summer, but core inflation won’t allow it to cut until at least the second half of 2024.

The above doesn’t translate into a clear signal for EUR rates with forwards slightly above our forecast in the near term and slightly below next year. Instead, what should increasingly drive the level of long-end interest rates is expectations about how far the ECB will cut rates in the next cycle. Barring a severe recession, our view – and the market’s – is that this cutting cycle will prove a shallow one, with the deposit rate stabilising at 2.5%. As usual this is, in effect, an average of two scenarios, one where the ECB cuts rates aggressively, and one where inflation prevents it from cutting altogether.

The swap curve implies that the room for the ECB to cut rates is limited

Source: Refinitiv, ING

… but pay attention to the downside risk at longer tenors

Given growing recession fears in the US, and doubts about the banking system’s ability to provide credit to the economy, we think the downside scenario warrants more attention. In a world where the ECB were to cut interest rates all the way down to zero by end-2025, even followed by a slow hiking cycle afterwards, we would see 5Y and 10Y swap rates bottom between 1.5% and 2% in the second half of 2024. This compares to a trough of around 2.5% and 3% in our base case.

Of course, the above is an extreme scenario but it illustrates the downside risk to European rates in the coming months as the Fed ends its hiking cycle, and shifts to easing. The crucial question is to what extent European rates can decouple from their US counterparts. Our view is that the ECB will keep rates at their peak for around a year before cutting them, but this won’t prevent forwards from pricing more and more aggressive rate cuts, the way the US curve has done in anticipation of rate cuts starting in 2023.

Note that the above estimate differs from its historical relationship. In our view, only in the most dire economic scenario would swap rates return to the sub-1.5% area as markets have durably shifted higher their estimate of the long-term neutral interest rates. This means that, in the same way that the higher the peak, the more subsequent cuts the curve implies so the deeper the bottom in the future cutting cycle, the more hikes the market will imply.

Sharper rate cut expectations would send swap rates down but not as low as in the previous cycle

Source: Refinitiv, ING

FX: Moderate downside risks for EUR/USD

From an FX perspective, we need to assess the impact on EUR/USD given the combination of both the Fed (Wednesday) and the ECB (Thursday) policy announcements. If our baseline scenario for both central banks proves right, we would see the Fed hike by 25bp and say that rate increases “may yet be appropriate” (here is our full FOMC preview), and the ECB follow with the same rate increase, stick to data dependency but hint at more tightening. Rate expectations indicate that markets are convinced this will be the peak of the Fed’s tightening cycle and price in around 50bp of cuts by year-end, while the ECB is expected to hike by another 50bp after this week’s increase and keep rates at the peak at least into year-end. This means that the bar for a hawkish surprise by the ECB is significantly higher, and we suspect President Christine Lagarde and her colleagues would probably struggle to exceed hawkish expectations.

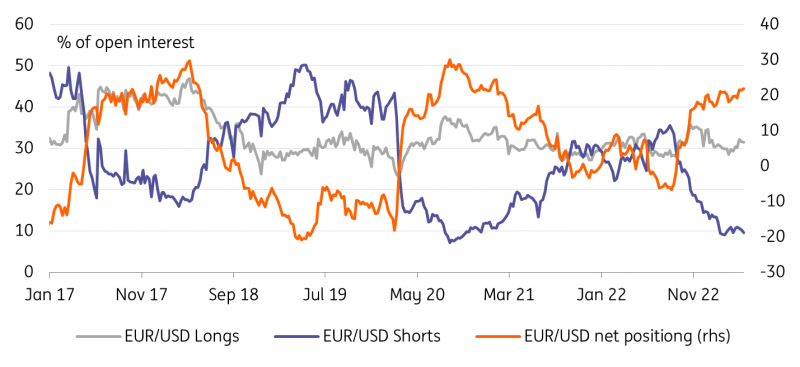

Incidentally, EUR/USD positioning has been quite stretched on the long side lately, which points to some short-term upside resistance for the pair. EUR/USD net long positions were worth 22% of open interest, which is significantly above its recent average and standard deviation, and close to the five-year highs (27% of open interest).

EUR/USD positioning

Source: CFTC, Macrobond, ING

Read the original analysis: ECB cheat sheet: Difficult to pull away from the Fed

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.