ECB April Preview: Quicker end to QE to help euro recover

- Euro has been struggling to find demand since the beginning of April.

- ECB is widely expected to leave key rates unchanged.

- A hawkish shift in ECB's policy outlook could trigger a steady rebound in EUR/USD.

EUR/USD is already down more than 2% in April amid the apparent policy divergence between the Federal Reserve and the European Central Bank (ECB). The European economy is widely expected to suffer heavier damage from a protracted conflict between Russia and Ukraine than the US economy, and the Fed remains on track to hike its policy rate by 50 basis points in May.

The shared currency needs the ECB to adopt a hawkish policy stance in order to stay resilient against the greenback.

In March, the ECB left interest rates on the marginal lending facility and the deposit facility unchanged at 0.00%, 0.25% and -0.50% respectively. The bank further announced that monthly net purchases under the Asset Purchase Programme (APP), which were initially planned to end in the fourth quarter, will amount to €40 billion in April, €30 billion in May and €20 billion in June before ending in the third quarter.

The accounts of the ECB’s March meeting revealed earlier in the month that a large number of the governing council members held the view that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalization.

Hawkish scenario

The ECB could decide to adjust the monthly purchases to open the door for a rate hike in the second half of the year if needed. The bank might keep the purchases under APP unchanged at €40 billion in April but bring them down to €20 billion in May to conclude the program by June. Even if the policy statement refrains from offering hints on the timing of the first rate increase, such an action could be seen as a sign pointing to a June hike.

In a less-hawkish stance, the bank may choose to leave the APP as it is but change the wording on the QE to say that it will be completed in June rather than in Q3. ECB President Christine Lagarde’s language on the timing of the rate hike will be key if the bank decides not to touch the APP. During the press conference in March, Lagarde noted that the rate hike would come “some time” after the end of QE. If Lagarde confirms that they will raise the policy rate right after they end the APP, this could also be seen as a hawkish change in forward guidance.

Dovish scenario

The ECB might downplay inflation concerns and choose to shift its focus to supporting the economy in the face of heightened uncertainty by leaving the policy settings and the language on the outlook unchanged.

The euro is likely to come under heavy selling pressure if the bank reiterates that the APP will end in the third quarter as planned. That would push the timing of the first rate hike toward September and put the ECB way behind the curve in comparison to other major central banks. According to the CME Group FedWatch, markets are pricing in a more-than-60% probability of back-to-back 50 bps hikes in May and June.

Conclusion

The ECB is likely to respond to the euro’s weakness, aggressive tightening prospects of major central banks and hot inflation in the euro area by turning hawkish in April. For EUR/USD to stage a steady rebound, however, the bank may have to convince markets that they are preparing to hike the policy rate by June.

On the other hand, there will be no reason to stop betting against the euro if the bank chooses to leave its policy settings and forward guidance unchanged.

EUR/USD technical outlook

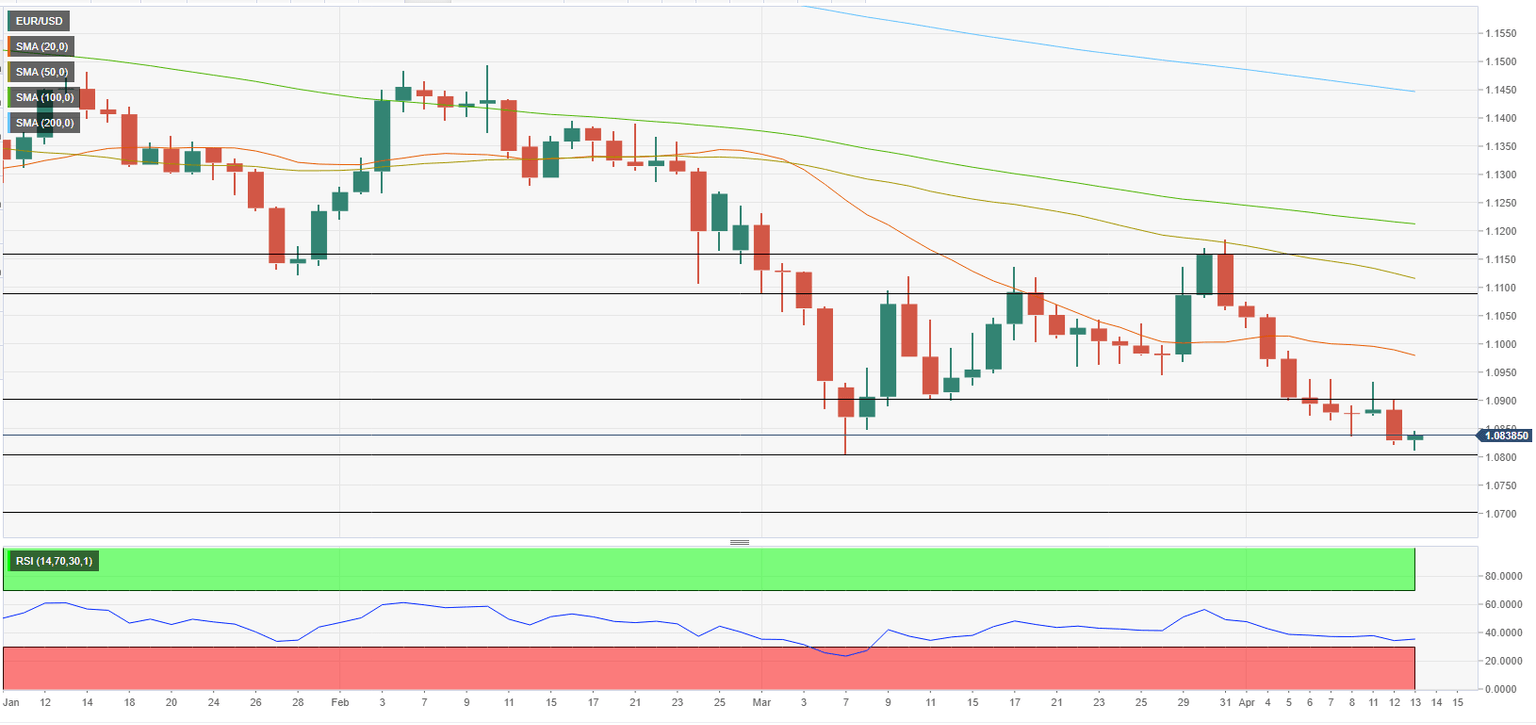

EUR/USD closed the previous seven trading days below the 20-day SMA and the Relative Strength Index (RSI) indicator stays below 40, suggesting that bears continue to dominate the pair’s action.

On the downside, 1.0800 (psychological level, March low) aligns as first support. With a daily close below that level on a dovish ECB, EUR/USD could target 1.0700 (psychological level) and 1.0630 (March 2020 low).

Key resistance seems to have formed at 1.0900 (psychological level, static level). In case this level turns into support, a steady rebound toward 1.1000 (psychological level, 20-day SMA) and 1.1100 (static level, psychological level) could be witnessed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.