Last week ended with the US Employment Situation Report. Markets witnessed a monster beat for employment growth; the US economy added more than 300,000 jobs in the month of March versus a median estimate of 210,000 (prior data: small downward revision from +275,000 to +270,000). This marked the largest one-month gain in nearly 12 months. The unemployment rate came in at 3.8%, slightly lower than the 3.9% forecast and down from the 3.9% prior reading; the lower range estimate was 3.7% heading into the event. Average hourly earnings were bang in line with market expectations at 0.3% and 4.1% for YoY and MoM, respectively. Given the soft jobs numbers also released from Canada (and strong data from the US), this opened the door to long trades in the USD/CAD on Friday, up +0.5% in the first 30 minutes after the releases. Another good trading opportunity on the back of the data, of course, was EUR/CAD.

Unsurprisingly, the US data triggered a hawkish repricing in rates. Fed funds futures are nearly fully priced in for a July cut (-24bps). June is still on the table, but only just. We now have a total of -67bps of easing priced in for the year. The repricing should not raise too many eyebrows as the US economy is quite something: we have strong job growth and low unemployment, resilient economic activity, ISM manufacturing and services PMIs in expansionary territory, as well as the US equity space testing all-time highs.

It will be interesting to see how the Bank of Japan (BoJ) react to the recent data this week and, of course, the push higher in the USD/JPY pairing, which is now on the verge of testing the ¥152.00 handle. Traders were clearly tentatively trading this pair following the release of the US jobs numbers, as we’ve seen officials repeatedly warn of a potential intervention to rescue the beleaguered Japanese yen (JPY).

Looking forward

This week will be important for market participants; mid-week trading offers a bumper slate of event risk. Three developed central banks (the RBNZ, the BoC, and the ECB) will deliver updates in addition to the eagerly anticipated US CPI inflation print and the minutes from the latest FOMC meeting.

ECB to hold steady; June cut?

The European Central Bank (ECB) will be widely watched this week, given the dovish vibe surrounding the central bank at the moment. The meeting is scheduled to make the airwaves on Thursday at 1:15 pm GMT+1. It is widely expected that the ECB will leave all three key benchmark rates unchanged for a fifth consecutive meeting; markets are pricing in a meagre 9% for a cut. A total of -89bps, however, is priced in for the year, with the first 25bp cut expected as soon as June (-24bps).

Increased volatility for the euro could be seen during the release should the ECB endorse its current dovish tone. The dovish vibe was further emphasised last week on the back of euro area inflation for March, highlighting further disinflation, softening to 2.4% on a year-on-year basis (from 2.6%) for the headline print (ultimately aligning with ECB projections) and underlying inflation (core) cooling to 2.9% from 3.1% over the same period. Couple this with meagre, stagnant growth, largely weighed by Germany, this has helped cool inflationary pressures.

Alongside STIR markets, the majority of ECB members are seen to be eyeing June’s meeting for a possible rate cut. ECB President Christine Lagarde recently noted that the eurozone’s economy is in a disinflationary process. The ECB head added that inflation is ‘making good progress’ and that they are confident but ‘not sufficiently confident’ and commented that additional data is needed; more will be known in June. Adding to this, more recently, in newspaper interviews, we saw ECB’s Yannis Stournaras and Robert Holzmann stress the point that the ECB could potentially cut rates by 100bps (aligning with market expectations) and be the first to cut ahead of the Fed.

US CPI inflation eyed

The main focus out of the US this week will be Wednesday’s US CPI inflation release at 1:30 pm and the FOMC meeting minutes at 7:00 pm GMT+1.

From a data standpoint, following the hotter-than-expected jobs data on Friday, all eyes will be on this week’s US CPI report. Should inflation increase, this could lead investors to begin considering a scenario where we only see two rate cuts from the Fed this year rather than three. Stronger-than-expected numbers could prompt a USD rally, but the threat of intervention from the BoJ is clearly there and may hamper demand for the buck in this case. Any meaningful broad downside deviation, of course, would firmly open the door to shorting opportunities for the dollar.

For the FOMC minutes, we’re unlikely to have much new from this report as the majority of key Fed members were out and about talking last week. As a reminder, the March FOMC meeting left the overnight lending rate unchanged at 5.25%-5.50% for a fifth successive meeting, its highest rate in more than two decades. The majority of Fed officials also still favour three rate cuts this year, which was moderately dovish—you may recall there was speculation leading up to the event that Fed officials may downshift to two rate cuts. The quarterly SEP was released alongside the rate announcement and was what the market most focussed on. Fed officials, as communicated above, still expect to ease policy by three quarter-point rate cuts by year-end, unchanged from December’s (2023) projections. However, what is important to take on board here is that rates are anticipated to be higher for longer than initially forecast three months ago, emphasising more of a hawkish tone.

Markets are clearly showing uncertainty for a rate cut in June. As of writing, markets are pricing in a total of +71bps of easing this year for the Fed. This is a pronounced deviation from the SIX rate cuts priced in at the beginning of this year and is now a whisker south of the projected three rate cuts by the Fed (as above). Any chances of a rate cut at May’s policy-setting meeting have fallen considerably, with the first 25bp cut set to take place in July (-27bps). However, June still remains a 50/50 coin toss at the moment.

Ultimately, whether the Fed pulls the trigger in June or July (or even further out in the year) will depend on inflationary pressures. The Fed will also want to see a weaker labour market and cooling wages.

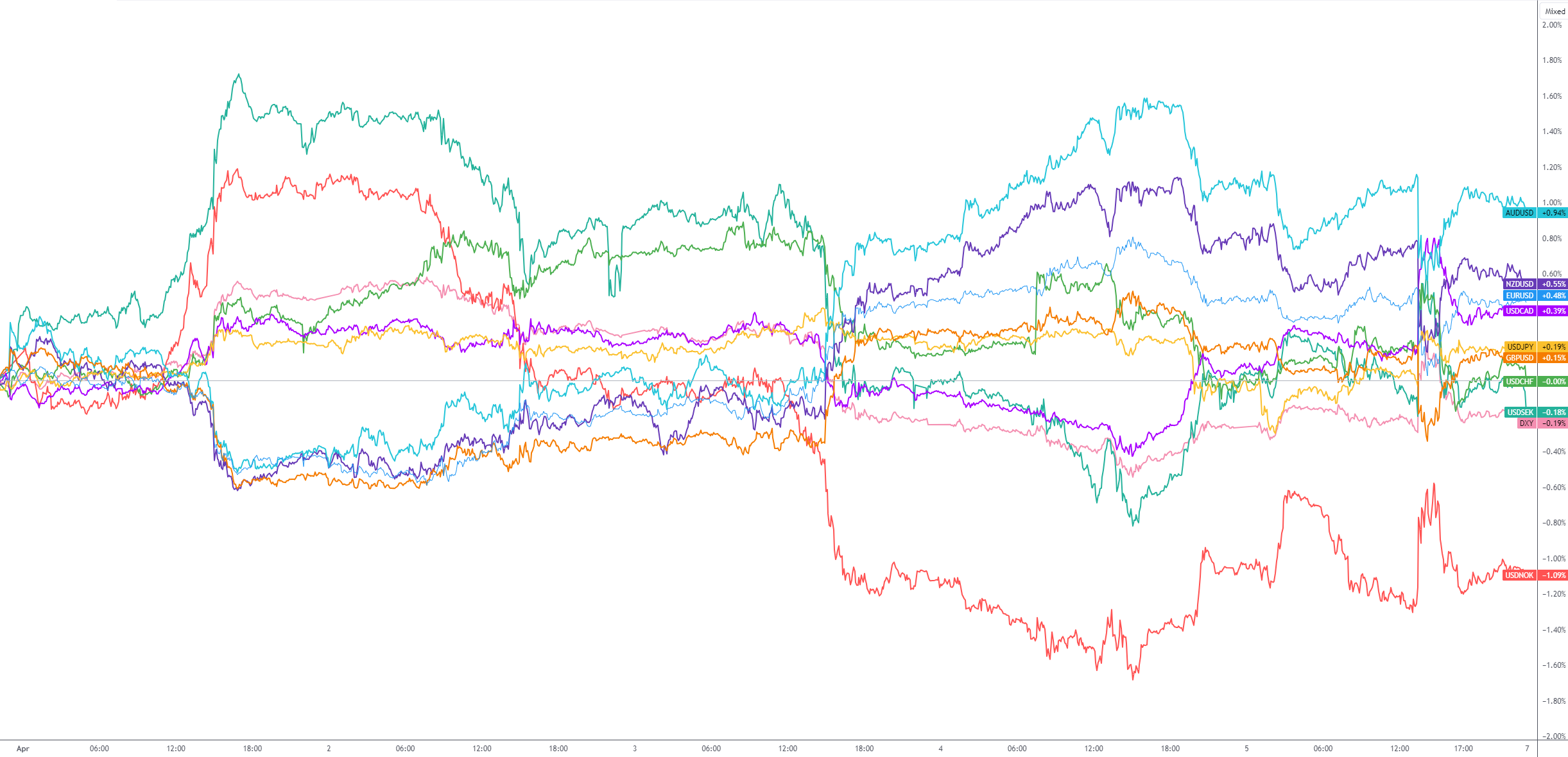

G10 FX (five-day change):

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD trades at yearly lows below 1.0500 ahead of PMI data

EUR/USD stays on the back foot and trades at its lowest level since October 2023 below 1.0500 early Friday, pressured by persistent USD strength. Investors await Manufacturing and Services PMI surveys from the Eurozone, Germany and the US.

GBP/USD falls to six-month lows below 1.2600, eyes on key data releases

GBP/USD extends its losses for the third successive session and trades at a fresh fix-month low below 1.2600. This downside is attributed to the stronger US Dollar (USD) as traders continue to evaluate the Fed's policy outlook following latest data releases and Fedspeak.

Gold rises toward $2,700, hits two-week top

Gold continues to attract haven flows for the fifth consecutive day and rises toward $2,700. XAU/USD continues to benefit from risk-aversion amid intensifying Russia-Ukraine conflict. Investors keep a close eye on geopolitics while waiting for PMI data releases.

Ethereum Price Forecast: ETH open interest surge to all-time high after recent price rally

Ethereum (ETH) is trading near $3,350, experiencing an 10% increase on Thursday. This price surge is attributed to strong bullish sentiment among derivatives traders, driving its open interest above $20 billion for the first time.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.