Durable Goods Orders Preview: Five scenarios to trade the event with EUR/USD

- Durable Goods Orders are expected to have dropped in September after five consecutive rises.

- The data is critical ahead of Thursday's growth figures.

- A rebalanced dollar and tensions ahead of the ECB meeting imply all options are open for trading the event.

"Hyperinflation is going to change everything. It’s happening." – these words by Twitter founder Jack Dorsey are probably at the extreme end of fears about rising prices, but headlines broadly suggest markets fear inflation. Such worries are nowhere to be seen when it comes to investment data. A big test comes now with Wednesday’s Durable Goods Orders.

Quick background

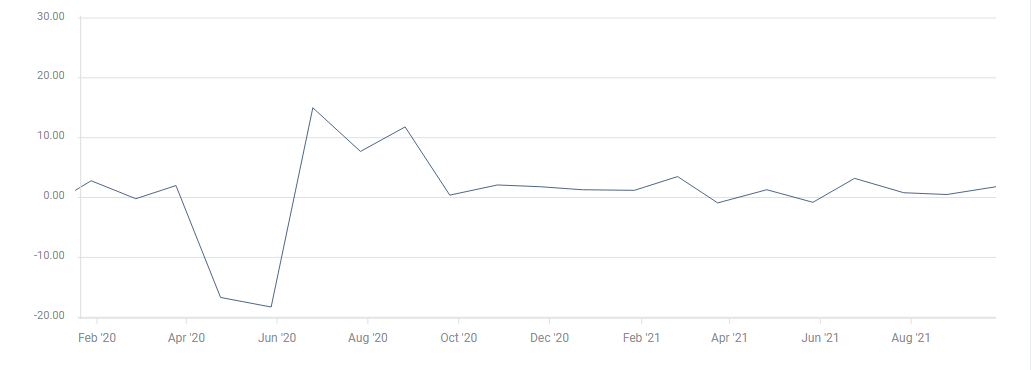

Durable Goods Orders have been rising in the past four months, showing eagerness from consumers and businesses. Will this winning streak continue? The economic calendar is pointing to a decline of 1.1% in headline orders in September after a surge of 1.8% in August. On the other hand, Retail Sales statistics – already out – were outstanding last month.

Recent Durables figures:

Source: FXStreet

The data is of high importance as it feeds into Gross Domestic Product figures due out on Thursday. It will be the first read of US GDP for the third quarter, and it may confirm or dismiss fears of a substantial slowdown. The market reaction is set to be straightforward – better than expected figures are dollar positive, and weaker data is dollar negative.

Sentiment and Levels

EUR/USD has been trading nervously in recent days, but there are two stabilizing factors. First, US 10-year Treasury yields have settled between 1.60% and 1.70%, allowing the dollar's moves to calm. Durables and GDP could change that, but at the moment, there is no bias in favor or against the dollar.

Secondly, the euro is also neutral ahead of the European Central Bank's meeting on Thursday. With common currency traders on the sidelines, EUR/USD is only at the mercy of the dollar. That adds to the straightforward trading setup.

Levels from top to bottom: 1.17, 1.1650, 1.1665 (triple-top), 1.1640 (early-October peak), 1.1615 (mid-October support), 1.1590 (late October low), 1.1565.

Five Scenarios for EUR/USD

- Within expectations: Any drop of between 0.6 to 1.6% could be considered as meeting estimates, as Durable Goods Orders are volatile. In that case, EUR/USD would likely chop around but hold onto its range.

- Above expectations: A modest drop of up to 0.5% or a flat read can be seen as exceeding expectations. In that case, the currency pair could lose one support line.

- Well above expectations: A fifth consecutive increase in Durable Goods Orders would already point to robust growth figures and boost the greenback. There would be room for a tumble below two support lines for EUR/USD.

- Below expectations: A drop of 1.7% to 2.2% could be considered as a disappointment, as it would erase August's gains. In that case, EUR/USD would have room to advance above one resistance line.

- Well below expectations: A tumble of 2.3% or worse would already paint a gloomy and uncertain picture of the US economy, potentially pointing to a meaningful slowdown. In such a case, EUR/USD could pierce through two resistance lines.

Conclusion

The release of Durable Goods Orders figures has an outsized impact due to the proximity to GDP and tapering. A neutral bias makes trading this event straightforward.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.