Durable Goods orders continue to reflect hesitant demand

Summary

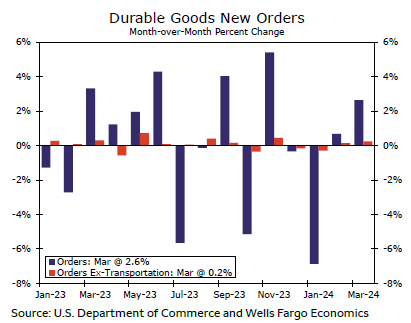

There was little surprise in the March durables release. Aircraft-related volatility boosted orders, and the underlying details suggest a continued hesitancy in demand. Shipments data remained weak and present some downside to Q1 real GDP growth—out tomorrow.

Up in the air

Orders for new durable goods ticked up 2.6% in March, but as has been the case in recent months, almost all the headline change can be attributed to orders for aircraft specifically (chart). Aircraft orders, which leaped 30% in March for nondefense orders, are notoriously volatile on a month-to-month basis, and the size of the expenditure causes it to have a large bearing on overall orders activity (chart). In stripping the broader transportation category from the estimate, orders were up a more modest 0.2% last month, which is roughly in line with a typical monthly gain.

The underlying order details were somewhat mixed as the data continue to indicate a hesitant demand environment. Core capital goods orders (excluding defense and aircraft) rose 0.2% but were down slightly for Q1 as a whole. All major orders categories other than primary metals saw an uptick in orders last month, but most gains were fairly modest and some, like computers & electronics and electrical equipment, came after sizable drops in February. Orders activity remains depressed on a year-ago basis, with computers & electronics and nondefense aircraft being the only major categories to post an annual gain in March.

Author

Wells Fargo Research Team

Wells Fargo