USD: Sep '23 is Up at 106.000.

Energies: Oct '23 Crude is Up at 91.79.

Financials: The Dec '23 30 Year T-Bond is Up 29 ticks and trading at 105.09.

Indices: The Dec '23 S&P 500 emini ES contract is 51 ticks Higher and trading at 4327.50.

Gold: The Dec'23 Gold contract is trading Down at 1913.50.

Initial conclusion

This is not a correlated market. The USD is Up and Crude is Up which is not normal, and the 30 Year T-Bond is trading Higher. The Financials should always correlate with the US dollar such that if the dollar is Higher, then the bonds should follow and vice-versa. The S&P is Higher, and Crude is trading Higher which is not correlated. Gold is trading Lower which is correlated with the US dollar trading Up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don't have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open. All of Asia is trading Higher with the exception of the Singapore exchange which is Lower. Currently all of Europe is trading Lower with the exception of the Spanish IBEX exchange.

Possible challenges to traders

-

Core Durable Goods Orders m/m is out at 8:30 AM EST. This is Major.

-

Durable Goods Orders m/m is out at 8:30 AM EST. This is Major.

-

Crude Oil Inventories are out at 10:30 AM EST. This is Major.

Treasuries

Traders, please note that we've changed the Bond instrument from the 30 year (ZB) to the 10 year (ZN). They work exactly the same.

We've elected to switch gears a bit and show correlation between the 10-year bond (ZN) and the S&P futures contract. The S&P contract is the Standard and Poor's, and the purpose is to show reverse correlation between the two instruments. Remember it's likened to a seesaw, when up goes up the other should go down and vice versa.

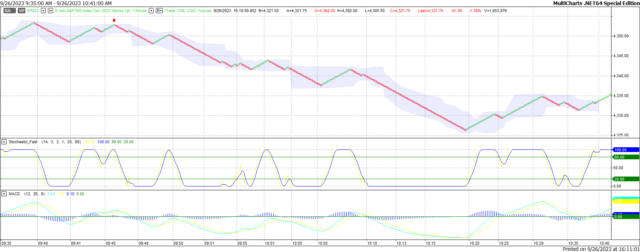

Yesterday the ZN migrated Higher at around 9:45 AM EST as the S&P hit a High at around the same time. If you look at the charts below the S&P gave a signal at around 9:45 AM and the ZN started its Upward ascend. Look at the charts below and you'll see a pattern for both assets. S&P hit a High at around 9:45 AM and migrated Lower. These charts represent the newest version of MultiCharts and I've changed the timeframe to a 15-minute chart to display better. This represented a Long opportunity on the 10-year note, as a trader you could have netted about 10 ticks per contract on this trade. Each tick is worth $15.625. Please note: the front month for the ZN is now Dec '23. The S&P contract is now Dec' 23. I've changed the format to filled Candlesticks (not hollow) such that it may be more apparent and visible.

Charts courtesy of MultiCharts built on an AMP platform

ZN - Dec 2023 - 9/26/23

S&P - Dec 2023 - 9/26/23

Bias

Yesterday, we gave the markets a Downside bias as all indications were for a Down Day. The markets didn't disappoint as the Dow dropped 388 points and the other indices traded Lower as well. Today we aren't dealing with a correlated market and our bias is Neutral.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Finally, we get a market that does what it should do. All indications were for a Down Day yesterday and the markets didn't disappoint. Could it be the combination of a looming government shutdown and the auto workers strike helped to drag the markets down. Readers of this newsletter knew that hours before the markets opened. Today we have the critical Durable Goods and Core Durable Goods out at 8:30 AM EST. This is used by the Fed as a bellwether on how the economy is doing. No doubt the Fed will use this as part of their criteria on interest rates.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.