Dow Jones Shows Two Possible Elliott Wave Scenarios

The Dow Jones Index seems not to be concerned about Apple's warnings caused by the effect of the virus outbreak on its first-quarter revenue, which could be worst than earnings released in 2019.

From the Elliott wave perspective, in its log-scale weekly chart, we see the Industrial Average advancing on the fifth wave of Intermediate degree identified in blue, still in progress.

The Dow Jones bullish cycle began in early March 2009, when the price found support at 6,466.6 points. In turn, according to the Elliott wave theory, we recognize that the third wave of Intermediate degree corresponds to an extended wave.

This context leads us to observe that it is likely that the wave (5) of Intermediate degree has a length similar to that developed by the first wave.

Following the concepts of the Elliott Wave analysis, in the previous chart, the rectangle projected on the first wave provides us the clue that Dow Jones could strike the 30,000 pts.

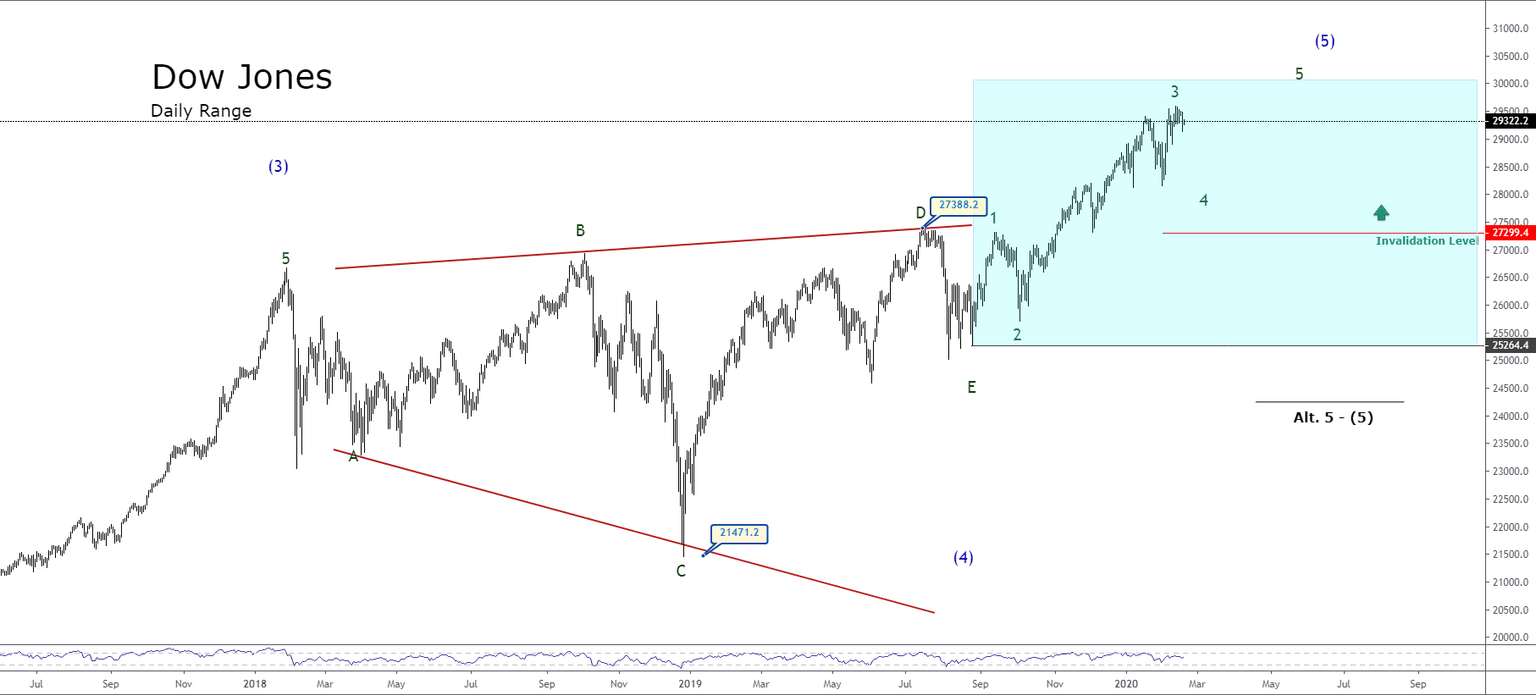

The following chart shows the Dow Jones 30 index in its daily timeframe. On the figure, we observe that the current bullish sequence started at 25,264.4 points. Likewise, once the price surpassed the end of the wave D of Minor degree, which belongs to the expansive triangle that formed the wave (4) of Intermediate degree located at 27,388.2 points, the Industrial Average activated a new bullish structure.

On the other hand, the Elliott Wave analysis perspective provides us with two possible scenarios for the Industrial Average. On the second figure, we detect that the price could be advancing in a wave 3 of Minor degree labeled in green.

Under this scenario, if it is accurate, the third wave in progress could be an extended wave, and in consequence, Dow Jones would have pending the development of waves four and five of Minor degree. This move would end the long-term bullish sequence.

An alternate scenario considers the possibility that the Dow Jones Index is running in its fifth wave of Minor degree of the fifth wave of Intermediate degree. Under this context, the Industrial Average could reach a marginal high, giving way to a corrective process that could lead it to penetrate the level of invalidation of the bullish cycle located at 27,299.4 points.

In conclusion, despite the upward bias of the long-term and short-term trend, both scenarios provide the possibility of a marginal bullish movement, so our preferred positioning at Dow Jones remains on the neutral side.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and