Stock markets continue being traded on the bear side on Tuesday despite the likely signing of phase one agreement next week.

The DAX 30 plummets 182.1 points or 1.37% dropping to 13,126.5 points, whereas the French index CAC 40 only moves 3.9 points or 0.06% to 5,977.6 points, and Euro Stoxx 50 drops 41.2 points or 1.09% touching the 3,738.4 points.

The declarations made on Monday by the commercial advisor of the White House, Peter Navarro, on the probable signing of the agreement of phase one of the United States and China next week, were not enough to support the optimism on traders.

This Monday, Dow Jones plunged over 150 points, closing at 28,478 points.

Technical Overview

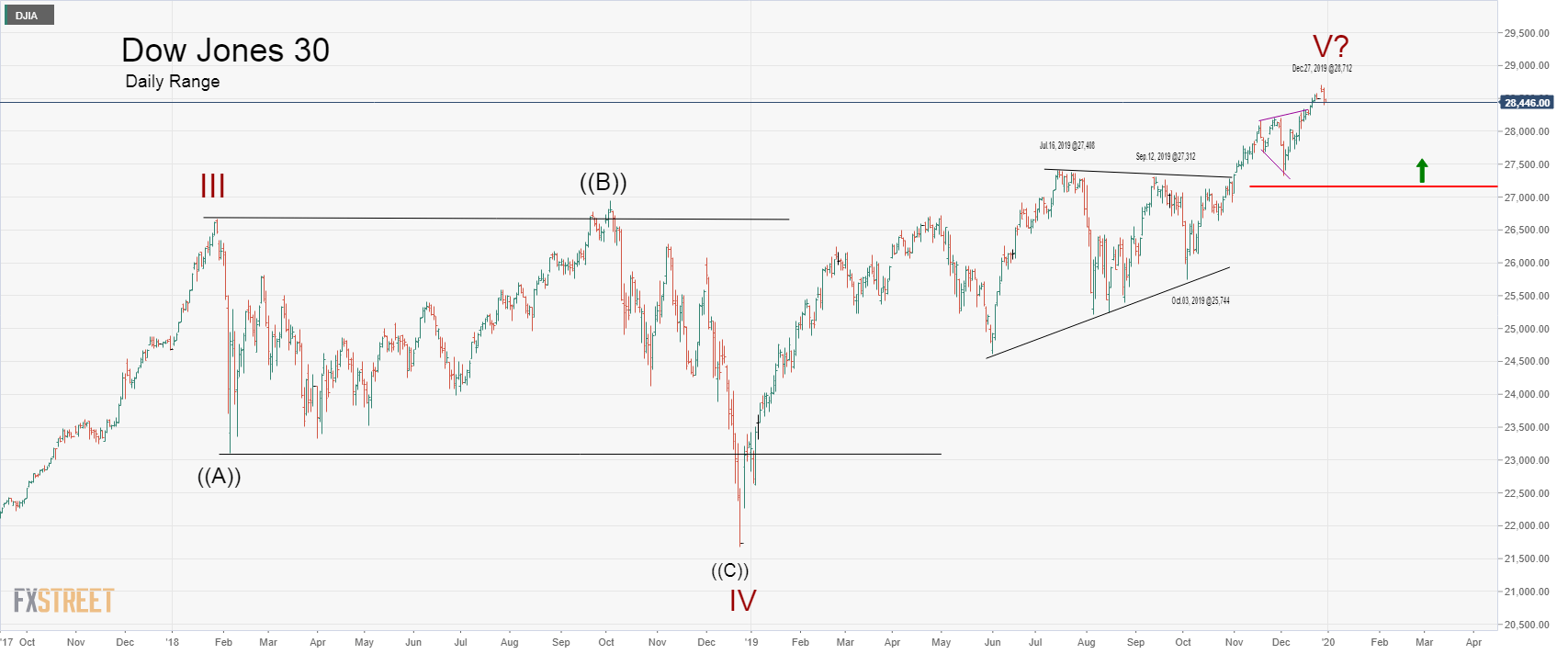

Dow Jones, in its daily chart, presents the retracement the price is developing after the last record high reached on December 27th at 28,712 points.

Although at a first look, it might be possible to think the Industrial Average could begin to develop an in-depth corrective process, the bias of the primary trend remains bullish as long as DJIA remains above 28,048 points.

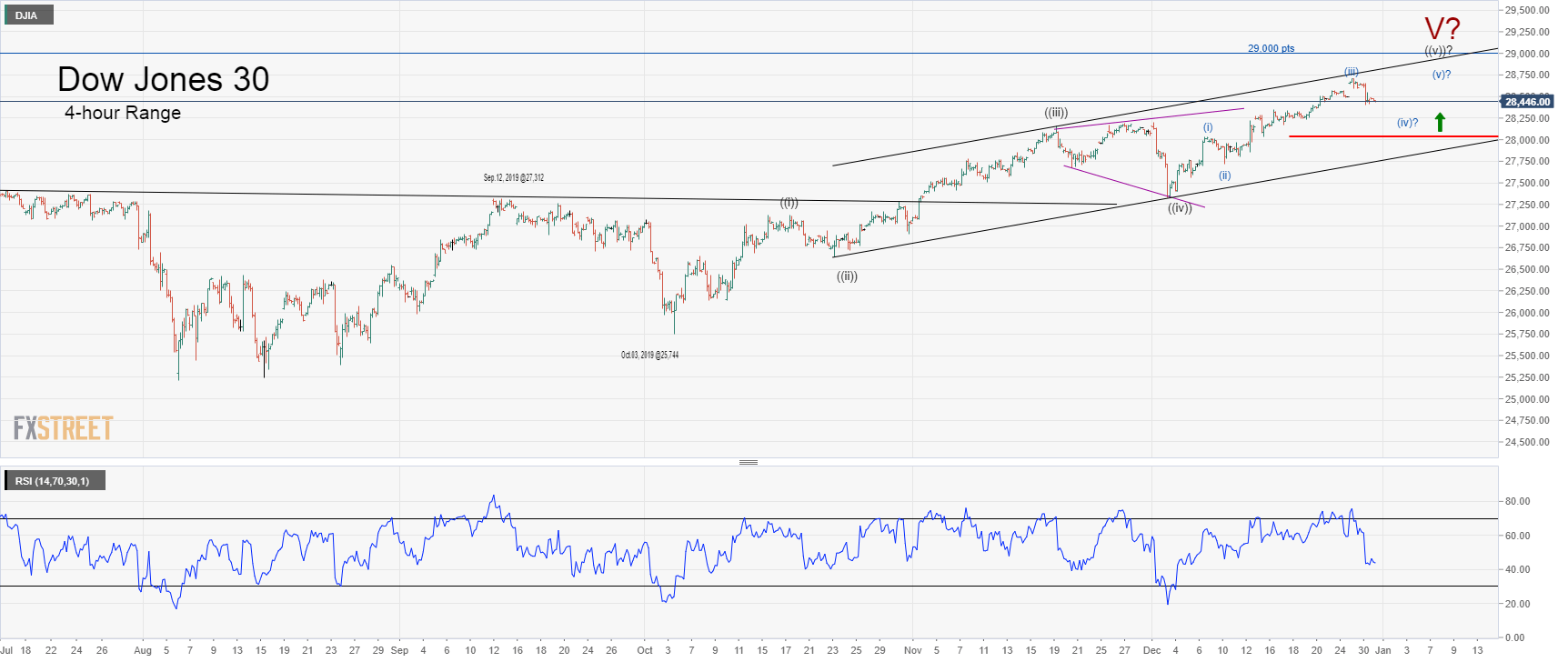

On the other hand, The 4-hour chart shows the price action making a retracement, that does not yet pierce the wave ((iii)) labeled in black, and remains above the level of invalidation of the bullish trend that locates at 28,048 points.

That is, while the price continues moving above 28,048 points, the Dow Jones Index could once again show a new record high. However, if the price closes below the invalidation level, the short term bias would change to bearish.

That is, while the price continues moving above 28,048 points, the Dow Jones Index could once again show a new record high. However, if the price closes below the invalidation level, the short term bias would change to bearish.

According to the Alternation Principle from the Elliott Wave Theory, the current move could most likely correspond to a wave (iv), labeled in blue.

This potential sequence in development could evolve as a complex wave because the last time, wave (ii) labeled in blue appeared as a simple correction, which was completed in a short time.

This scenario would be valid if the price of the Industrial Average holds above the 28,048 points.

Finally, the price action could carry the Dow 30 to exceed the upper line of the ascending channel, which is kept intact since October 3rd when the price found buyers at 25,744 points.

In conclusion, as long as the Dow Jones continues moving above 28,048 points, a new bullish movement making another new all-time high is possible for the Blue Chip average, before a more profound corrective sequence begins.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

Gold falls amid a possible de-escalation of US-China tensions Premium

Gold pulled back from its all-time high of $3,500 per troy ounce reached earlier on Tuesday, as a resurgent US Dollar and signs of easing tensions in the US–China trade dispute appeared to draw sellers back into the market.

EUR/USD retreats to daily lows near 1.1440

EUR/USD loses the grip and retreats to the 1.1440 zone as the Greenback’s rebound now gathers extra steam, particulalry after some positive headlines pointing to mitigating trade concerns on the US-China front on Tuesday.

GBP/USD deflates to weekly lows near 1.3350

GBP/USD loses further momentum and recedes to the 1.3350 zone on Tuesday, or two-day troughs, all in response to the frmer tone in the US Dollar and encouraging news from the US-China trade scenario.

3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugly

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.