Dow Jones bounces back

USD/JPY bounces off key floor

The US dollar recovered after surprisingly robust jobs data in April. Coming off this year’s high of 137.80, the pair is looking to preserve its gains without losing more ground. 133.50 at the base of the previous rally is an important level to keep the directional bias upward, as its breach would dent the optimism and force buyers to bail out. The RSI’s oversold condition has attracted some bargain hunters and 135.50 is the first obstacle to lift. A close above 137.80 would resume the uptrend in the medium-term.

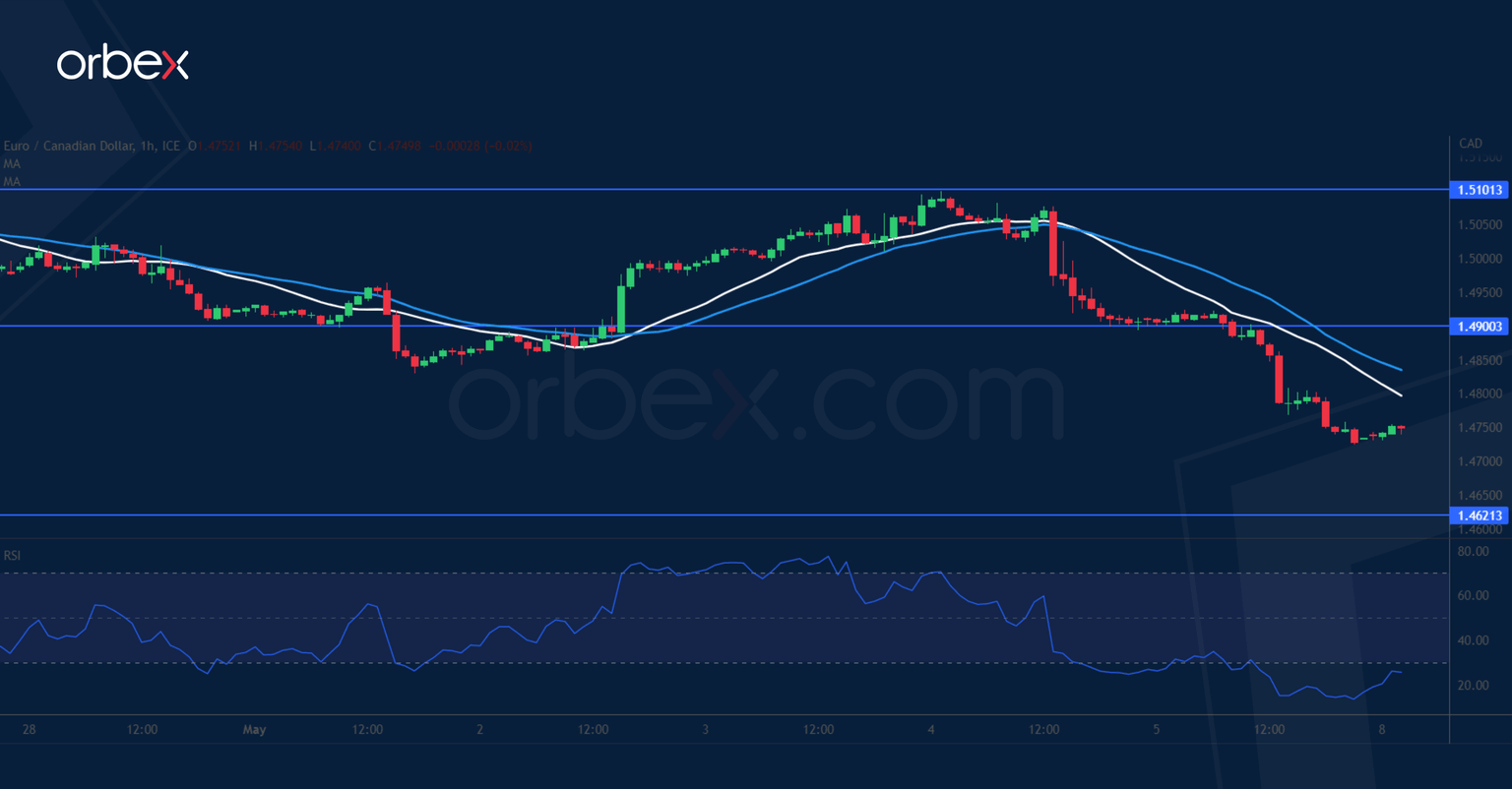

EUR/CAD to test daily support

The Canadian dollar soared after April’s jobs number smashed expectations. A break below the confluence of the recent swing low of 1.4840 and the 20-day SMA triggered a new round of liquidation of leveraged short-term positions. The daily support of 1.4620 is a key level to prevent a deeper correction. An oversold RSI might trigger a ‘buy-the-dips’ behaviour. 1.4900 is a fresh resistance and the double top at 1.5100 which coincides with the September 2021 high is a major ceiling should the bulls manage to make their way back.

Dow Jones 30 jumps back

The Dow Jones 30 rallies as Apple's solid results eased worries about a recession. A combination of fresh selling and profit-taking have made this year’s highs around 34300 a solid supply zone. A fall below the recent low of 33300 and the 30-day SMA has put the bulls under pressure, but with layers of support underneath, this is likely to be a consolidation rather than a bearish reversal. 32900 from the late March breakout rally saw strong support and 33800 is the resistance to lift before the rebound could gain traction.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.