Dollar’s and Gold’s outlook right before Fed’s cut

It’s the Fed’s interest cut day, and the markets keep on expecting a 0.5% cut.

Currency behavior defies expectations

In my view, incorrectly so. We’ll see what happens in just several hours. I previously wrote that the markets appear to be reacting to rate cuts and hikes in the opposite way to what seems logical, but it can all be explained through the “buy the rumor, sell the fact” mechanism. In it, people make transactions based on the expectations of a given move, and they reverse the trades once the move (in this case: in rates) happens. It’s likely to work even more so if the market is surprised by what happens – just like it’s likely to happen now in the case of the Fed’s rate cut.

The logical thing to do for a given currency is to increase when the rates for it are hiked and decline when they are cut. After all, more money can be made by holding it – or less, in case of a rate hike and a rate cut, respectively.

And yet, when the Bank of Japan hiked rates, the yen’s value declined, and when the European Central Bank cut the rates, the value of the euro increased.

Combining both suggests that the value of the USD Index might rally after the Fed cuts the rates by 0.25%.

In fact, that’s what already may have started given what the USDX did from the technical point of view.

The U.S. dollar rallied after reversing from the levels that stopped the declines many times in the past. I marked the previous bottoming area with a green rectangle, and the USD Index rallied after moving to its lower border.

The history tends to rhyme, so the USDX is likely to rally once again, especially that the RSI indicator (upper part of the chart) recently flashed a major buy signal.

Since gold price’s rally has been mostly fueled by dollars declines in the most recent months (in particular, since early August), it seems likely that the above would translate into a decline in the price of the yellow metal.

Stocks at likely upside target

If the markets are negatively surprised today, it might imply a decline in stocks as well.

The S&P 500 Index just moved very slightly above the previous all-time high and then moved back below it. It was a tiny invalidation, but still, it was one, and invalidations are sell signs. We’ll know more after today’s session.

Still, since stocks have already moved to their likely upside target based on the Fibonacci extension technique, it seems that declines here are more likely than not.

When we zoom out, it becomes even clearer.

World stocks are trying to break above their previous highs, and I doubt that they will be successful. Please consider the long-term situation in the USD Index (bottom part of the above chart). It’s after a medium-term decline and a long back-and-forth trading pattern.

The sentiment for the USD Index is also very negative and that’s been the case at the previous bottoms as well. The “BRIC-countries-get-out-of-USD” argument is alive and well and while that might be the case eventually, it doesn’t seem that likely for now. This exact theory was very popular at the 2008 bottom and in 2021 as well.

Similar patterns were seen when the world stocks were previously trading at the current levels and it meant three things:

-

An upcoming (big) rally in the USD Index.

-

A profound slide in world stocks.

-

And even bigger slide in mining stocks (middle part of the chart).

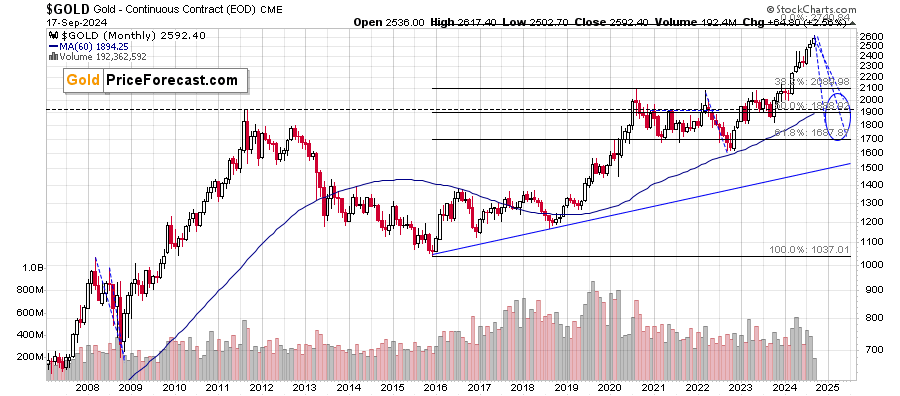

And what if gold keeps on rallying here? Zooming out shows that it has an upside target at about $2,730 – based on the 1.618 Fibonacci extension of the 2015 – 2020 rally. This might result in a rally in silver as well, which would significantly boost returns from some silver investments.

A move there (to $2,730) without a prior decline seems unlikely, though – especially given the situation in the USD Index.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any

-638622583544862155.png&w=1536&q=95)