Dollar traders lock gaze on NFP report

-

Fed sticks to ‘higher for longer’ mentality.

-

PMIs pose downside risks to nonfarm payrolls.

-

But point to sticky wage growth.

-

The data comes out on Friday, at 12:30 GMT.

US inflation slows but Fed signals patience

Although the latest CPI data revealed that inflation in the US has resumed its downtrend, Fed officials have been continuously signaling patience about when they may start lowering interest rates, with some of the ultra-hawks, like Minneapolis Fed President Neel Kashkari, even leaving the door open to the possibility of resuming rate hikes.

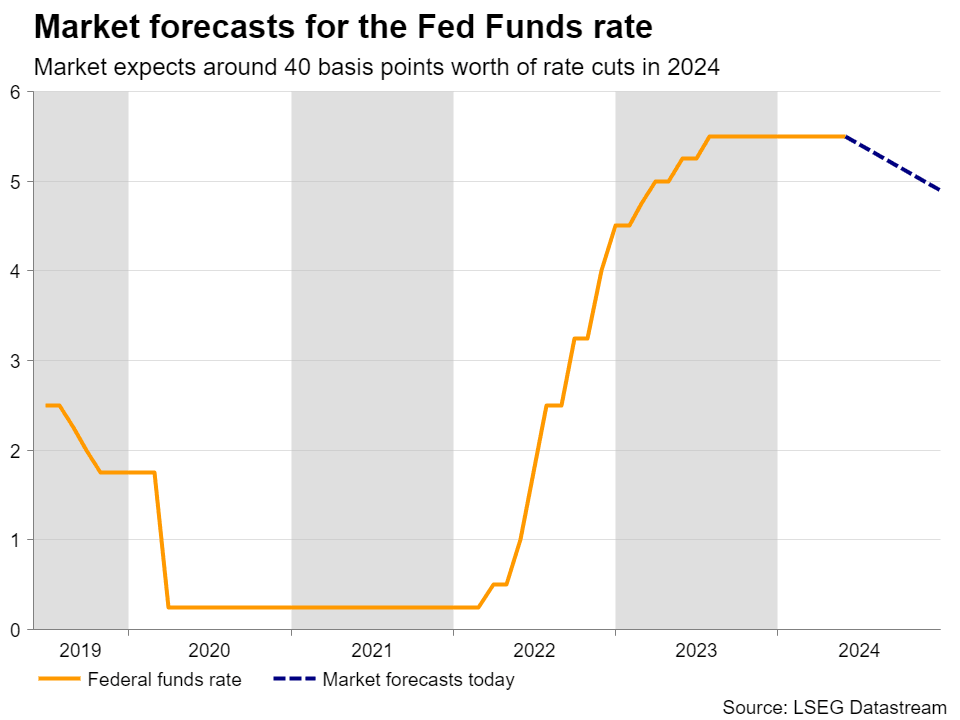

That said, Kashkari is not a voting member this year and thus, given that most of the rate setters have been abiding by just a ‘higher for longer’ mantra, investors have scaled back their rate cut bets to the extent where only 40bps worth of reductions are expected by the end of the year, with the probability for a first quarter-point cut being delivered in September now resting at around 70%.

NFP could slow, but wages may accelerate

So, as the market tries to figure out whether and when the Fed will decide to press the rate-cut button, Friday’s nonfarm payrolls for May are likely to attract special attention. According to the preliminary S&P Global PMIs for the month, employment fell for a second successive month in May, contrasting with the prevailing hiring trend that’s been in place for 45 months. This poses some downside risks to the forecast of a mild acceleration in nonfarm payrolls to 185k from 175k. The unemployment rate is anticipated to have held steady at 3.9%.

Having said that, input and output prices accelerated in May and, among many others, one of the drivers of input prices was higher labor costs. Thus, even if the official jobs report reveals that the world’s largest economy has added less jobs than in April, average hourly earnings may point to still-elevated wage growth, which could lead to stickier consumer prices in the months to come. Indeed, expectations are for a mild acceleration to 0.3% m/m from 0.2%, which would keep the y/y rate at 3.9%.

Dollar retreat to stay limited

Therefore, even as the labor market continues to show signs of cooling, due to inflationary risks, the Fed may not risk changing its mentality. A still-elevated wage growth rate may revive concerns about whether inflation will meet the 2% objective soon, thereby supporting the US dollar, even if the first reaction is negative due to a potential slowdown in nonfarm payrolls. A good proxy for exploiting some dollar gains may be the dollar/loonie pair. The probability for a BoC rate cut on Wednesday has risen to around 85%, while the total number of bps worth of reductions by the end of the year now rests at around 65. Ergo, a rate cut accompanied by dovish language by the BoC could help dollar/loonie trade north.

USD/CAD uptrend still intact

Technically, dollar/loonie has been trading in a sideways manner lately, staying between the key support zone of 1.3600 and the resistance barrier of 1.3735. That said, in the bigger picture, it continues to hold above the uptrend line drawn from the low of January 31, which means that the near-term outlook remains cautiously positive.

If the bulls are willing to charge again, they may test the 1.3735 area again soon, the break of which could signal the resumption of the prevailing uptrend. The first line of bear-defense may be at around 1.3785, with the next resistance marked by the high of April 16, at around 1.3845. For the picture to darken, the pair may need to drop below the crossroads of the 1.3600 zone and the aforementioned uptrend line.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.