Dollar surge on above expectation job data

Mixed economic data ended the U.S. equity markets' winning streak as the Dow Jones closed about 0.5% lower.

The U.S. equity market's winning streak ended as the Dow Jones closed about 0.5% lower due to mixed economic data. The Fed's preferred inflation measure, the PCE index, matched market forecasts at 4.2%, while Initial Jobless Claims fell to 228k, indicating a tight labour market. A rebound in the U.S. dollar ensued as the economy's strength heightened expectations of a September rate hike. Conversely, oil prices surged over 2% following Russia's announcement to extend oil export cuts into October supporting its OPEC+ alliances. In the cryptocurrency realm, the SEC's delay in deciding on the Spot BTC ETF application triggered a nearly 5% overnight drop in bitcoin's value.

Market movements

Dollar index

The dollar gained strength this week in anticipation of the NFP report. Despite PCE inflation meeting expectations at 4.2%, strong job data could solidify expectations of prolonged higher interest rates from the Fed. Initial Jobless Claims slightly declined to 228k. Investors await the NFP figures, which could impact the dollar and broader markets.

The dollar gained nearly 0.5% yesterday and is strongly supported at above 103 trajectory, providing a bullish bias signal for the dollar. The MACD has crossed below while the RSI rebounded to support the view of a bullish bias for the dollar.

Resistance level: 103.88, 104.40.

Support level: 103.40, 102.85.

XAU/USD

Gold prices experienced a retreat from their recent monthly peak of $1949, as the dollar showcased renewed strength in the latest trading session. The closely watched Personal Consumption Expenditures (PCE) data remained aligned with market expectations, registering a 4.2% figure for July. This result reinforced the perception of a robust economy, despite the Federal Reserve's assertive implementation of a monetary tightening strategy since March. Investors closely watch the highly anticipated NFP reading that is going to be released today to gauge the price movement for gold.

Gold prices came to a crucial pivotal level at near $1938.50 level as a break below such level will serve as a bearish signal for gold prices and vice versa. The RSI has declined from the overbought zone while the MACD has crossed, suggesting the bullish momentum has eased.

Resistance level: 1967.00, 2000.00.

Support level: 1940.00, 1900.00.

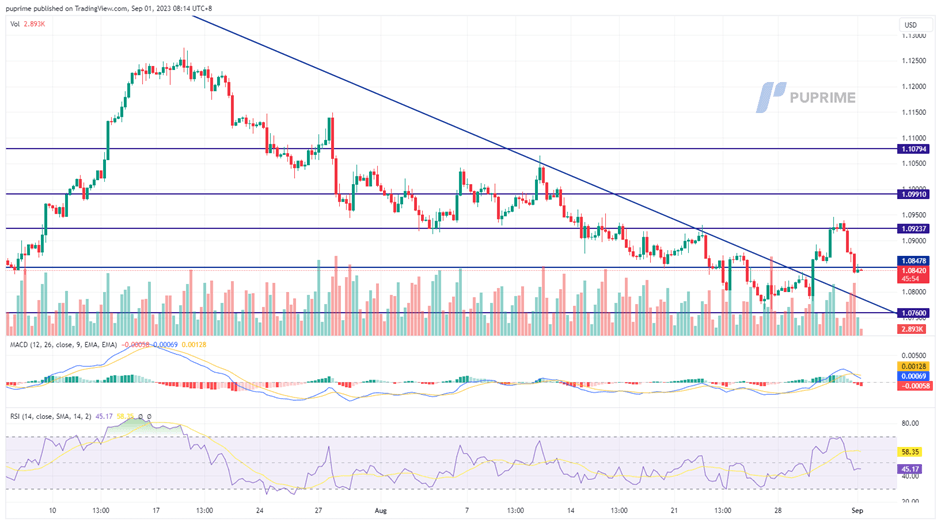

EUR/USD

The euro encountered a setback as it struggled to maintain its crucial support level at 1.0900, failing to defend this critical threshold. The release of the eurozone Consumer Price Index (CPI), which remained unchanged at 5.3% from its previous reading, failed to provide the support needed to sustain the euro's position. The euro's relative underperformance against the US dollar can be attributed to investors factoring in the certainty of the ECB continuing its rate hike trajectory. This contrasts with the more uncertain stance that the Federal Reserve (Fed) might adopt in September. Adding to the euro's challenges, robust employment data released by the US further amplified the possibility of the Fed's continued interest rate hikes, bolstering the dollar's strength against the euro.

The EUR/USD is struggling to find support at the crucial level of 1.0850. The RSI has declined drastically while the MACD has crossed on the above, suggesting the bullish momentum has vanished.

Resistance level: 1.0990, 1.1080.

Support level: 1.0850, 1.0760.

GBP/USD

The Pound Sterling (GBP/USD) retreated on the back of a resurgent dollar driven by robust economic indicators—the U.S. Personal Consumption Expenditures (PCE) figure aligned with market forecasts. Initial Jobless Claims underscored a persistently taut labour market, potentially influencing a more hawkish stance from the Federal Reserve in the upcoming September meeting. Concurrently, market participants maintain vigilant attention on the impending Non-Farm Payrolls (NFP) report, expected to wield influence over Cable's price trajectory.

The Cable’s bullish momentum seems eased as the RSI has fallen to the 50-level while the MACD is about to cross the above.

Resistance level: 1.2780, 1.2870.

Support level: 1.2640, 1.2540.

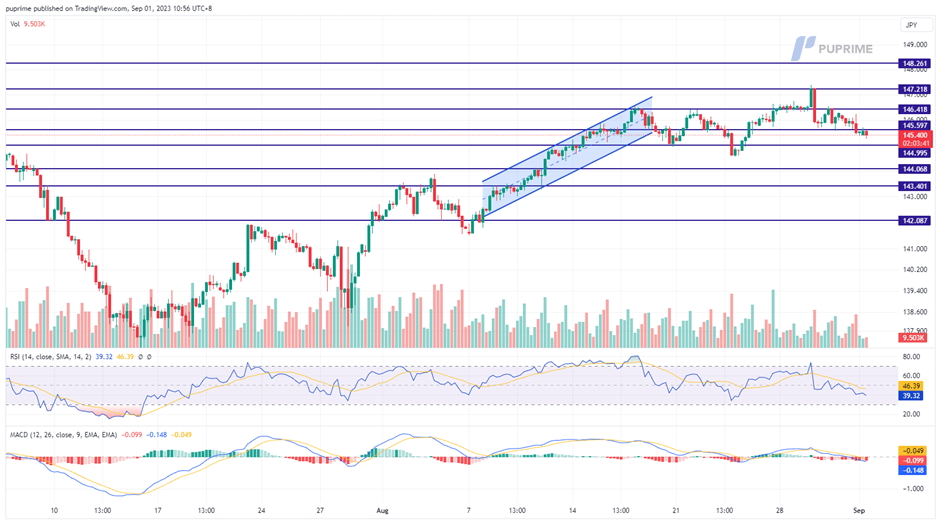

USD/JPY

The Japanese Yen exhibited strength against the USD despite a notable 0.5% climb in the dollar index yesterday. In contrast, the USD/JPY pair experienced a 0.5% decline. A hawkish pronouncement from BoJ Board Member Tamura suggested the Japanese central bank could potentially adjust its monetary policy as early as next year. This sentiment bolstered the Japanese Yen's position against other major currencies.

The USD/JPY pair has dropped more than 1% this week from its recent peak at 147.20, suggesting the bearish momentum is strong with the pair. The RSI is moving downward while the MACD has crossed below the zero line, suggesting a bearish bias for the pair.

Resistance level: 146.40, 147.20.

Support level:145.60, 144.00.

Dow jones

The U.S. stock market halted its rally as the Dow dropped 168 points. While the PCE reading met expectations, initial jobless claims decreased to 228k, implying a tight labour market and boosting the likelihood of a Fed rate hike in September. The upcoming NFP that is scheduled to be released today is anticipated to influence the equity market significantly.

The Dow failed to hold above its then-resistance level at 34800 level, but the bullish momentum seems intact with the index. The RSI maintains at above the 50-level while the MACD continues to diverge, suggesting a bullish bias for the index.

Resistance level: 35400.00, 36000.00.

Support level: 34200.00, 33600.00.

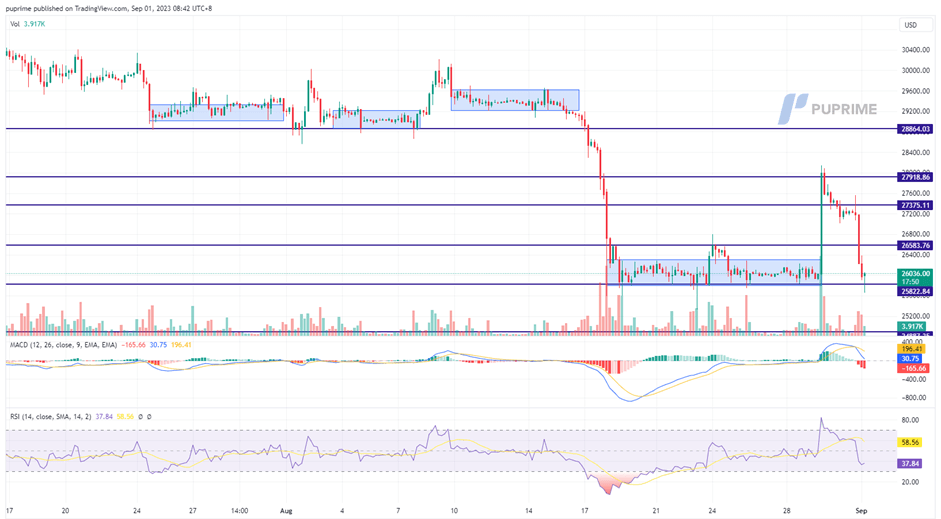

BTC/USD

Bitcoin experienced a sharp decline of almost 5% yesterday, retracing its gains from earlier rallies. The surge had been fueled by the optimism surrounding Greyscale's victory in a court case against the SEC. However, the Securities and Exchange Commission (SEC) has chosen to defer its decision on the application for a spot BTC exchange-traded fund (ETF) until October. This delay has dampened the previously high hopes of approval for BTC ETF applications submitted by notable entities such as BlackRock and WisdomTree, among others. The SEC's decision to prolong the evaluation timeline has weighed on the market sentiment, impacting the value of Bitcoin and causing a substantial drop. The uncertainty created by the delay has led to a significant market downturn.

BTC has fallen back to its previous price consolidation range, and the near-term price movement has become more uncertain. The MACD has crossed while the RSI declined sharply, suggesting the bullish momentum has vanished.

Resistance level: 26580, 27370.

Support level: 25800, 24880.

CL Oil

Oil prices maintained their impressive streak, logging a six-session winning streak characterised by robust bullish momentum. The market witnessed a substantial surge of over 2% in oil prices, primarily attributed to Russia's declaration of extending oil export cuts through September. The commitment to further cuts by OPEC+ also contributed to the upward trajectory of oil prices. Adding to the positive sentiment, the weekly U.S. oil data demonstrated a promising uptick in oil demand, enhancing the overall outlook for the commodity. These combined factors acted as potent catalysts, propelling oil prices to trade higher.

The oil price is approaching its peak at $84.80 with strong bullish momentum. The RSI has broken into the overbought zone while the MACD continues to move upward, suggesting the oil prices are trading in a strong bullish momentum.

Resistance level: 83.25, 87.25.

Support level: 79.15, 76.65.

Author

PU Prime team

PU Prime

PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX, Commodities, Indices, Share CFDs and Bonds.