Dollar loses shine in trade war as investors rethink impact on US economy [Video]

-

Trade war gathers pace as Trump slaps tariffs on Canada, Mexico and China.

-

But US dollar starts to wobble as cracks appear in US economy.

-

Growing concerns about Trump’s policies also weigh on US outlook.

![Dollar loses shine in trade war as investors rethink impact on US economy [Video]](https://editorial.fxsstatic.com/images/i/DXY-bullish-object_XtraLarge.png)

Not a bluff, as Trump proceeds with tariffs

US President Donald Trump went ahead this week with his pledge to implement 25% tariffs on goods entering America from its northern and southern borders, while adding another 10% to imports from China. Although the announcement wasn’t exactly out of the blue, investors had been hoping that a last-minute deal, at least with Canada and Mexico, would have averted the spike in tariffs with the United States’ biggest trading partners.

What is perhaps a more surprising development, however, is how the decision to proceed with the tariffs has changed investors’ perception about the implications of Trump’s trade war on the US economy.

Dollar gives up post-election bounce

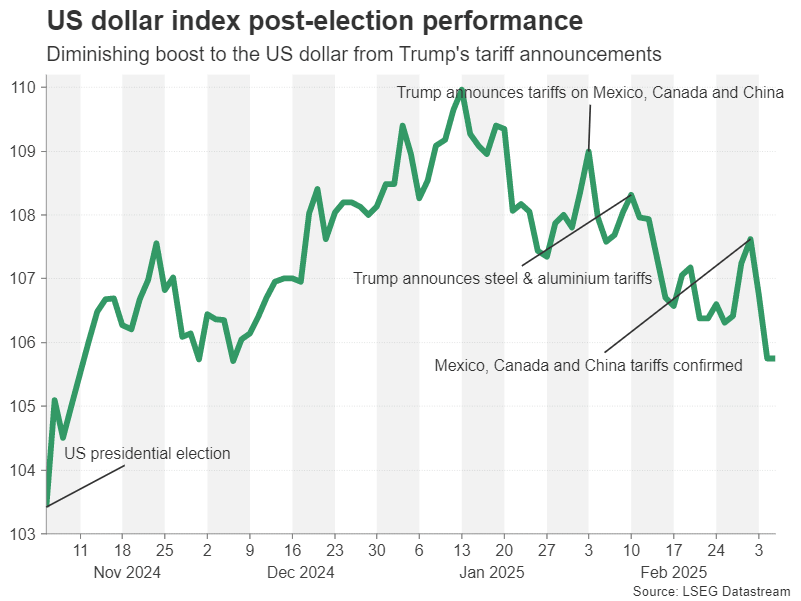

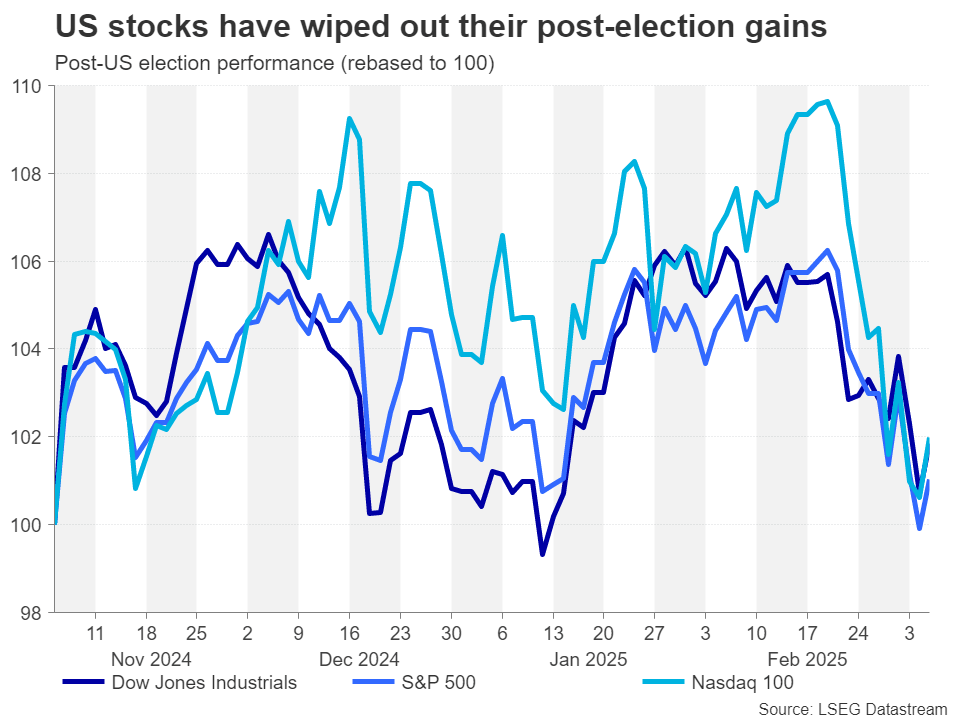

Following Trump’s resounding election victory in November, the US dollar rallied on the expectation that his pledge of higher tariffs would be inflationary, but that the impact on growth would be limited due to the boost from his promise of large tax cuts and deregulation. The former spurred a rally in the dollar, as investors pared back their rate cut bets for the Fed, while the latter kept risk appetite alive on Wall Street.

However, the optimism that America would be able to withstand Trade War II appears to have faded, partly because investors didn’t believe the White House would impose substantial tariffs on its allies, focusing mainly on China, and partly because the US economy is showing signs of cracks even before the full force of the tariffs has been felt.

Fed rate cut bets ramped up as mood sours

Trump’s increasingly unpredictable nature has started to rattle markets, not just his stance on tariffs but also his positions on key foreign policy issues such as Ukraine. The destabilizing effect on world order of the current Trump administration is far greater than anything investors had seen during the President’s first term.

This is adding to the general anxiety both in the markets and among businesses. Combined with the uncertainty created about future costs by Trump’s constant wavering on tariffs, business sentiment is taking a knock.

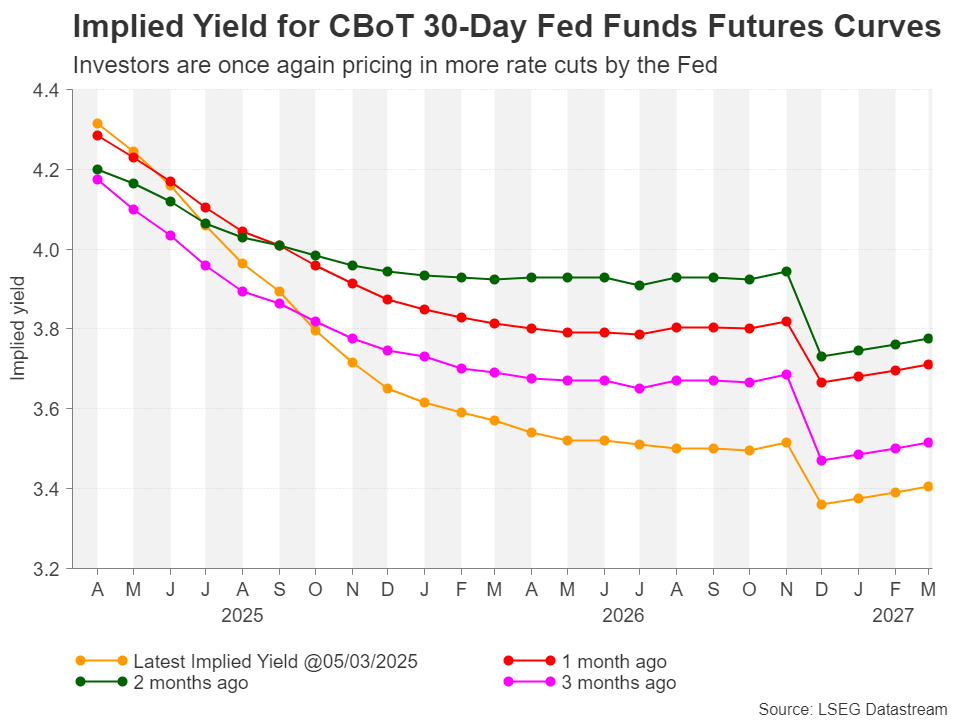

Investors have already started to price in steeper rate cuts by the Federal Reserve this year, betting that economic worries will outweigh inflation ones for policymakers. Ultimately, the Fed will only prioritize growth over inflation if the labour market deteriorates. That hasn’t happened yet and so the Fed has strongly signalled it intends to stay on pause for the time being.

The end of US exceptionalism?

Nevertheless, the dollar has come under intense selling pressure following the confirmation by Trump that the 25% levies on Canada and Mexico are definitely ‘on’. What was different this time was the fact that Trump seems unwilling to negotiate or compromise, as also demonstrated in the talks with Ukraine’s President Zelensky. If he applies the same ‘take it or leave it’ approach with all the countries that are set to be targeted by the reciprocal tariffs due to come into effect on April 2, there will be little chance of finding a middle ground.

This potentially marks a turning point for American exceptionalism that was sustaining the strong dollar and Wall Street rally for such a long time. If what replaces it is US isolationism, the dollar could be facing a prolonged downtrend, while US equities could lose out to their international rivals. The S&P 500 has already erased its post-election rally and not even tech stocks are safe, as the Nasdaq is down the most year-to-date compared to both the Dow Jones and S&P 500. Of course, small caps have taken the biggest hit, with the Russell 2000 trading about 15% below its November all-time high.

Dollar rivals fight back

For the greenback, it doesn’t help that the yen is currently benefiting from a more hawkish Bank of Japan, while the euro got a shot in the arm by Germany’s decision to relax its self-imposed rule on borrowing. The pound is also holding its ground as the UK looks set to escape Trump’s tariffs, while the Australian and New Zealand dollars are being supported by China stepping up its stimulus measures to counter a more hostile Washington. Even the Canadian dollar has avoided a sharp selloff, as investors no longer see clear winners or losers in this trade war.

In the meantime, the traditional safe haven of gold has been attracting record inflows amid the heightened geopolitical risks and predictions about a US recession.

Will Trump back down?

For now, a full-blown recession in America seems unlikely, although it cannot be ruled out. Consumption appears to be waning and with mass government layoffs on the way thanks to Elon Musk’s DOGE, households may curtail their spending even more over the coming months. Reduced consumer spending and an increase in unemployment would likely trigger a strong response by the Fed.

However, it is possible that President Trump may yet do a U-turn on tariffs, especially if there’s a slump on Wall Street. The USMCA agreement, for example, is up for review in 2026. Trump may be laying the ground for tough talks with Mexico and Canada. In Europe, he has already won a major concession by forcing European nations to beef up their defence spending.

Uncertainty and stagflation cloud Dollar’s outlook

The problem, though, for the dollar and the US stock market is that even if Trump gets his way and the trade war de-escalates at some point in his presidency, the uncertainty generated by his style of leadership and radical policies is already wreaking havoc on business confidence and market sentiment.

This could all change once the Trump administration unveils its tax cut plans as well as announce measures to ease the regulatory burden. But hopes for a major boost are slowly dimming as it’s unclear whether the tax reductions and business-friendlier regulation will substantially offset the massive cuts to spending that are on Republicans’ agenda.

What is even less certain, however, is whether any slowdown in the economy will significantly dampen inflationary pressures to allow the Fed to cut rates as aggressively as the markets are currently pricing in. Any disappointment on this front could pave the way for a potential bounce back in the US dollar, although the scope for a rebound in a stagflationary environment is probably quite modest.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl