Dollar Index: Price action favouring bears

The US dollar is poised to end the month lower against a basket of six major currencies. According to the US Dollar Index, the greenback is down -1.5% in May and on track to snap a four-month winning streak.

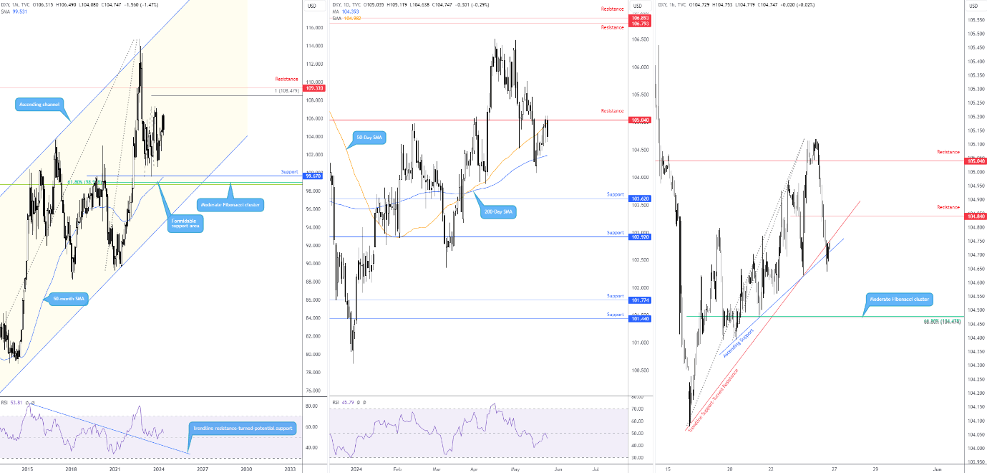

Technically speaking, the monthly timeframe presents little to work with this week (well, anything within touching distance that is). The 107.35 October 2023 peak remains a possible resistance, shadowed closely by another resistance level at 109.33 and a 100% projection ratio at 108.48. Below, support is at 99.67, accompanied by a 50-month simple moving average (SMA) at 99.53 and a moderate Fibonacci cluster from 98.72.

200-day SMA offers logical downside target

Meanwhile, on the daily timeframe, Friday finished considerably lower after bumping heads with resistance at 105.04 and the 50-day SMA at 104.98. With the scope to explore deeper waters from here on the monthly scale, the 200-day SMA calls for attention as a logical downside support target of around 104.39. A break south of here unearths 103.62 support. Further supporting bearish flow is the inability of the Relative Strength Index (RSI) to find acceptance north of the 50.00 centreline last week (though it is worth bearing in mind that the RSI has maintained a position above the 50.00 centreline since 2022 on the monthly chart).

Looking ahead, the daily chart shows early signs of a downtrend (series of lower lows and lower highs), with Friday's reaction to the underside of resistance suggesting that dollar bears may maintain control, at least until the 200-day SMA. This dynamic value will be a crucial test for bears, considering the previous reaction observed in mid-May.

Short-term action on the H1 chart concluded the week sandwiched between ascending support, extended from the low of 104.39, and trendline support-turned potential resistance, drawn from the low of 104.08. Overhead, resistance calls for attention at 104.84 and 105.04 (daily resistance); lower, eyes might be drawn toward a moderate Fibonacci cluster from 104.47, plotted just north of the 200-day SMA.

This week’s direction?

Coupled with the monthly chart displaying limited support and Friday acknowledging daily resistance around 105.04 (accompanied by the current downtrend and the RSI shaking hands with the lower side of 50.00), this is a sellers’ market for the time being and price action on the H1 timeframe could defend the underside of the breached trendline support and push through H1 ascending support in the direction of the Fibonacci cluster at 104.47. However, were current trendline resistance to cede ground, H1 resistance at 104.80 could be the next port of call for sellers this week.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,