The dollar index returned to red on Monday after a gap higher opening in market reaction on assassination attempt on former President Donald Trump, though dollar-negative sentiment on growing expectations for September Fed rate cut, dominated during European and early US session.

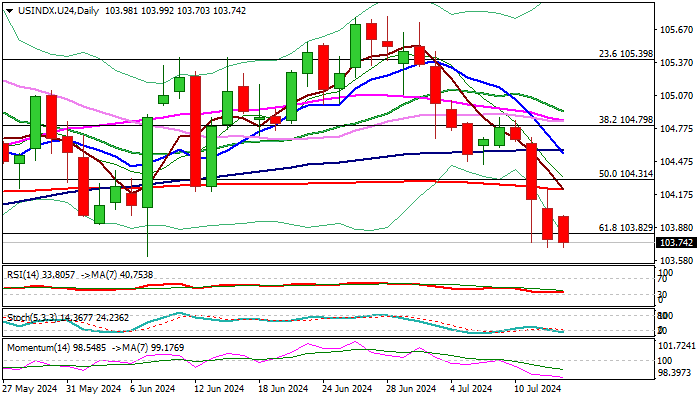

Bears pressure supports at103.69/61 (last Friday low / June 7 low), on track for the second consecutive daily close below pivotal Fibo support at 103.82 (61.8% of 102.26/106.36 ascend), which would reinforce bearish signal.

Firm break of 103.69/61 pivots to risk acceleration towards 103.22/00 (Fibo 76.4% / psychological).

Technical picture on daily chart is firmly bearish, with strong negative momentum and multiple MA bear-crosses (the latest was attempt to form 5/200DMA death-cross) adding to bearish near-term outlook.

However, speech of Fed Chair Powell, due later today, is also in focus, with comments about the central bank’s next steps regarding monetary policy, expected to have strong impact on dollar.

Dovish stance will reinforce growing expectations for rate cut and push the dollar further down, while hawkish comments would harm larger bears and give fresh boost to the currency, with lift above 200DMA (104.22) and violation of daily cloud base (104.49) seen as minimum requirement to revive bulls.

Res: 104.00; 104.22; 104.49; 104.74

Sup: 103.61; 103.22; 103.00; 102.80

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD consolidates in a range above mid-0.6700s

AUD/USD holds steady above mid-0.6700s during the Asian session on Tuesday. The US Dollar languishes near a three-month low touched on Monday. Apart from this, the prevalent risk-on environment, bets that the RBA could be raising interest rates again and hopes for more stimulus from China lend support to the pair.

EUR/USD Monday bidding blinks as ECB rate call looms over the horizon

EUR/USD fell short of recent bullish momentum, pulling back sharply after a brief jump above 1.0900 to kick off the new trading week and keeping price action strung out along the top end of a descending price channel.

Gold price holds comfortably above $2,400 amid September Fed rate cut bets

Gold price is seen consolidating in a range during the Asian session on Tuesday. Growing acceptance that the Fed will start cutting interest rates in September keeps the US Dollar close to over a three-month low and continues to offer support to the non-yielding yellow metal. The upbeat market mood is seen acting as a headwind for the safe-haven precious metal.

Meme coins soar in double-digit gains as PEPE, WIF, FLOKI, MOG lead the charge

Meme coins are leading the crypto market again as the ripple effect of Bitcoin's recovery is flowing across major crypto categories. PEPE, WIF, FLOKI and MOG are at the forefront of the recovery, elevating their daily performance above the 20% mark on Monday.

The Trump trade

The US markets may have had a mild reaction to the assassination attempt on Donald Trump at a rally in Pennsylvania at the weekend, however, there are long term ramifications for financial markets, particularly in Europe.