US Dollar Index

The dollar rose across the board on Thursday, following widely expected Fed’s decision to cut rates by 25 basis points and signal a slower pace of rate cuts in 2025.

The US policymakers are fully aware of the new reality, in which inflation remains elevated above desired levels and may rise further on expectations that new policies of Trump’s administration will boost economic growth and subsequently fuel inflation.

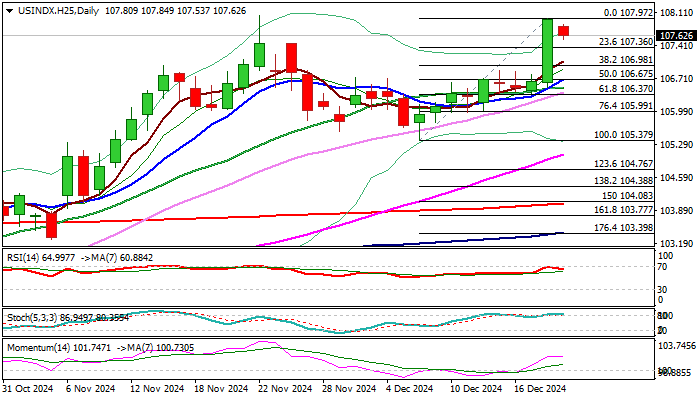

The dollar index gained around 1.3% in immediate reaction to Fed’s comments and neared key barrier at 108.04 (two-year high / 2024 peak).

The price eased in early Thursday’s trading on partial profit-taking from strong post-Fed rally, as traders also reacted on overbought conditions on daily chart.

Correction is likely to be limited in increasingly dollar-supportive fundamentals which complement bullish technical studies and shape positive near-term outlook.

Dips should be ideally contained above 107.00 zone (Fibo 38.2% of 105.37/107.97 upleg) to keep bulls intact for renewed attack at 108.04 trigger, break of which to open way for test of 108.79 target (Fibo 61.8% retracement of larger 114.72/99.20 downtrend and possibly unmask psychological 110 barrier.

Alternative scenario sees possibility of deeper correction on loss of 107.00 handle, though overall bullish bias should stay unharmed while the price stays above 106.70 (daily Kijun-sen).

Res: 107.97; 108.04; 108.79; 109.06.

Sup: 107.36; 107.00; 107.86; 107.60.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

GBP/USD struggles around 1.2600 after BoE rate decision

GBP/USD retreated from its daily peak and battles around 1.2600 following the Bank of England monetary policy decision. The BoE kept the benchmark interest rate unchanged at 4.75% as expected, but the accompanying statement leaned to dovish. Three out of nine MPC members opted for a cut.

EUR/USD retakes 1.0400 amid the post-Fed recovery

EUR/USD is recovering ground to near 1.0400 in the European session on Thursday. The pair corrects higher, reversing the hawkish Fed rate cut-led losses. Meanwhile, the US Dollar takes a breather ahead of US data releases.

Gold price recovers from one-month low, retains modest gains above $2,600

Gold price attracts some haven flows in the wake of the post-FOMC sell-off in the equity markets. The Fed’s hawkish outlook lifts US bond yields and provides near-term support to XAU/USD. Market players await US GDP and employment-related data.

Aave Price Forecast: Poised for double-digit correction as holders book profit

Aave (AAVE) price hovers around $343 on Thursday after correcting more than 6% this week. The recent downturn has led to $5.13 million in total liquidations, 84% of which were from long positions.

Fed-ECB: 2025, the great decoupling?

The year 2024 was marked by further progress in disinflation in both the United States and the Eurozone, sufficient to pave the way for rate cuts. The Fed and the ECB did not quite follow the same timetable and tempo, but by the end of the year, the cumulative size of their rate cuts is the same: 100 basis points.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.