Dollar Index

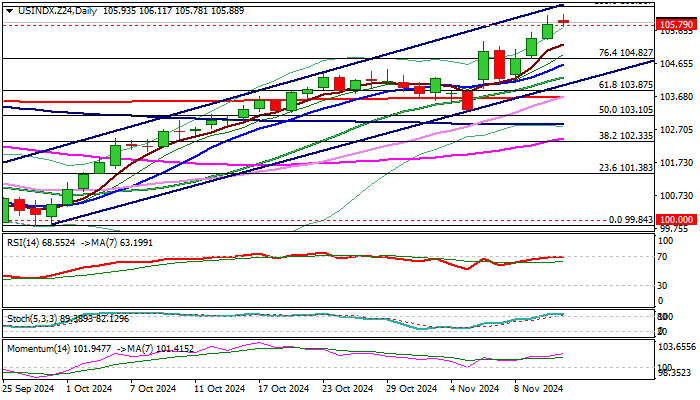

The Dollar index keeps firm tone and holding above former top 105.79 but near term action turned to the quiet mode in early Wednesday, ahead of key economic event today – US inflation data.

Recent strong bullish acceleration after the dollar was lifted by US election results (so-called Trump trades) has slowed, as markets look for fresh signals from CPI numbers which will subsequently affect Fed’s stance on interest rates.

However, the new reality after Trump’s election victory and anticipated impact of policies he plans to implement, implies that Fed is unlikely to go for initially planned strong policy easing, but will likely look to adjust its action to expected stronger economic growth and elevated inflation.

This sets stage for further Dollar’s advance with initial target at 106.36 (May 1 peak) and more significant barriers at 107.00 zone (Oct 2023 lower platform /ceiling of a larger range / 50% retracement of 114.72/99.20 downtrend)., violation of which to signal an end of broader range and open way for stronger gains.

Technical picture is firmly bullish on daily chart positive momentum is strong and MA’s in bullish setup and formed a number of bull-crosses, with price action holding near the upper borderline of a bull-channel (106.41).

However overbought conditions may keep bulls on hold for consolidation, with likely shallow dips to offer better levels to re-enter bullish market.

Former top (105.79) marks immediate support, followed by 5DMA (105.22) and broken Fibo 76.4% level (104.82).

Res: 106.41; 106.96; 107.03; 107.88.

Sup: 105.79; 105.22; 104.82; 104.62.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0500 after upbeat US data

EUR/USD continues to trade in a narrow range at around 1.0500 on Tuesday. The data from the US showed that job openings rose more than expected in October, helping the US Dollar hold its ground and limiting the pair's upside. Investors await comments from Fed officials.

GBP/USD trades below 1.2700 as focus shifts to Fedspeak

GBP/USD loses its recovery momentum and retreats to the 1.2650 area after rising toward 1.2700 earlier in the day. The US Dollar stays resilient against its rivals on upbeat JOLTS Job Openings data and makes it difficult for the pair to regain its traction as focus shifts to Fedspeak.

Gold keeps struggling for direction

Following Monday's retreat, Gold stabilizes and trades in a narrow band below $2,650. The benchmark 10-year US Treasury bond yield stays flat near 4.2% ahead of Fedspeak, making it difficult for XAU/USD to gather directional momentum.

Chainlink holds near three-year high fueled by EU tokenized securities partnership

Chainlink (LINK) price trades slightly down around $25.50 on Tuesday following a 33% rally that was spurred by its partnership with Frankfurt-based fintech 21X for Europe’s first tokenized securities trading and settlement system.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.