Dollar Index looking for a flat Elliott Wave correction [Video]

![Dollar Index looking for a flat Elliott Wave correction [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/DollarIndex/us-currency-with-one-quarter-coins-50559936_XtraLarge.jpg)

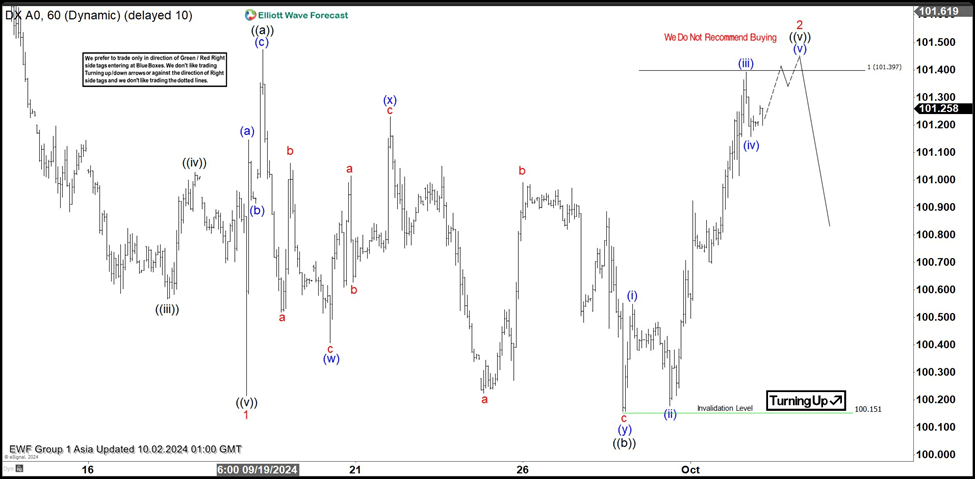

Short Term Elliott Wave View in Dollar Index (DXY) suggests that decline to 100.2 ended wave 1. Rally in wave 2 is in progress as an expanded flat Elliott Wave structure. Up from wave 1, wave (a) ended at 101.14 and pullback in wave (b) ended at 100.91. Wave (c) higher ended at 101.47 which completed wave ((a)) in higher degree. Wave ((b)) dips takes the form of a double three Elliott Wave structure. Down from wave ((a)), wave (w) ended at 100.4 and wave (x) ended at 101.23. Wave (y) lower ended at 100.15 which completed wave ((b)) in higher degree.

The Index has turned higher in wave ((c)). Up from wave ((b)), wave (i) ended at 100.54, and pullback in wave (ii) ended at 100.18. Wave (iii) higher ended at 101.39 and pullback in wave (iv) ended at 101.15. Expect the Index to extend higher 1 more leg in wave (v) to finish wave ((v)) of 2 in higher degree. Afterwards, expect the Index to resume lower. Possible target for wave (v) of ((v)) of 2 is 100% – 161.8% Fibonacci extension of wave ((a)). This comes at 101.4 – 102.1 area.

Dollar Index (DXY) 60 minutes Elliott Wave chart

DXY Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com