Dollar Index in view ahead of data

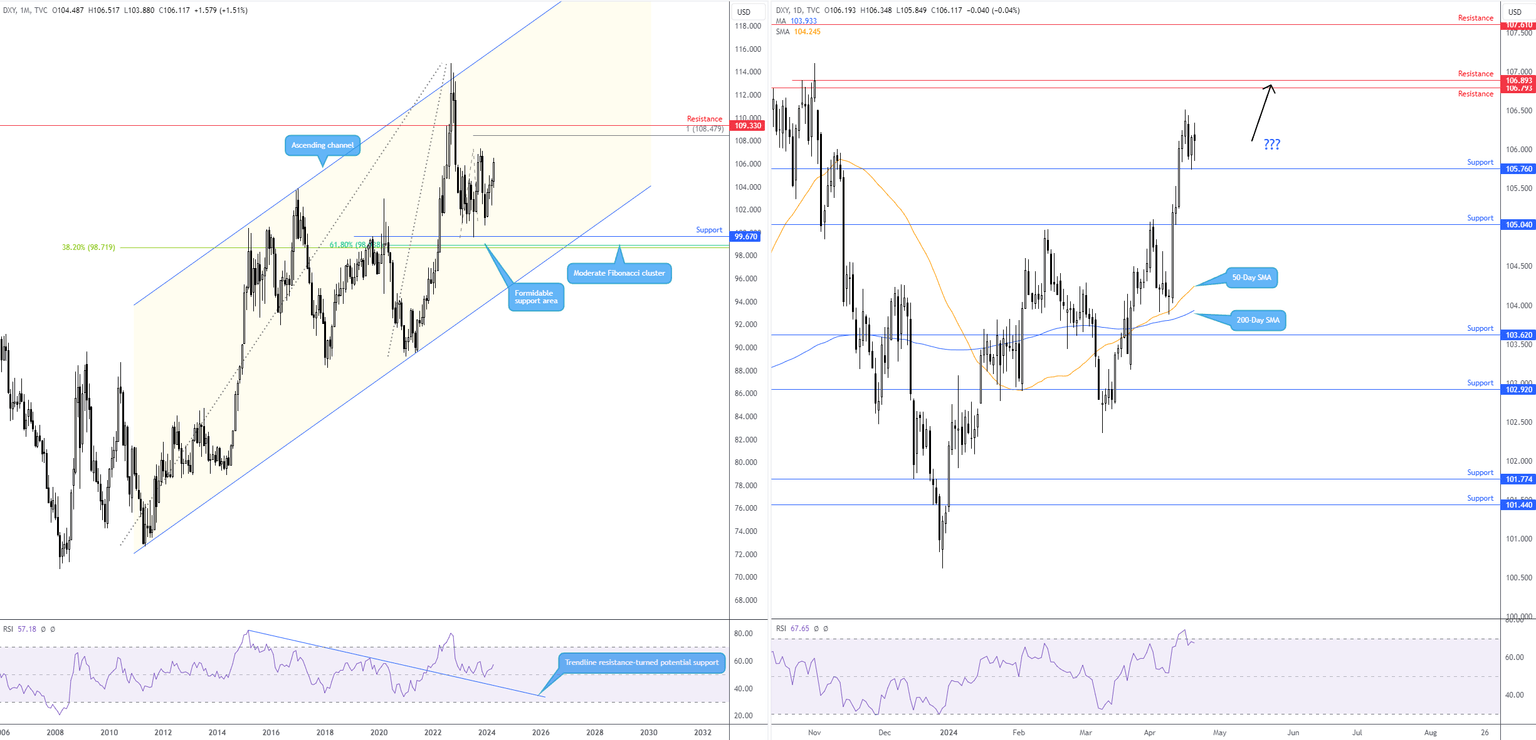

Ahead of this week’s US GDP first estimate print and the PCE Price Index numbers, the US Dollar Index will likely be a watched market.

Buyers remain firmly at the wheel. YTD, we are nearly +5.0%, with April on track to close higher for a fourth consecutive month, up +1.5% MTD. And from a technical standpoint, further outperformance is on the table.

October 2023 peak within reach

Based on price action from the monthly timeframe, the unit is on track to register its fourth consecutive month in the green and is within a stone’s throw of touching gloves with the 107.35 October 2023 peak. Beyond here, the scales tip towards a 100% projection ratio at 108.48 (equal AB=CD resistance) and resistance from 109.33. Reinforcing the possibility of bulls remaining in command this month is the Relative Strength Index (RSI) rebounding from the 50.00 centreline support, indicating positive momentum.

Retesting support

On the daily timeframe, last week observed price movement refresh YTD highs at 106.52 and pencil in a correction in the second half of the week to retest support at 105.76. Overhead, a small, albeit potentially effective, area of resistance resides between 106.89 and 106.79, with a break exposing the October 2023 pinnacles highlighted above and a layer of daily resistance at 107.61.

Consequent to the above, the daily support base from 105.76 could be area buyers enter this week to refresh YTD peaks and perhaps take aim at daily resistance from 106.89-106.79. Of course, the caveat to upside this week is the daily RSI departing from overbought territory.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,