Dollar Index (DXY) extends rally, US Treasury Yields soar

US Consumer Confidence slumps, Stocks fall; Risk-off

Summary: The Dollar Index, which gauges the value of the Greenback against a basket of 6 major currencies extended its rally, breaking above 106 to 106.15 (105.55 yesterday).

Risk aversion following a steep fall in US Consumer Confidence to 103 from an upward revised 108.7 previously, weighing on sentiment. US New Home Sales fell to 675K from 739K.

US Treasury Bond yields soared with the benchmark 10-year rate up to 4.54% from 4.43%, a 16-year high. The two-year US yield rose to 5.12% (5.11%). Minneapolis Fed President Kashkari said one more rate increase was needed after US Consumer prices rose in August.

Other global bond rates rose but to a lesser extent. Germany’s 10-year Bund yield settled at 2.80% (2.74% yesterday). The UK 10-year Gilt rate was up 8 basis points to 4.32%.

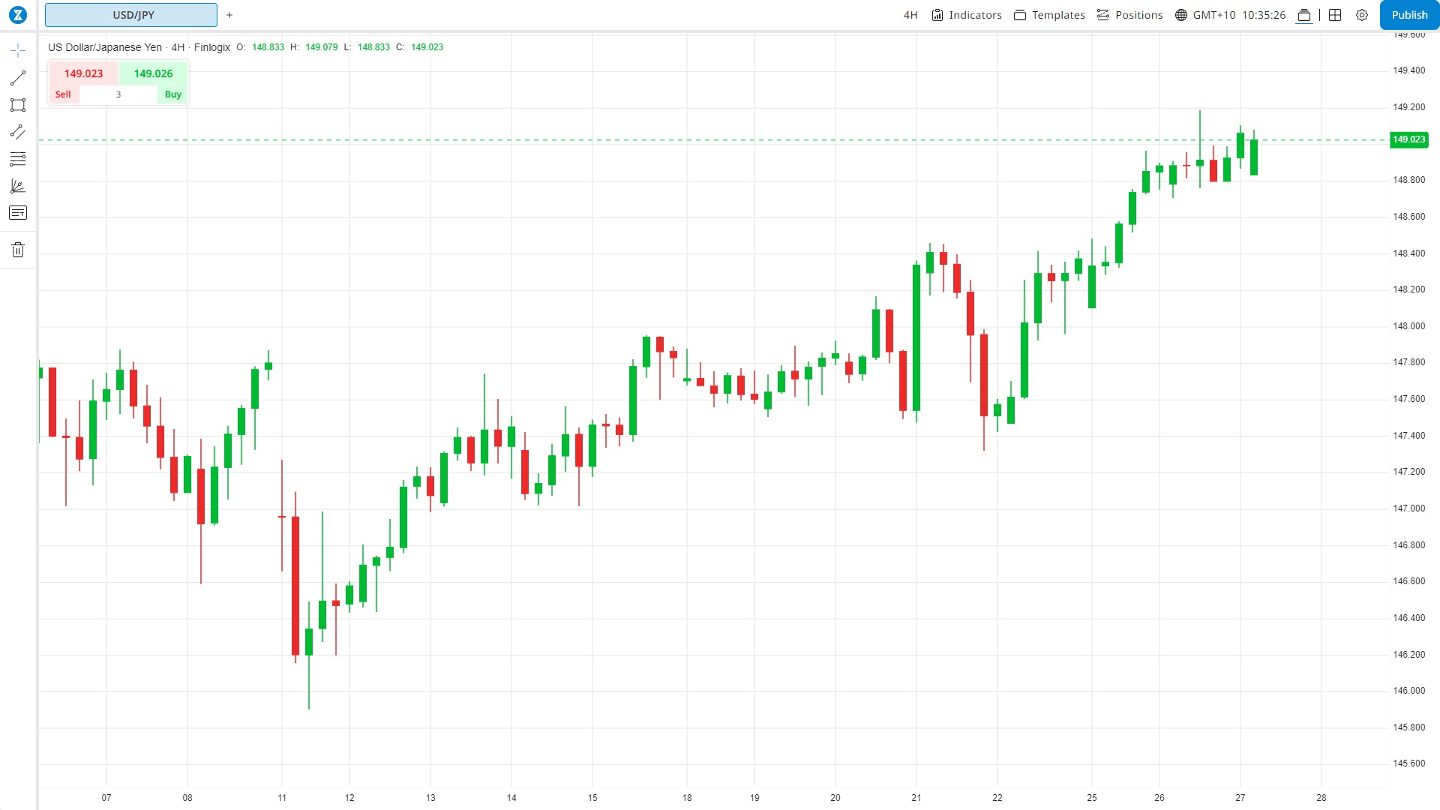

Against the yield sensitive Japanese Yen, the US Dollar rallied to 149.10 (148.37), highs not seen since November 2022. The Greenback edged closer to the 150 JPY level, even as Japanese Prime Minister Kishida told his cabinet to prepare a new economic package to cushion inflation’s rise.

The Euro (EUR/USD) dipped further to 1.0562 (1.0655 yesterday) an overnight and fresh six-month low. Sterling slid 0.48% to 1.2153 from 1.2253 weighed by broad-based US Dollar strength.

The Greenback rose against the Asian and Emerging Market Currencies. Against the Offshore Chinese Yuan (USD/CNH), the Dollar jumped to 7.3120 from 7.2985. USD/THB ratcheted higher to 36.40, up from yesterday’s 36.00.

Wall Street fell, leading global stocks lower. The DOW slumped 1.19% to 33,670 (33,980) while the S&P 500 settled at 4,282, down from yesterday’s 4,322.

Other economic data released yesterday saw Germany’s IFO Business Climate rise to 85.7 in September, matching August’s climb, and higher than estimates at 85.2. UK CBI Realized Sales improved to -14 in September from -44 in August, and better than expectations at -33.

- USD/JPY – Supported by rising US yields, the Dollar rallied to 149.18, an overnight and 9-month high before easing to settle at 149.10. Japanese officials continued to express their concerns on the excessive moves of the Yen. The USD/JPY traded to a low at 105.62.

- GBP/USD – Sterling slid against the overall stronger US Dollar to finish at 1.2153, down 0.48% from 1.2253 yesterday. Overnight, the British currency slid to a low at 1.2153 while the overnight high recorded was 1.2215.

- AUD/USD – The Australian Dollar edged lower against the Greenback to 0.6398, 0.4% lower than yesterday’s 0.6440. The Aussie Battler tumbled to a low at 0.6387 before steadying. The overnight high traded for the AUD/USD pair was 0.6431.

- EUR/USD – The shared currency weakened against the Greenback, edging lower to 1.0570 from 1.0655 yesterday. The Euro traded to an overnight high at 1.0609. The overnight low was 1.0562. Overall US Dollar strength continued to push the Euro lower.

On the lookout:

The Bank of Japan releases its latest meeting minutes to start off today’s economic calendar. Australia follows with its August CPI release (y/y f/c 5.2% from 4.9% - ACY Finlogix). China releases its August Industrial Profits (y/y f/c -10.0% from -15.5% - ACY Finlogix). Japan follows with its July Leading Economic Index (f/c 107.6 from 108.8 – ACY Finlogix), Japanese July Final Coincident Index (f/c 114.5 from 115.6 – ACY Finlogix).

Germany starts off Europe with its October GFK Consumer Confidence (f/c -26 from -25.5 – ACY Finlogix). France follows with its September Consumer Confidence (f/c 84 from 85 – ACY Finlogix). Switzerland releases its Credit Suisse Bank Economic Expectations (no f/c, -38.6 previously – Forex Factory). The US rounds up today’s data with its August Headline Durable Goods Orders (m/m forecast -0.5% from -5.2% - ACY Finlogix), August Core Durable Goods Orders (m/m f/c 0.1% from 0.5% - ACY Finlogix).

Trading perspective:

Surging US yields resulting from a hawkish Federal Reserve continued to lift the Greenback despite weaker-than-expected economic data. Market sentiment deteriorated, which saw risk-off, and pushed stocks lower. Today, Asian share markets will open lower. The Greenback will stay bid, keeping gains versus its Rivals. Traders will focus on the next set of economic data, as well as further rhetoric from various global central bankers.

- USD/JPY – The US Dollar continued its move north, advancing 0.2% against the Japanese Yen to 149.10 at the New York close. Today, look for immediate resistance at 149.20 (overnight high traded was 149.18). The next resistance level lies at 149.50. Immediate support lies at 148.70 (overnight low) followed by 148.40 and 148.00. Expect volatility to stay elevated in a likely range today of 148.50-149.50. Keep an eye on comments from Japan Inc today.

Source: Finlogix.com

- EUR/USD – The Euro continued to lose ground against the overall stronger Greenback, settling at 1.0570 (1.0655 yesterday). Look for immediate support at 1.0550 (overnight low traded was 1.0562). The next support level is found at 1.0520. Immediate resistance today lies at 1.0600 followed by 1.0630. Look for the Euro to grind lower initially. Likely range today: 1.0530-1.0630. Sell rallies still the way to go.

- AUD/USD – The Aussie Battler lost ground against the stronger Greenback to finish at 0.6396 in New York (0.6440). On the day, look for immediate support at 0.6380 (overnight low traded was 0.6387). The next support level is found at 0.6350. On the topside, look for immediate resistance at 0.6430 (overnight high was 0.6431). The next resistance level lies at 0.6460. Look for a likely range today in the AUD/USD pair of 0.6370-0.6470. Preference is still to sell Aussie rallies.

- GBP/USD – Sterling slid against the Greenback to close at 1.2153, down from yesterday’s close at 1.2253. On the day, look for immediate support at 1.2150 (overnight low traded was 1.2153). The next support level lies at 1.2120. Immediate resistance can be found at 1.2180, 1.2210 (overnight high traded was 1.2215), and 1.2240. Look for the GBP/USD pair to trade in a likely range today of 1.2130-1.2230. Trade the range.

Happy trading and Wednesday all.

Author

Michael Moran

ACY Securities

Michael has over 40 years’ FX experience, including running FX trading desks for some of the largest banks in the world.