Diverse productivity growth amid demographic challenges

-

In this next part of our series on demographics, we dive deeper into global production and productivity, both from a per capita and per worker standpoint.

-

Worker productivity for low-income economies has almost quadrupled since 2000, but rapid population growth has also played a large role for GDP growth.

-

High-income countries have seen steady productivity growth in recent decades. This holds also for the Nordic countries.

-

There is a large disparity in productivity growth in all income groups, but in particular in middle-income- and low-income countries.

-

High-income countries face growth headwinds from changing demographics but might be able to make up for it through productivity growth.

How much have low-income economies caught up?

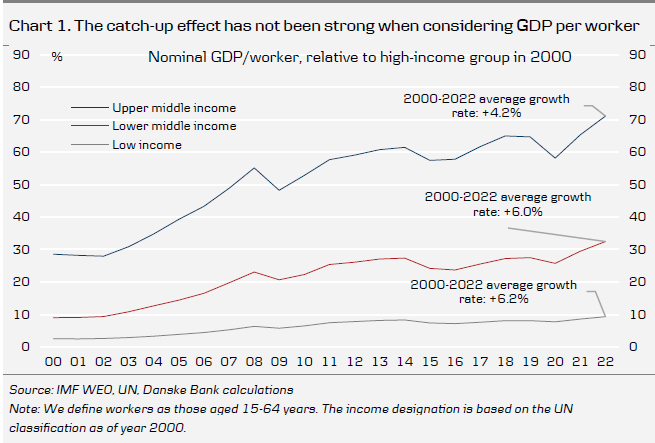

Typically, we anticipate economies with lower productivity to outpace their higher productivity counterparts in growth, as they adopt knowledge and technology from more advanced economies. This phenomenon, frequently analysed on a per capita basis, gains relevance when considered in terms of per worker growth, particularly considering diverging workforce sizes - a perspective we adopt in this paper.

In Chart 1, we average GDP per worker, measured in USD, across various country income groups and divide it by the level of the high-income group in the year 2000. Countries are categorized based on their income classification at the onset of our sample period, the year 2000. Our definition of the working-age population includes individuals aged from 15 to 64 years.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.