Disinflation or deflation?

GDP above expectations as I called it to be, sent S&P 500 only modestly down, but stocks slowly recovered after the close. This tight range of last 5 sessions makes you wonder whether we‘re consolidating (before another upleg) or about to roll over for a healthy correction. It‘s a balancing act, where sellers however aren‘t having much success. In the States, it‘s disinflation still.

Would 4,535 be deep enough for that, or 4,656 would ultimately keep holding? I have an answer which way things look to be leaning, and that‘s thanks to looking at rotations, also inside sectors. You remember me talking very favorably growth stocks and also financials (yes, yields retreat is nowhere over) in Monday‘s extensive analysis for stock market investors seeking to select sectors to do well for more than a couple of weeks.

Trading and Stock Signals clients needn‘t be worried about positioning for a low core PCE figure when used car prices and oil hadn‘t been adding to the heat (and S&P 500 went through the anticipated setback yesterday – and it turned out really shallow), and I kept our intraday clients in the loop as well with this prediction yesterday (time stamp is 1hr before London as always):

What I see as unfolding over the near term in stocks thereafter – core PCE met my preannounced expectations, and readied clients can be seen in the full analytical section.

Also please note how the 102.30 USD Index support called Monday, worked. Ultimately though, I‘m looking for this rebound to fail, and 102.30 to be broken to the downside – and yields would make another clear push lower as well – all of significance to long-term investors and intraday traders alike..

Let‘s move right into the charts – today‘s full scale article contains 3 of them, featuring S&P 500, precious metals and oil.

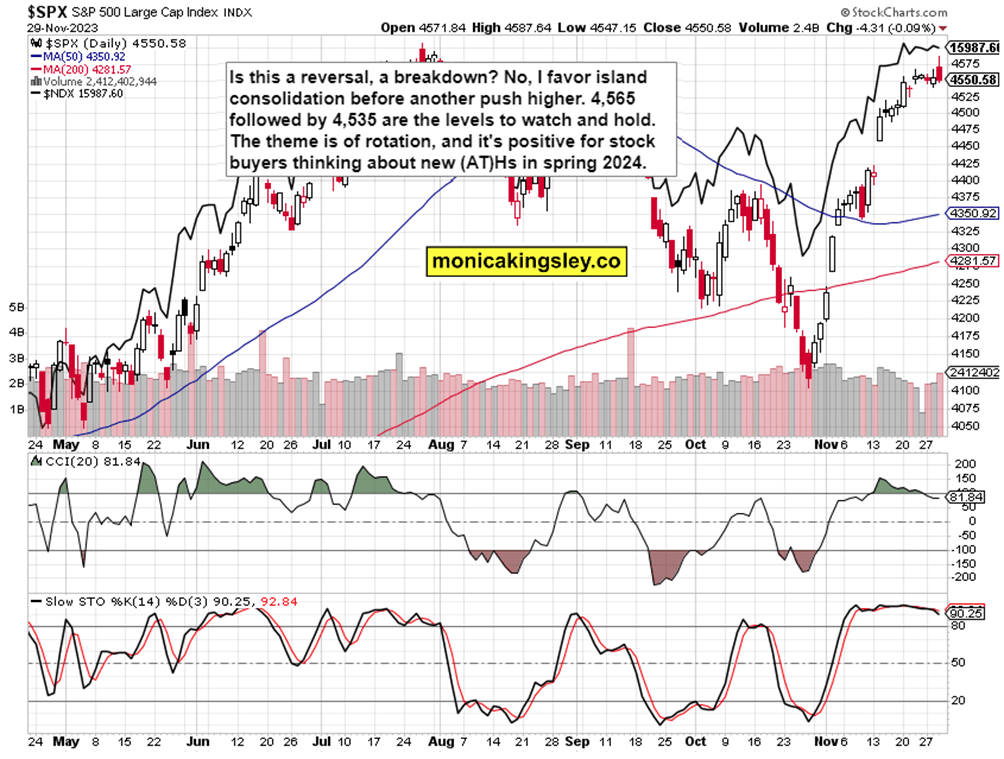

S&P 500 and Nasdaq outlook

The caption captures my key point for 1-3 sessions ahead, and while a little shakedown is possible (to see what‘s beneath 4,535), I don‘t favor it really to strike today. Fears before Powell are to show up in stock prices, but they would be overcome, maybe even still tomorrow.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.