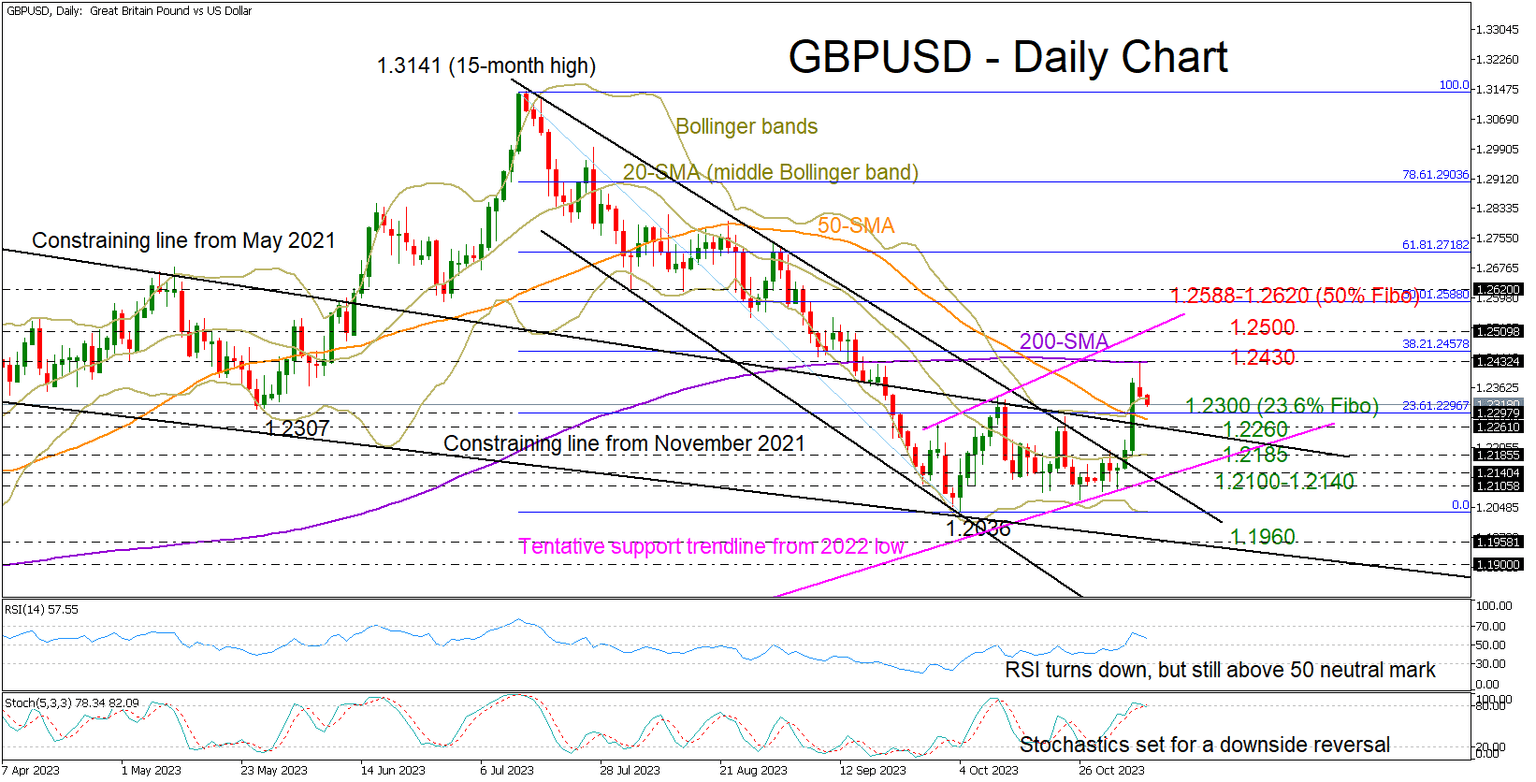

Did GBP/USD get caught in a false breakout? [Video]

-

GBP/USD trims gains after rejection from 200-SMA.

-

Buying appetite falls; support at 1.2260-1.2300.

![Did GBP/USD get caught in a false breakout? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/new-style-twenty-pound-notes-3079195_XtraLarge.jpg)

GBPUSD could not find enough buyers to expand Friday’ bull run above its 200-day simple moving average (SMA), closing with marginal losses within the 1.2300 area on Monday.

Given the current negative momentum in the price, the question now is whether the pair will stay resilient above the 1.2260-1.2300 key region. A clear step below it and beneath the 50-day SMA would wipe out Friday’s boost, pressing the price back to the 20-day SMA. Slightly lower, the tentative ascending line from the 2022 low at 1.2140 and the upper band of the broken bearish channel at 1.2100 could prevent a drop towards October’s low of 1.2036. If not, the sell-off might stretch towards the falling support line from November 2021 at 1.1960.

Technically, the short-term risk is leaning to the downside. The price has closed above the upper Bollinger band, while the stochastic oscillator seems to have peaked above its 80 overbought level, both suggesting that the latest spike in the price is overdone.

Nevertheless, the RSI is still some distance above its 50 neutral mark, raising speculation that the bulls still have the power to stage a rebound. In this case, traders will wait for a close above the 200-day SMA at 1.2430, and more importantly, beyond the 1.2500 mark to upgrade their outlook. Then, the next battle could take place somewhere between the 50% Fibonacci retracement of the previous downleg at 1.2588 and the 1.2620 barrier.

To sum up, the latest spike in GBPUSD has not excited traders yet. An extension above the 200-day SMA and the 1.2500 number is still required to make the upturn look more credible. Note that the death cross between the 50- and 200-day SMAs is intact.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.