Deep Dive Into the BLS Job Revisions: What Really Happened?

Job Revisions

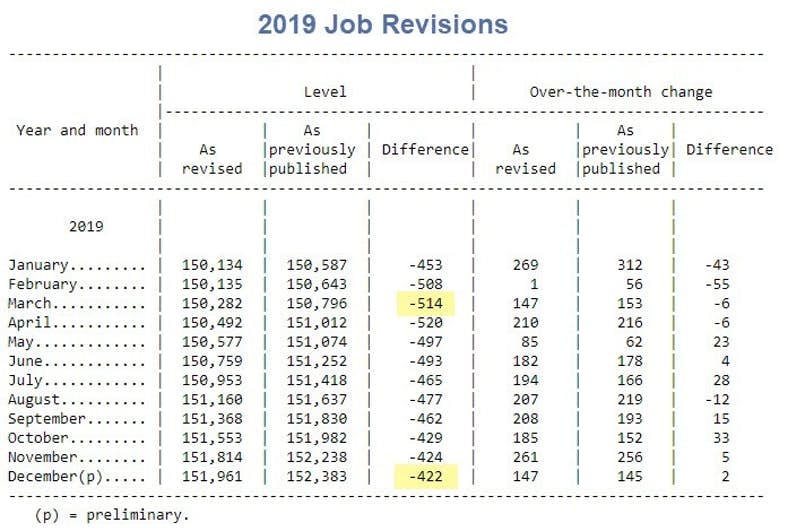

Today the BLS provided these month-over-month revisions.

- The change in total nonfarm payroll employment for November was revised up by 5,000 from +256,000 to +261,000, and the change for December was revised up by 2,000 from +145,000 to +147,000.

- With these revisions, employment gains in November and December combined were 7,000 higher than previously reported.

The BLS also provided the lead image.

Recall my August 21 report: BLS Revises Payrolls 501,000 Lower Through March.

Today the BLS says "The total nonfarm employment level for March 2019 was revised downward by 514,000 (-505,000 on a not seasonally adjusted basis), or -0.3 percent."

For December 2019, the BLS previously reported jobs at 152,383,000. Today we see it's really 151,961,000.

That a difference of 422,000 jobs.

Jobs Rise 225,000 But Employment Fell by 89,000

Today the BLS benchmarks January 2020 at 152,186,000 jobs.

That's a net increase of 1,599, 000 jobs, about 133,000 per month vs the original January 2019 total.

Seasonal reports make today's report more than bit suspect, especially construction work which allegedly added 44,000 jobs.

For more details and discussion, please see Jobs Rise 225,000 But Employment Fell by 89,000.

I commented "Seasonal adjustments make this report more than a bit suspect."

Reader Tony added: "Yes, seasonal adjustments most certainly play a role during the winter. During January, the NOAA reported the average contiguous U.S. temperature was 35.5°F, 5.4°F above the 20th century average, ranking fifth warmest in the 126-year record."

What revisions will we see this March?

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc