Decoding the Bitcoin and Gold rally: Understanding the correlation

In the realm of alternative investments, Bitcoin and gold have emerged as star players, both exhibiting remarkable surges in their values. The cryptocurrency community often likens Bitcoin to "digital gold," positioning it as a modern store of value. The recent resurgence of Bitcoin, approaching its all-time high of nearly $69,000, has caught the attention of crypto enthusiasts. Simultaneously, traditional gold has not been left behind, reaching a record high of over $2,100 per ounce.

Parallel peaks: A curious phenomenon

The simultaneous ascent of both new and old gold prompts a deeper inquiry. Traditionally, investors turn to gold and Bitcoin as hedges against inflation. However, current market conditions, with receding inflation pressures and a relatively stable U.S. Dollar Index, defy the conventional rationale behind their upward trajectory.

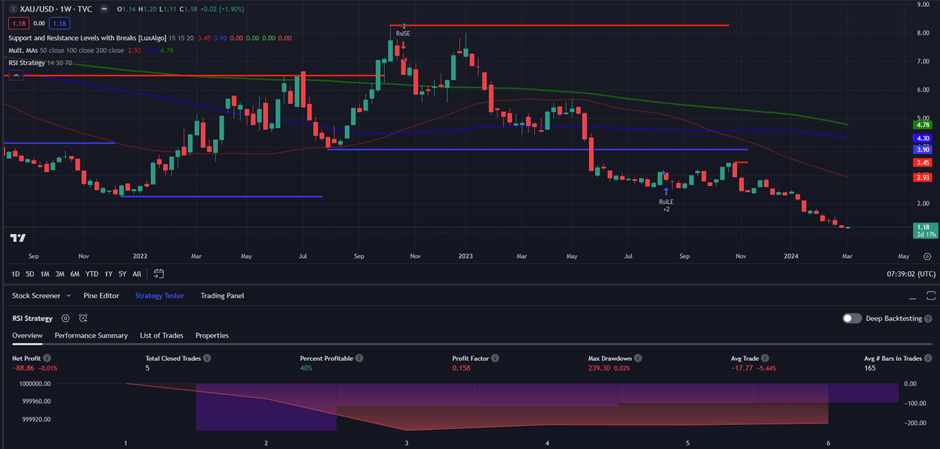

Gold Weekly Chart, Source: Trading view

One significant development in the crypto space is the launch of spot Bitcoin ETFs, drawing retail investors into the market. Notable financial institutions like BlackRock, Fidelity, and ARK Invest facilitating easy access to Bitcoin have led to substantial inflows, propelling its prices higher. However, this alone doesn't account for the parallel surge in gold prices, raising questions about underlying factors.

BTC Weekly Chart, Source: Trading view

Global unrest: A catalyst for precious assets

John Norris, Chief Investment Officer at Oakworth Capital Bank, points to a broader context of "general angst" about global events. Geopolitical tensions, including the Russia-Ukraine war, Israel-Hamas conflict, and attacks on cargo ships in the Red Sea, contribute to the uncertainty. Norris suggests that the spikes in both gold and Bitcoin may be reflections of people feeling increasingly uncertain about the world around them.

Central banks' moves and geopolitical concerns

Central banks, notably Turkey, China, and India, are making substantial gold purchases, influencing the precious metal's upward trajectory. The World Gold Council reports significant additions to reserves in January. Geopolitical concerns have created a complex landscape, providing a broader case for gold, according to Joe Cavatoni, Senior Market Strategist for the Americas at the World Gold Council.

Looking ahead: Potential challenges

While the current climate supports the upward momentum of gold and Bitcoin, potential challenges loom on the horizon. A dovish Fed has been a driving force behind gold's strength, but uncertainty arises regarding the timing of the next rate cut. Bitcoin faces its own set of challenges, including an impending halving event in April, which may impact its price significantly.

Investment caution: Volatility persists

Recent volatility in gold-mining and crypto stocks serves as a reminder of the inherent risks associated with these assets. Companies like Riot Platforms, Marathon Digital, Coinbase, and MicroStrategy have experienced fluctuations, underscoring the need for investors to tread carefully.

Bitcoin-Gold correlation

The correlation between Bitcoin and gold has experienced fluctuations throughout much of Bitcoin's existence. Initially, the prices of these two assets moved mostly independently, meaning that when one asset's price increased, the other did not necessarily follow suit. However, following the market crash in 2020 at the onset of the COVID-19 crisis, the correlation between Bitcoin and gold tightened, reaching historical levels once again. Currently, the correlation stands at 0.87 (or 87%), indicating a strong positive relationship between the prices of Bitcoin and gold. A correlation of 1 signifies a perfect positive correlation, while -1 indicates a perfect negative correlation.

One year The Correlation Between Bitcoin and Gold, source: longtermtrends

The charts illustrate a steep climb in Bitcoin's ratio to gold throughout the first quarter of 2024, peaking towards the new quarter expecting a slight retracement waiting for the BTC to halve. This ratio is a metric derived from dividing the price of Bitcoin by that of gold, offering insight into the purchasing power of Bitcoin relative to gold. At its zenith, the ratio reached an impressive 253.9, implying that 253.9 ounces of gold could be purchased with 1 BTC. This figure underscores the belief among Bitcoin enthusiasts that BTC serves as a reliable store of value.

Bitcoin and Gold Ratio, source: longtermtrends

Despite Bitcoin's foray into the stock market via ETFs, investors seem to be gravitating towards Bitcoin's gold-like qualities. Despite exhibiting characteristics akin to stocks, Bitcoin continues to provide investors with a sense of stability reminiscent of gold. With the U.S. inflation rate persisting above the desired Federal Reserve target of 3.1% and Bitcoin experiencing a spike in value this month, it becomes evident that investors are not solely pursuing growth but also seeking stability amid economic uncertainty.

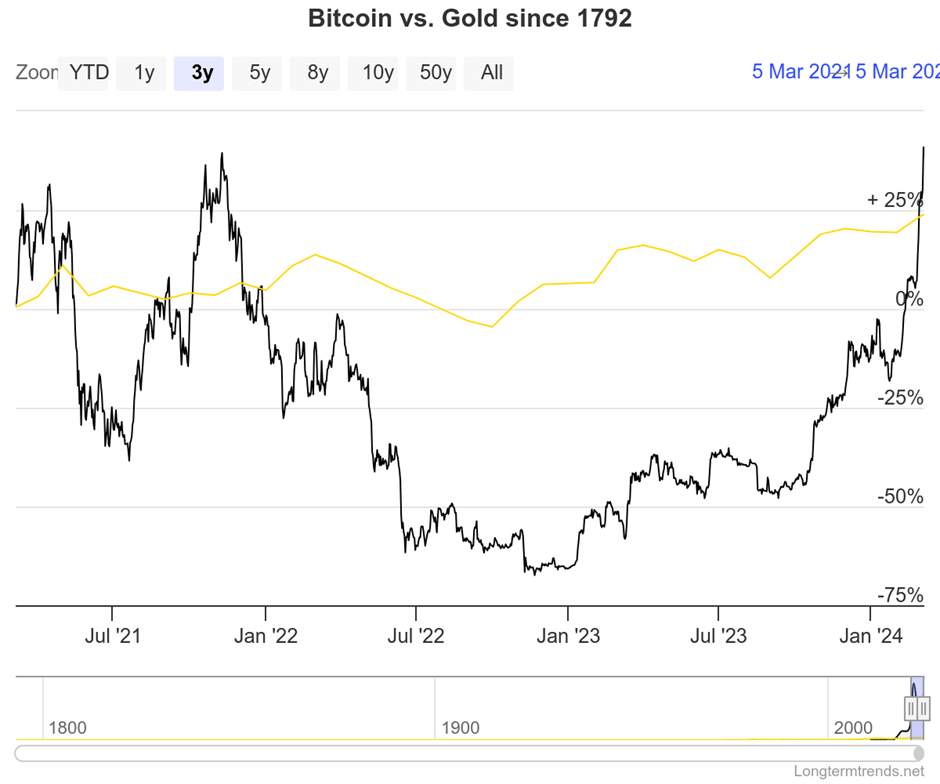

Bitcoin Vs Gold, source: longtermtrends

Note: This chart gives a different view of the data from the charts above, comparing the percentage change between the prices of bitcoin and gold over time.

The relationship between Bitcoin and gold underscores the intricate and evolving nature of Bitcoin as both a digital currency and an asset class. As Bitcoin matures, it appears to be incorporating certain qualities of gold while assimilating traits from stocks and commodities. This Bitcoin-gold kinship highlights the complexity of Bitcoin's role in the financial landscape, offering investors a unique blend of stability and growth potential in uncertain times.

Deciphering the trends

Understanding the correlation between Bitcoin and gold is essential in decoding the recent rally of these assets. As Bitcoin and gold continue to surge in tandem, investors navigate the intricacies of the financial landscape, seeking opportunities for growth and stability. The correlation between Bitcoin and gold serves as a barometer of market sentiment, reflecting investors' quest for certainty in uncertain times. By unravelling the correlation between these assets, investors gain insights into the evolving dynamics of the financial markets and position themselves strategically for the future.

Author

Faouz Rejeb

Independent Analyst

Transitioning from my distinction as the Best Crypto Analyst in 2022, I actively serve as a distinguished Marketing Brand Manager and acclaimed independent Market Analyst.