December CPI: The sting of 7%

Summary

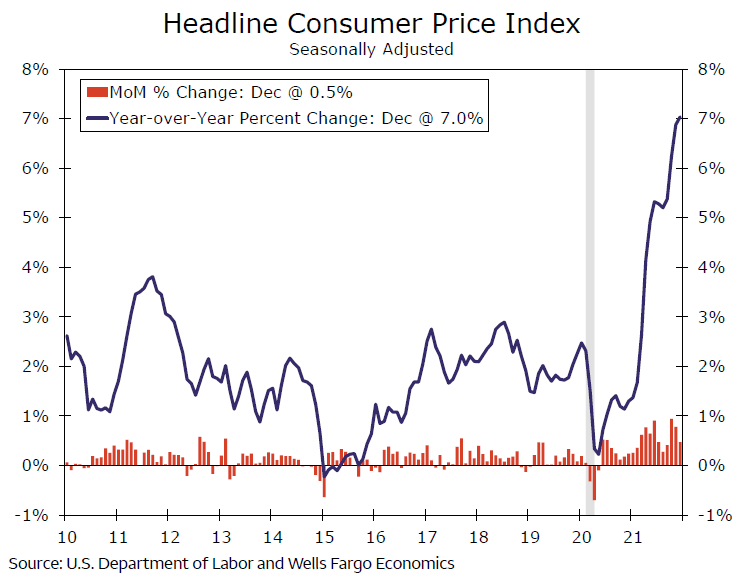

December's 0.5% increase in the Consumer Price Index marks a slowdown from November's gain, but the relative size should not detract from the absolute size which shows prices continue to rise at a menacing pace. The ongoing strength of inflation was underscored by the year-over-year change rising to 7%, which is the largest increase in nearly 40 years. If CPI inflation is still around 7% heading into the March FOMC meeting, as we expect it to be, it will be hard for the Fed to stand by idly.

Source: U.S. Department of Labor and Wells Fargo Economics

No relief heading into 2022

A remarkable year of inflation ended with a bang in December. The Consumer Price Index (CPI) rose7.0% over the past year, the largest one-year change since 1982. Price growth moderated somewhat on a monthly basis, with the CPI advancing 0.5% compared to a 0.8% gain in November. But that still translates to a 5.8% annualized rate of change–far above the Fed's goal and highly visible to consumers whose earnings have not kept pace with prices this past year.

The headline gain came in a bit softer than the core reading of 0.6% due to some giveback in energy prices. But goods prices continued to lead the way in inflation in general. Excluding food and energy, goods prices jumped another 1.2%, driven in large part by additional hefty gains in vehicle prices. New vehicle pries rose 1.0%, while used vehicles were up 3.5%. That puts used vehicle prices more closely on par with the run-up in auction prices, suggesting somewhat smaller contributions from used cars to the headline for the next couple of months at least.

Author

Wells Fargo Research Team

Wells Fargo