DAX keeps bullish bias

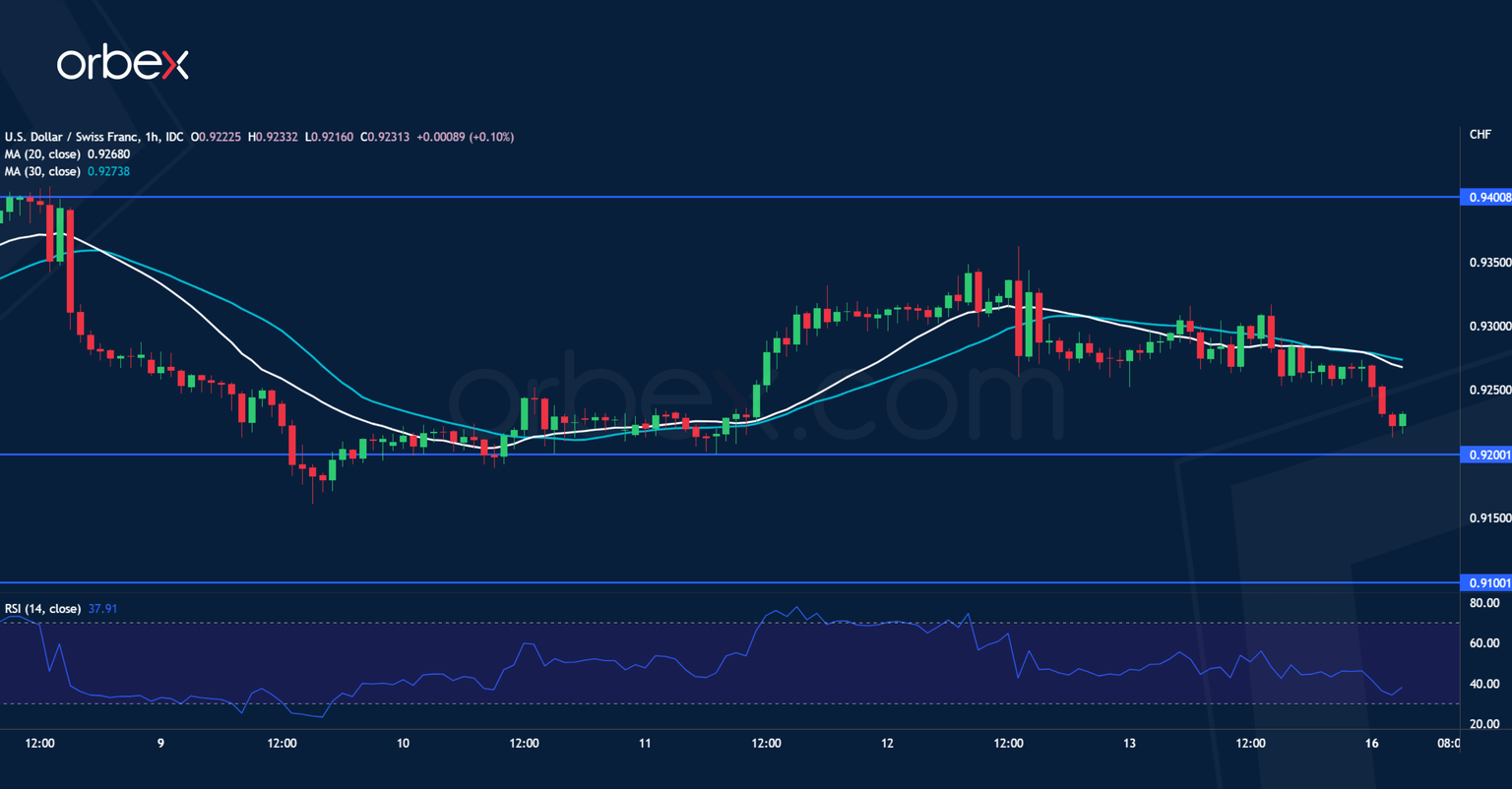

USD/CHF hits resistance

The US dollar softened after Fed policymakers cheered the news of easing inflation. On the daily chart, the pair has remained under pressure after a tentative break below last April’s low of 0.9200. The current rebound from this critical level has led to a consolidation. Though the greenback must clear the recent swing high and daily resistance at 0.9400 before it would attract buyers. A bullish reversal could take shape should this happen. Otherwise, renewed selling pressure would send the pair towards 0.9100.

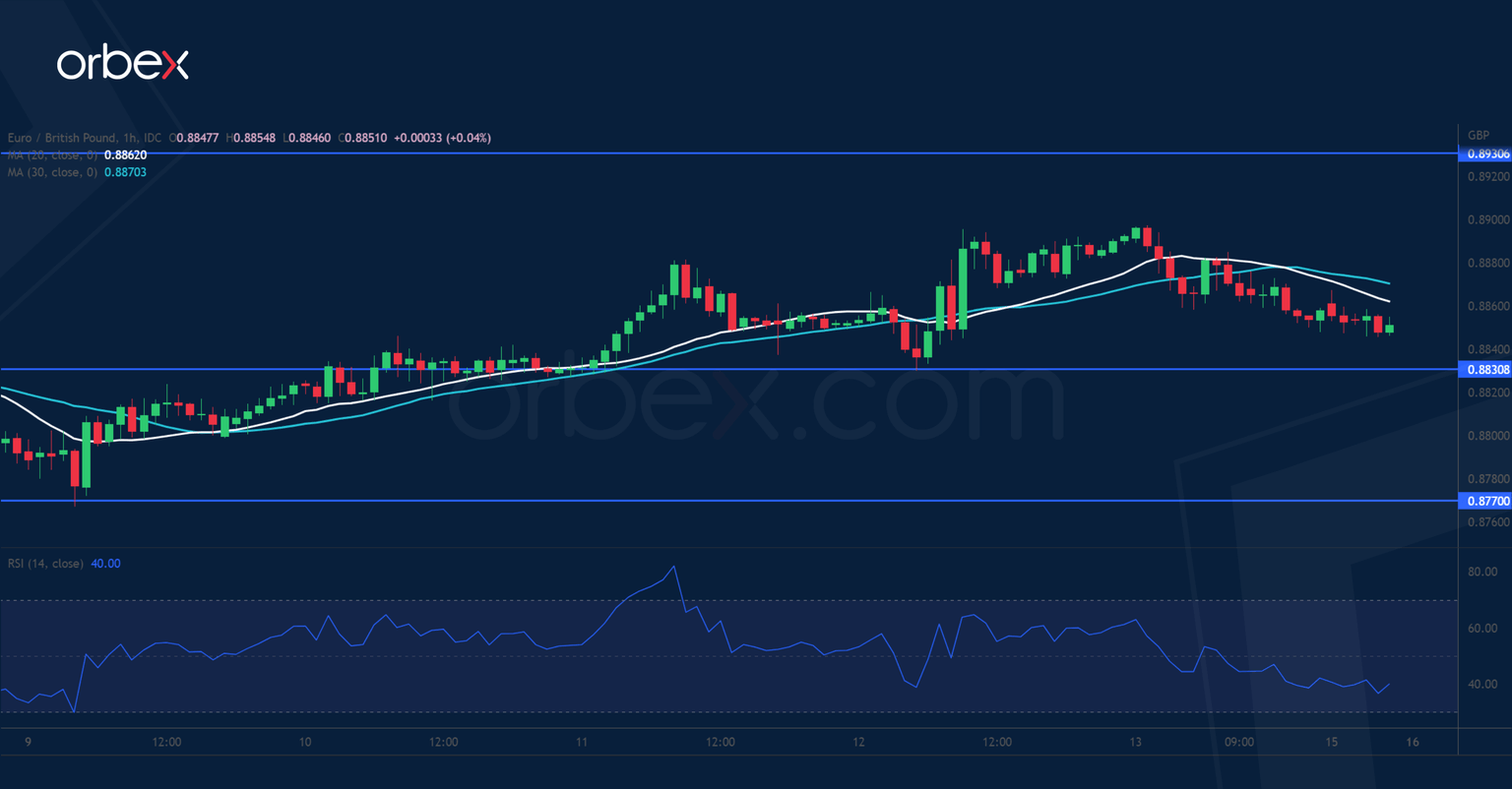

EUR/GBP tests support

The pound recouped losses as the UK’s economy avoided a contraction in November. However, overall sentiment still favours the single currency. A break above the higher band (0.8870) of the consolidation range means that the bulls are still in charge of the price action. A pullback would be seen as an opportunity to stake in and join the trend. The previous low of 0.8830 is the first support and further down 0.8770 on the 20-day moving average is a critical floor. 0.8930 from last September’s sell-off is the target.

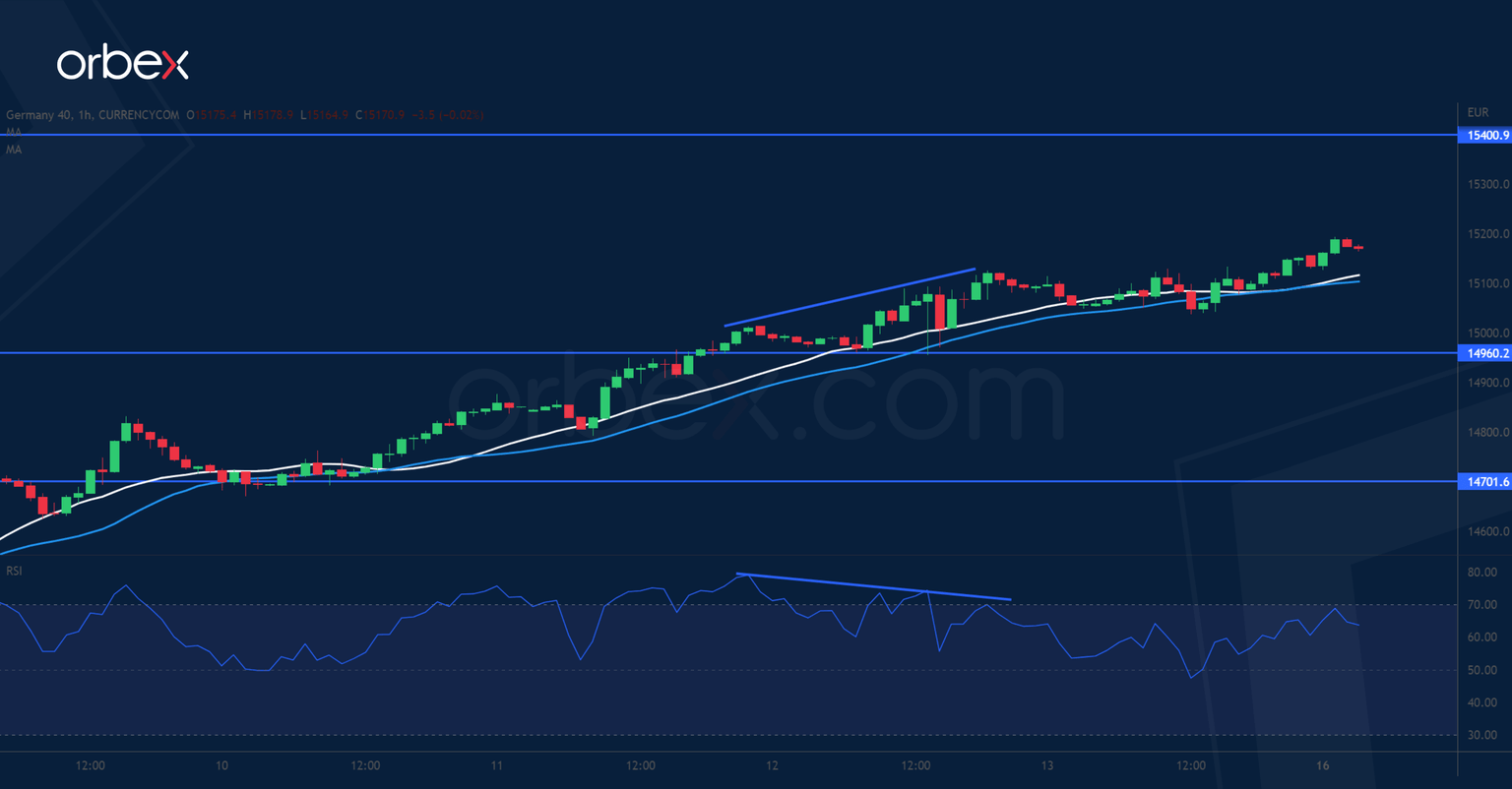

DAX 40 grinds higher

The Dax 40 extends gains as markets go risk-on post-US inflation. A bullish MA cross on the daily chart confirms increased risk appetite after a rally above last June’s high of 14650. As the RSI repeatedly flirts with overbought territory, a pullback may catch the eye of bullish followers. Another sign of exhaustion comes from the hourly chart where a bearish RSI divergence shows a loss of momentum. 14960 is the immediate support in case the index takes a breather. 15400 at the start of a sharp sell-off in February is the target.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.