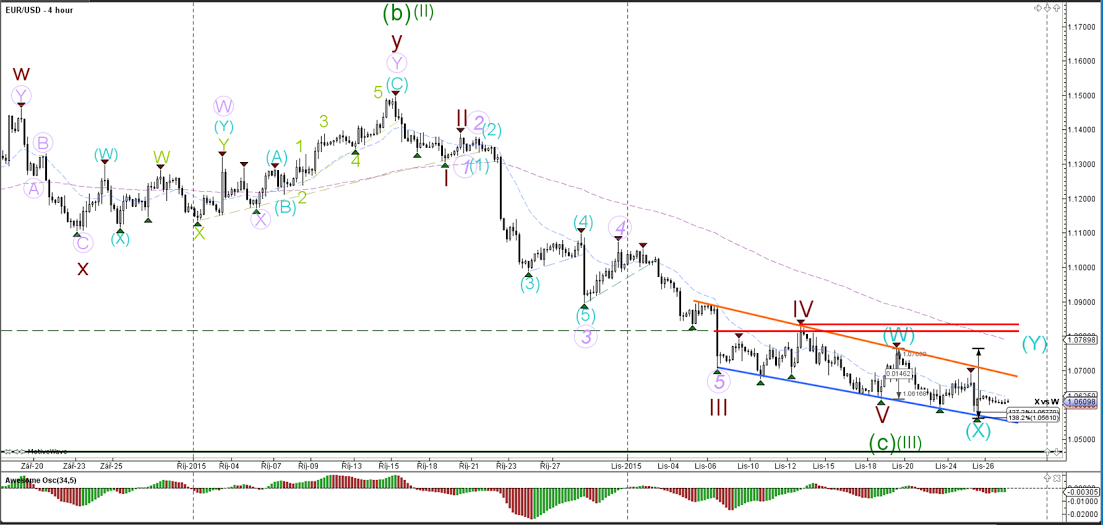

EUR/USD

4 hour

The EUR/USD remains ingrained in a downtrend channel which is indicated by the orange and blue trend lines. Price is near the year low (green) of 1.0460 which could act as a strong support level.

1 hour

The EUR/USD price action has moved sideways yesterday representing a consolidation zone. The zone could be part of a wave B (green) correction.

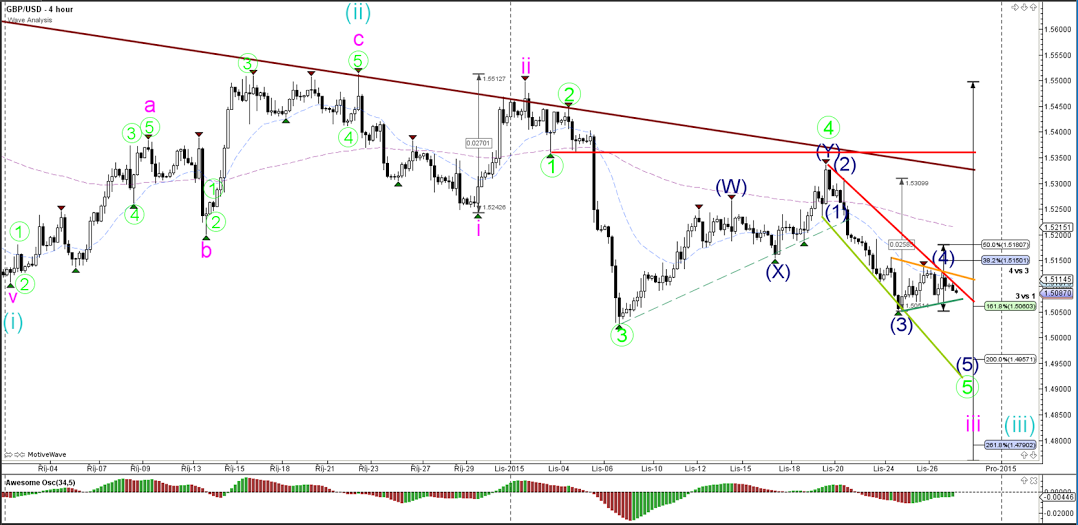

GBP/USD

4 hour

The GBP/USD is in a downtrend channel which is indicated by the support (green) and resistance (red). Price is most likely in a wave 4 (blue) correction.

1 hour

The GBP/USD is building a contracting triangle, which is indicated by the support (green) and resistance (orange/red). A break below support could see price move down towards the Fib targets. A break above the resistance trend line could see price struggle with the resistance Fibs.

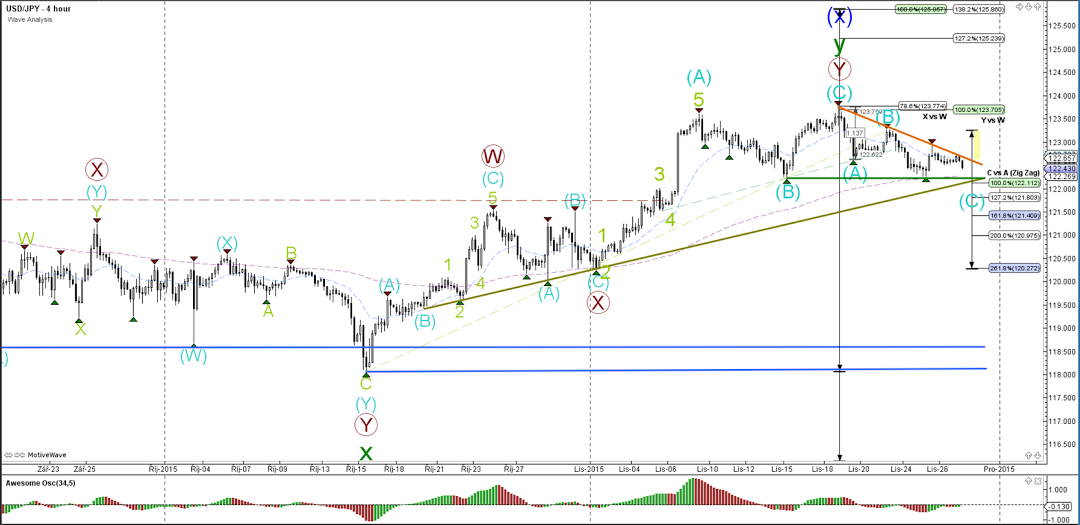

USD/JPY

4 hour

The USD/JPY turned at the 78.6% Fibonacci resistance level. A break above resistance (orange) could see price move up toward the next confluence zone of Fibs. A break below support (green) could see price move towards the Fibonacci targets of wave C (blue).

1 hour

The USD/JPY could have completed a wave 4 (green) retracement. Price broke the mini support trend line (dotted green) but a bigger bottom remains intact (solid green).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.