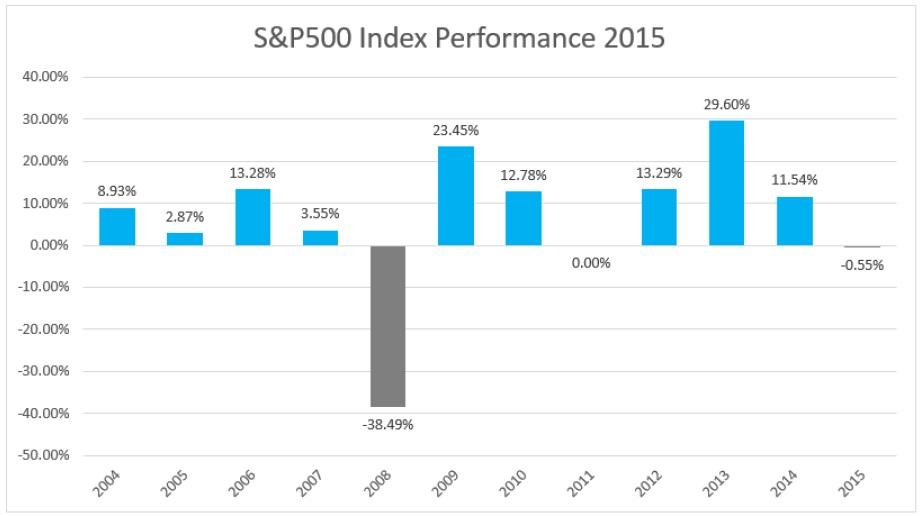

The S&P 500 index fully recovered after falling in August to as low as 1,835 when fears of a slowdown in China shocked the global markets. The index experienced its first technical correction during the month of August as it fell more than 6% from its all‐time high. This is the biggest fall since September 2011 where the index faced a ‐7.20% drop. Even though the index recovered above the psychological level of 2,000 it went negative on the year‐to‐date (YTD) at 1.85% and in the past one year period is down about 0.60%. For the third quarter, the index finished with a total return of ‐ 6.90%.

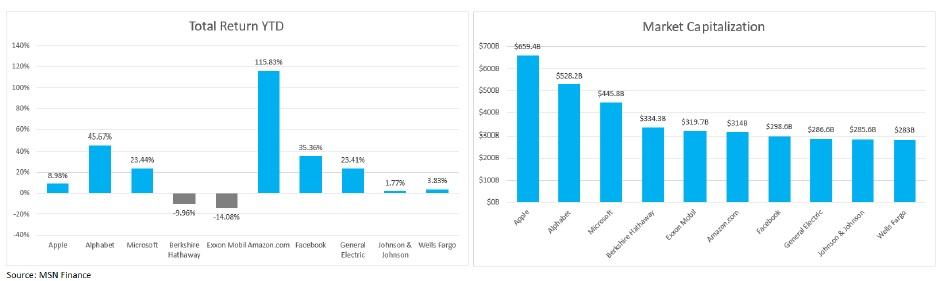

However, the main concern is that the index return is coming from a few of its stocks. Among the 10 most valuable stocks in the market which are up roughly 20% as a group this year versus a ‐3% for the rest of the stocks. For example, shares of Amazon.com (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), Facebook (NASDAQ: FB) and Alphabet (NASDAQ: GOOG) have led the way, while Exxon Mobil (NYSE: XOM) and Berkshire Hathaway (NYSE; BRK) have been underperformed. Thus, we should examine this more closely as a widening of the stocks between the market's best performers and the rest of the market could raise some worries for the whole performance of the index in the near term.

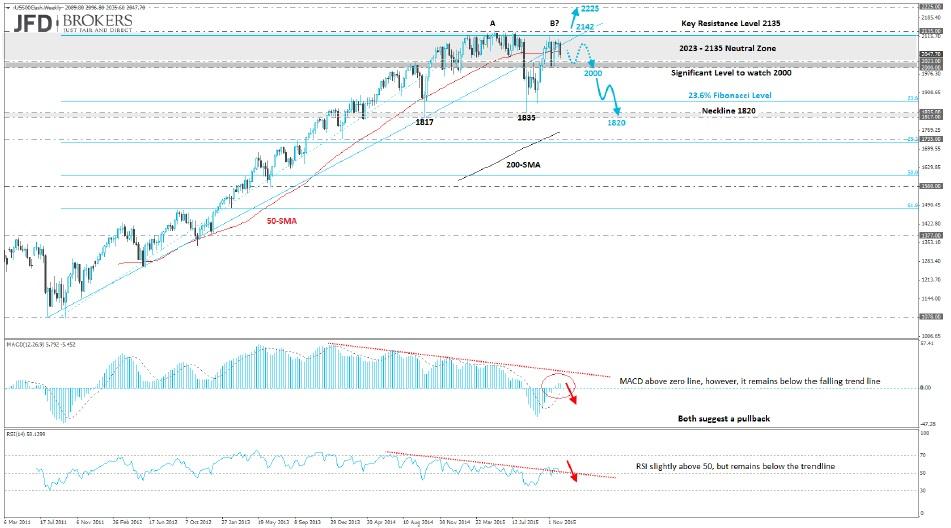

Technically, the index is struggling to extend the bullish rally above the all‐time high of 2,135 following the aggressive buy from the 1,835 in mid‐August. The recent sell‐off in mid‐November saw the key zone of 2,000 – 2,023 once again provide solid support for the index. Therefore, the key zone which will have a significant impact on the direction of the index will be the 2,000 – 2,023 zone. The recent rally above the aforementioned zone has been extremely aggressive and if we see a close above the key 2,135 or the all‐time high, would be a strong bullish signal.

On the other side of the coin, a break below the aforementioned zone could be seen as a double top reversal, which is a bearish reversal pattern, and therefore, we should expect a further pressure on the bottom of the pattern or the neckline, around 1,835 and slightly below the 23.6% Fibonacci retracement level.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD rebounds on Thursday after midweek pullback

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.