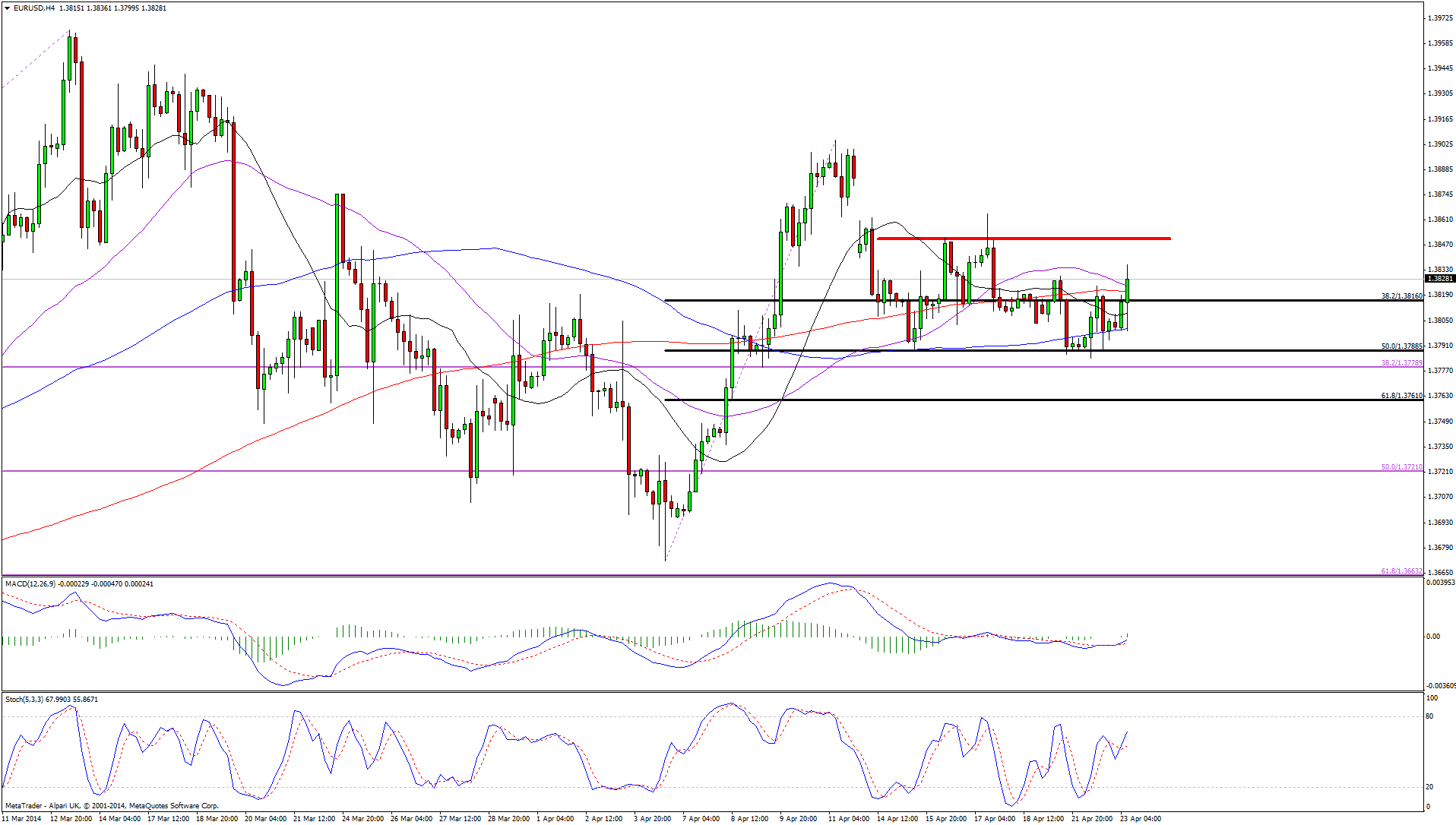

EURUSD

The euro is looking a little more bullish against the dollar again, but the lack of momentum is a concern. Not only did the pair fail to make a new higher during the previous rally before correcting, the bounce off the 50 fib level wasn’t very convincing. Clearly 1.40, not far above the current level, is a major psychological level and is making traders a little cautious as we approach it. Should we break above that level, we could then see more aggressive buying. For now I expect the caution to continue with mild gains being made. The 4-hour chart shows an imperfect double bottom forming with the neckline around 1.3850. A close above this level could prompt the next surge in buying with the target being just above 1.39, based on the size of the formation. This coincides roughly with the previous resistance found on 11 April.

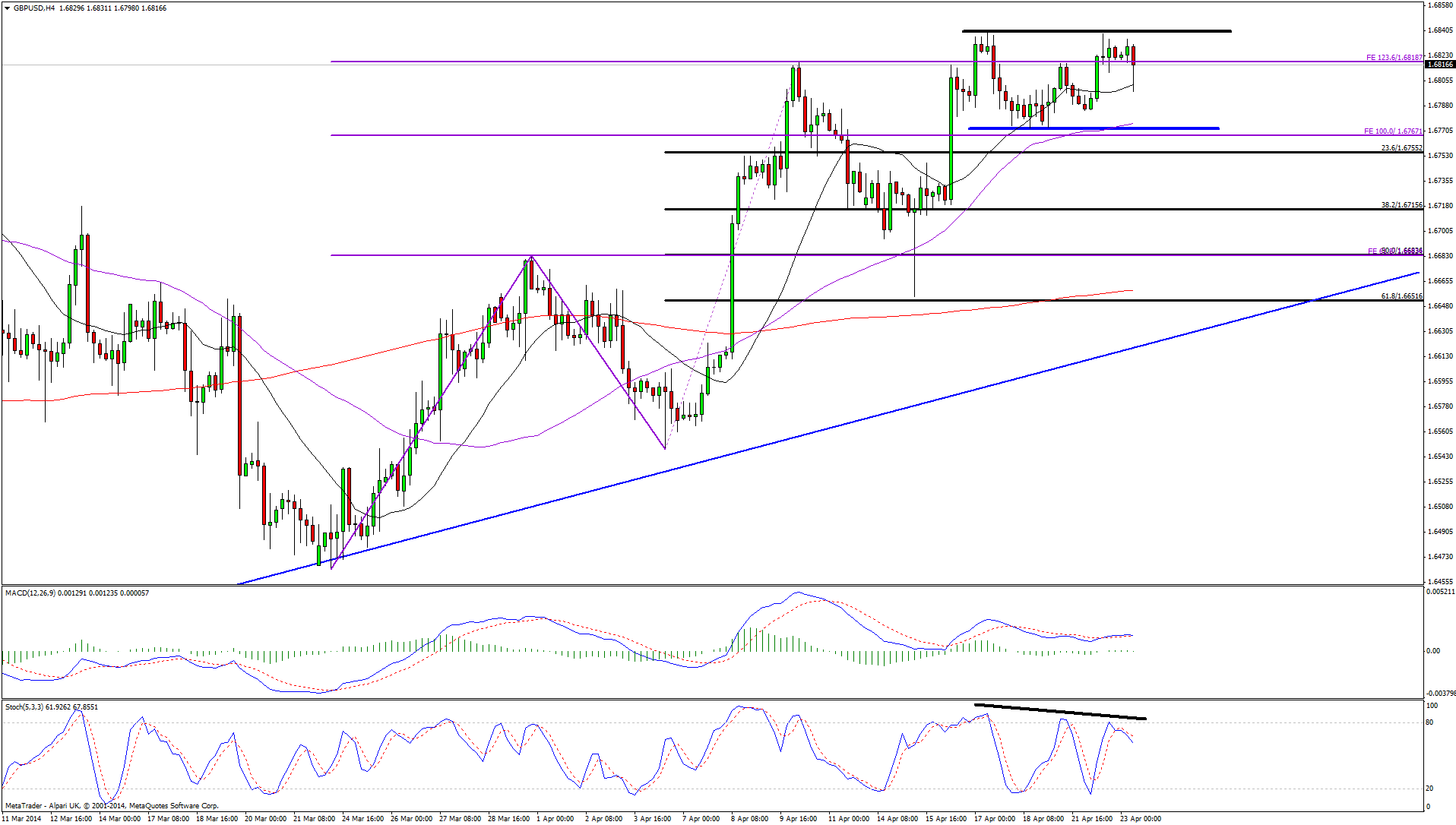

GBPUSD

Sterling is really struggling around 1.6820 right now having reached the 123.6 fib expansion level, which happened to coincide with a previous resistance level, dating back to 17 February. Numerous attempts to significantly break through this level have failed which suggests the bullish move may be running out of steam. This can also be seen on the 4-hour chart where the pair has been testing previous highs while momentum, as seen on the stochastic, is being lost. This bearish divergence could be an early warning of a more significant correction in the near term, although as always this is only a secondary indicator so further confirmation of this will need to be seen. This could come from the pair breaking through the previous support around 1.6772, with further confirmation coming from the pair making lower highs and lower lows. For now though, the pair appears stuck in a tight range between 1.6772 and 1.6840.

USDJPY

This pair remains range bound at the moment and yesterday’s doji candle at the top of the range suggests this is not going to change. The ADX continues to hover around the 20-level which supports the continuation of this range bound trading. We’ve already seen some selling early in the session which suggests once again that we’re going to see another move back towards the bottom of the range. That said, it may not reach the support that it has previously, with an ascending trend line having now penetrated the trading range. Significant support could now be found around 101.60. Should we see this it could point to a breakout to the upside over the next month or so, with further resistance then being found around 103.50, previous resistance. For now, the pair appears to have formed a small double top on the 4-hour chart and is currently finding support along the neckline. A break of this should prompt a move towards 102.25 based on the size of the formation.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.