Technical Bias: Bearish

Key Takeaways

- Most majors are sitting in ranges as the Forex market prepares for action.

- Chinese Gross Domestic Product (GDP) measuring the annualized change in the inflation-adjusted value of all goods and services is set to rock market during the next Asian session.

- Aussie dollar might climb and take advantage of the Japanese yen weakness moving ahead.

Earlier, the Governor of the Bank of Japan Haruhiko Kuroda stated that the central bank would keep up with monetary easing until inflation is firmly anchored. His remarks increased bearish pressure on the Japanese yen especially against the Aussie dollar.

Technical Analysis

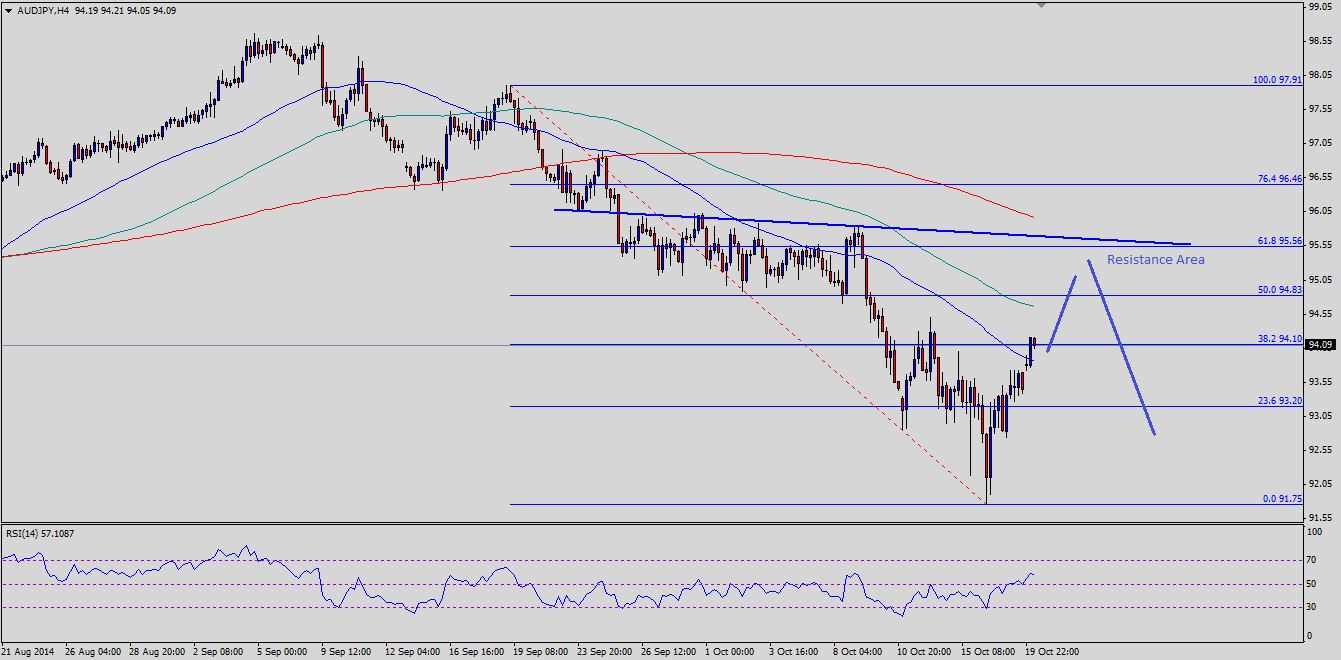

AUDJPY benefited from the Japanese news as it climbed higher above the 94.00 level. There is no denial that the pair is positively biased in the near term, but a lot would depend on the upcoming Chinese GDP release. If the outcome surpasses market’s expectation, then the Aussie dollar might surge against a basket of currencies including the Japanese yen. There are several hurdles on the way up for the pair, starting with the 100 simple moving average which is sitting around the 50% Fibonacci retracement level of the last drop from the 97.91 high to 91.75 low. If AUDJPY buyers manage to surpass the mentioned resistance area, then it might head towards another critical zone at 95.50. There is a monster trend line around the stated area which is also meeting the 61.8% fib level. So, AUDJPY buyers could struggle around 95.10-95.50 if the pair climbs higher.

On the downside, there is only open space. So, if the Chinese GDP fails to impress investors, then we might witness pressure selling in AUDJPY. In that situation, the pair might fall towards the 92.00 support area.

Chinese GDP

There is an important economic release lined up during the next Asian session i.e. the Gross Domestic Product (GDP) will be published by the National Bureau of Statistics of China. The forecast is of a minor decline from the previous rate of 7.5% in Q3 (YoY). Let us see how the outcome shapes out and affects the price action moving ahead.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.