Technical Bias: Neutral

Key Takeaways

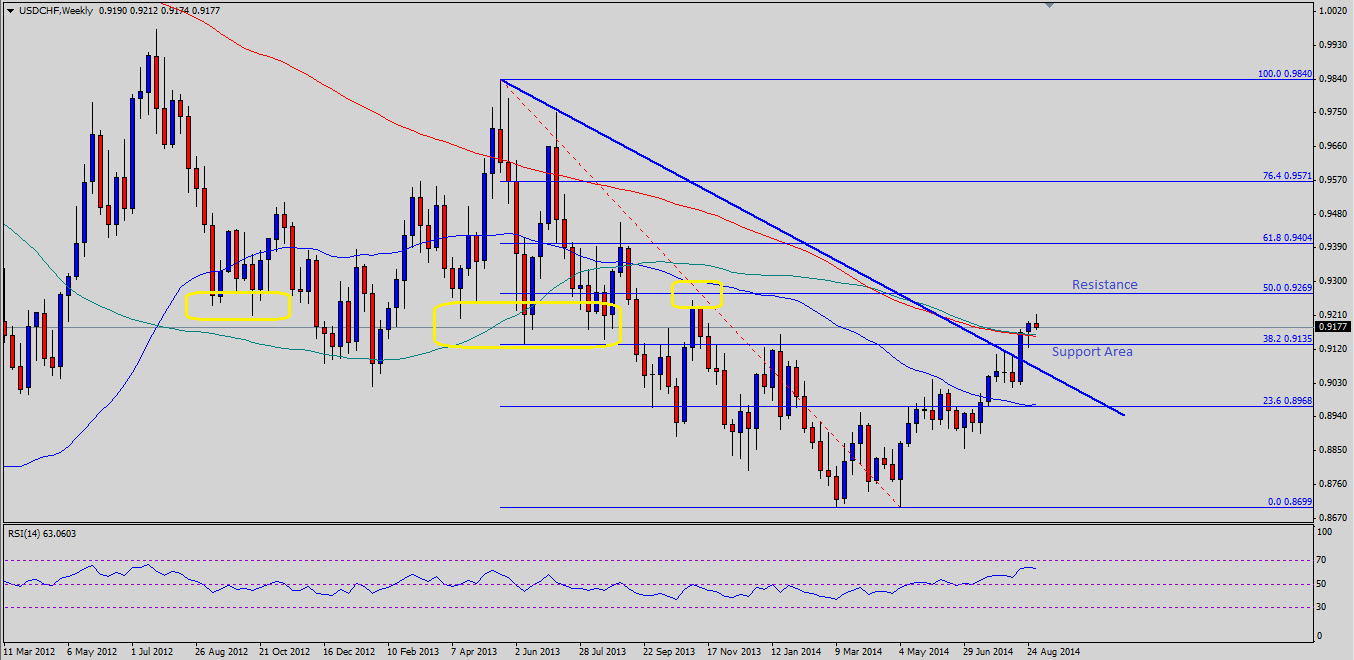

- US dollar continued to rise against the Swiss franc after breaching an important resistance area.

- 0.9270 might act as a strong hurdle for the USDCHF pair in the medium-term if reached.

- USDCHF support seen at 0.9150 and resistance ahead at 0.9270.

The US dollar gains might pause against the Swiss franc around the 0.9270 area, as it represents a critical swing area for the USDCHF pair.

Technical Analysis

There was a monster bearish trend line on the weekly timeframe for the USDCHF pair, which was broken two weeks ago. This particular break was critical, and caused solid gains in the pair. The pair is now trading above all three important simple moving averages (200, 100 and 50) on the weekly chart. However, there is one more aspect which we need to keep in mind, and that is the pair is heading towards a crucial swing resistance area around the 0.9260-80 area. The 50% Fibonacci retracement level of the last drop from the 0.9840 high to 0.8699 low is also around the mentioned area. So, there is a great chance that the pair might struggle to break the 0.9260-80 resistance zone if reached. If the US dollar buyers manage to achieve this tough task, then a move towards the 61.8% fib level might be on the cards.

On the downside, initial support can be seen around an important confluence area of 100 and 200 weekly SMA’s at 0.9150. Any further correction could take the pair closer to the broken trend line, which might act as a support in the near term.

Moving Ahead

The US nonfarm payrolls data might act as a catalyst for the US dollar this week. Overall, staying on the sidelines seems like a wise option until the pair corrects substantially to present a solid buying opportunity.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.