ASIA ROUNDUP:

AUD Consumer Confidence Index rose +1.9% to 94.9 in July. AUDUSD traded back up to yesterday's highs but retraced back towards 0.94 leading up to the employment data.

China CPI came in slightly less than expected by 0.1% at 2.3% but the markets hardly reacted as

UP NEXT:

CAD Housing Starts expected to be slightly slower but still healthy at 191k. This is considered a leading indicator of construction so a positive reading (and above expectations) is generally good for the CAD.

FOMC minutes will be closely scrutinised by traders later today

GBP House Price Index is forecast to have slowed slightly by -0.3%. However last month’s +3.9% was at decade highs, so a negative number means the rate of growth has declined, ever so slightly, from the highs. Only a significant number below expectations should be GBP bearish.

TECHNICAL ANALYSIS:

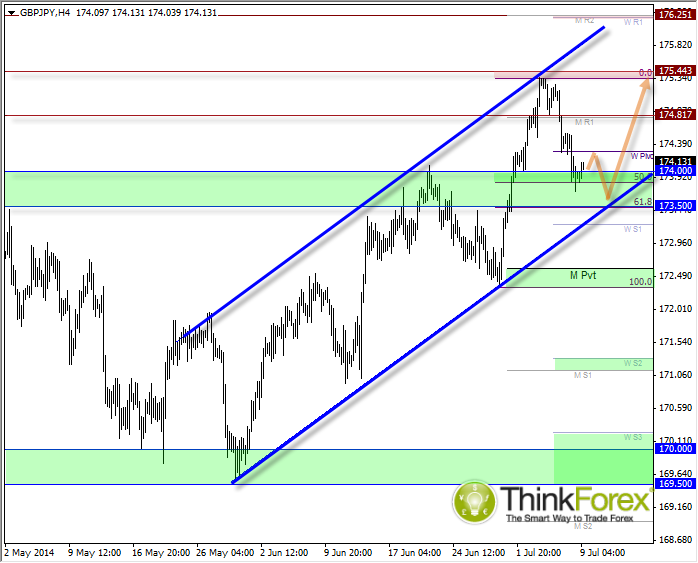

GBPJPY: Retraced to our favoured buy-zone (one dip lower would be better though...)

Following the breakout last week GBPJPY has retreated towards a buy-zone between 173.50 - 174. I am favouring another dip lower before the uptrend resumes because we are now trading beneath the weekly pivot (likely resistance upon first visit) and we have not yet tested the lower channel line. Another reason is this correction seems a little short in time and price compared to the previous decline.

A break below 173.50 would then target the monthly pivot around 172.50 and bring us back within the bullish triangle breakout. Under this scenario I would prefer to stand aside, or only consider short opportunities on much lower timeframes until a clearer trend has been established.

Please view previous analysis for a larger picture:

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.