Daily Forex Market Analysis: EUR/USD

EURUSD Overview:

Watch the video for a summary of today’s news releases, a review of the USD Index, and complete Top Down Analysis of the EURUSD.

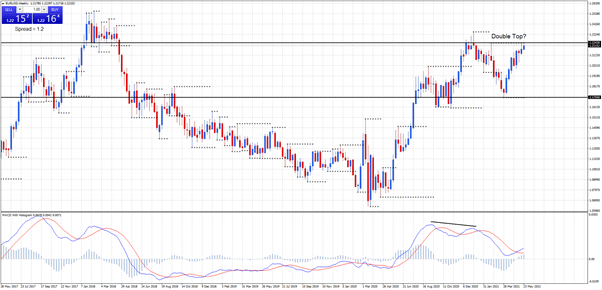

EURUSD Weekly:

Weekly support at 1.1704, resistance at 1.2243.

On the weekly chart we may be seeing a double top. Price has moved up to resistance at 1.2243 and then sold off during last Friday’s trading. MACD on the weekly has shown negative divergence and this current move up could be the last weekly rally before a longer-term decline.

EURUSD Daily:

Daily support at 1.2181, 1.2150 and 1.2051, resistance at 1.2245.

Price is holding to an uptrend and on Friday closed at daily support at 1.2181. Price did show a reversal candle and it may be the first sign of a change in trend at or above the 1.2200 level.

Price closing above 1.2245 resistance would keep the uptrend in play. Another retest and failure at the 1.2200 level would present an ideal opportunity to sell at a strong resistance level. Price breaking below 1.2051 support would confirm a change in trend and start to confirm the possibilty of a weekly double top and a larger move down.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Duncan Cooper

ACY Securities

Duncan Cooper is a full-time trader and mentor. He has been actively trading the financial markets for more than 15 years and has traded stocks, options, futures, and the Forex Market since 2005.