Czech PMI falls amid stumbling automotive sector

The Czech manufacturing PMI dived deeper into contractionary territory in December, setting a downward trend in the conditions of automotive havoc in Europe. The outcome is worse than market participants expected, and brings bad news for output, new orders and workforces.

Manufacturing in hot water

The overall conditions in Czech manufacturing in December recorded the most pronounced deterioration since July, with the PMI manufacturing index falling to 44.8 points. The index has been drifting in contractionary territory for longer than two and a half years, suggesting that the prolonged malaise cannot to be attributed to a business cycle justification but rather to broad-based and deeply rooted structural issues. Challenges in the European car industry represent the main source of the trouble with suppressed output, declining new orders, and wrecked confidence. Firms have continued to reduce their workforces in the light of lower production requirements.

PMI in contraction zone for way too long

Source: S&P Global, Macrobond

Input costs rose for 11 months in a row in December, and the main cost-push factors were higher prices in the food segment and transportation. At the same time, suppressed demand fostered competition, resulting in a third month of declining selling prices. Nevertheless, overall moves in input costs and selling prices were rather moderate at year-end.

No good news ahead for Europe

Falling demand from key customers in Europe (particularly Germany) is undoubtedly bad news for the Czech economic outlook, and this leaves consumers largely driving the economic rebound. We're hoping for a turnaround here somehow – but this could be a false dawn, based on times when the necessary conditions for economic expansion in Europe were still intact. The situation has, however, changed dramatically over the recent years. For some European economies under these conditions, cyclical upswings become stagnations, and cyclical downswings become outright recessions.

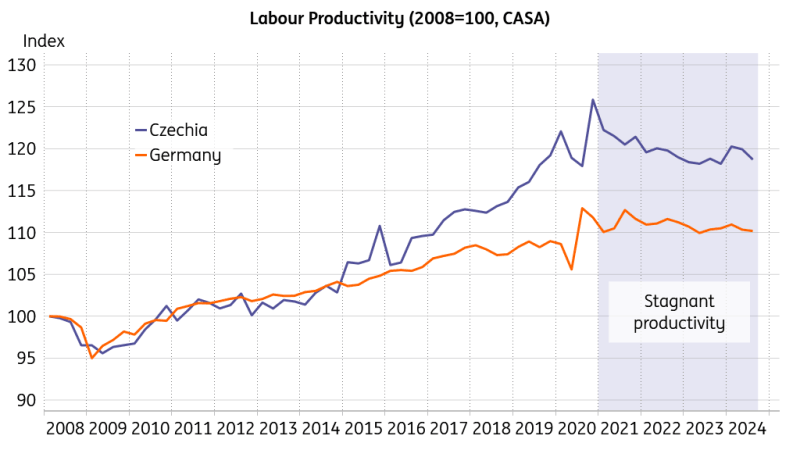

Stagnant labour productivity has become a pressing issue for the European economy in recent years. And we think that things are unfortunately set to deteriorate further in the coming years due to inferior innovation, obsolete infrastructure, and wrecked investment incentives. Add the neck-breaking global competition to the mix and here Europe stands, non progredi est regredi – not to go forward is to go backward.

Stagnant productivity continues to weigh

Source: Eurostat, Macrobond

There is no reason that things should take a turn for the better on their own if the conditions are not right. It's difficult to say when the Germany's economic underperformance will come to an end and what the long-term spillover will be for the neighbouring economies – that said, every crisis is an opportunity. Still, the overall regulatory framework still matters. The thing is that when short-term harm turns into a protracted malaise, the effects on aggregate skillsets, research capabilities, and the willingness to succeed can be devastating, non-linear, and irreversible.

Great leap forward?

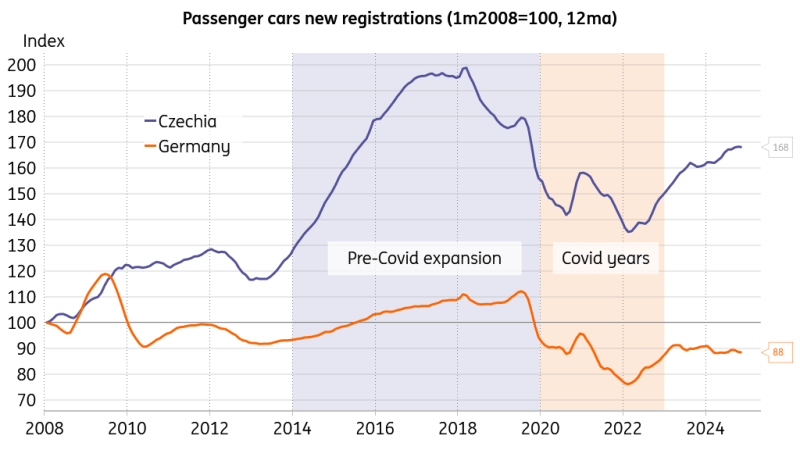

Indeed, the idea that Europe is now leaping ahead into an advanced microchip and AI-driven economy while decapitating its car industry with the guillotine of high energy prices, mounting regulation, and banning products that the customer requires appears more and more like a fool’s game.

This could be vaguely reminiscent of the principle of China's Great Leap Forward, which sought to further the country's industrialisation efforts through labour-intensive measures – but with disastrous consequences. We don't think that real change in Europe's manufacturing performance will materialise until the parameters of such an endeavour are significantly adjusted to a more growth-friendly environment. It's not hugely complicated: if the conditions are set in such a way that European industry constantly has a foot on its neck, it will bow under the pressure.

Lofty levels of car purchases lie in the past

Source: Macrobond

From the Czech perspective, even Skoda Auto will not avoid cutting staff despite a good overall performance in the past year and a significant overperformance relative to its other brands within the Volkswagen Group. The staff trimming will be moderate, only affecting agency staff, but this doesn't provide much of a confidence boost for the potentially tough times ahead.

Read the original analysis: Czech PMI falls amid stumbling automotive sector

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.