Cuts, it’s always the cuts

S&P 500 couldn‘t just surge right after core PCE coming (only) in line – personal income underwhelming isn‘t a good sign for earnings ahead, but I wrote about that amply in connection with CPI and PPI (companies just can‘t pass on their rising costs, and you know about credit card debt too). But after the opening bell, the first swallow of turnaround Thursday continued, and I gave it better odds of succeeeding than it did on Thursday.

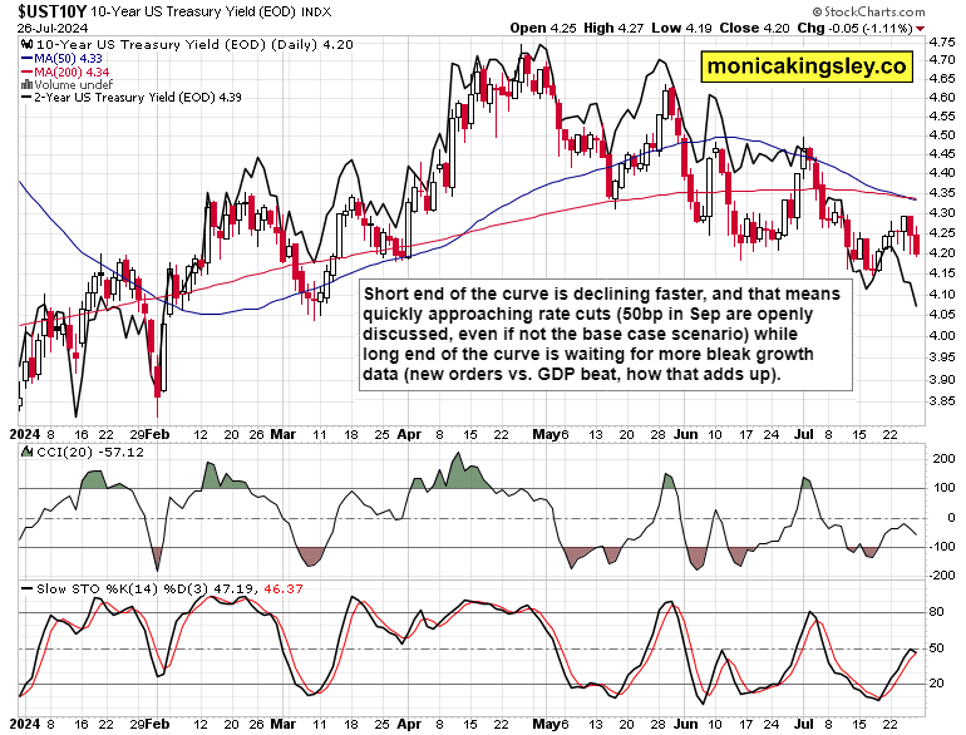

In every case, my weekly roadmap shared with clients on Sunday, was fulfilled to the letter – down first, but Thursday Friday the card starts turning. So it was, and rate cut expectations powered that – now, we‘re up to three for 2024. But as we see disinflation continuing, real rates are getting more restrictive, serving as a headwind for asset prices from equities to commodities. Add in increasingly squeezed and not optimistic consumer (retail sales in aren‘t rising in real terms really, people are mostly just paying more for the same basket), and you see many XLY names (LULU, HELE etc) taking it on the chin. Also, used car prices sliding is an ominous sign, and pressure on the consumer won‘t be relieved by retreating rents.

Remember not just manufacturing PMI last month, but how fast the latest services PMI reading flipped recessionary. Yet here we are with the Fed (I think content about letting some hot air go) not cutting in Jul, and that affects S&P 500 rebound prospects as much as the oil, silver and copper bearish calls (gold was to stand apart here and there, but as long as it‘s not capturing headlines by $2,500s figures…).

Way more details reserved for clients and that of course includes new equities path, stock picks and expectations for Russell 2000 and Nasdaq dynamics, where the ratio swung one way pretty much lately (you remember me covering the CPI consequences). Let‘s also talk Bitcoin rising and how MSTR (then COIN) keeps performing better than the other plays (MARA, RIOT), which I discussed last week too. Just careful about post conference stuff and the Fed not cutting Jul.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.