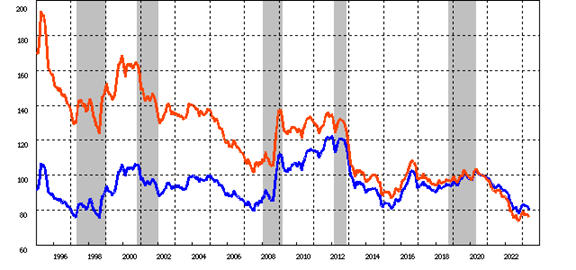

Currency market: USD/JPY, exchange rate indices and intervention

The Japan, BOJ and USD/JPY question to intervention from a trade perspective is a moot point as the BOJ Trade weight index from Nominal and Efffective Exchange Rates operates as a picture-perfect Picasso. The intervention question becomes very real in terms of the USD/JPY price at 143.00's in relation to the current Nominal Exchange Rate index at May's reported 80.5.

Al data, charts and information was derived from the BOJ.

The Nominal exchange rates are highlighted in Blue while the Real Effective Exchange rates were chosen as Orange.

BOJ Monetary Policy in the 1990's Pegged USD/JPY to GDP and the Money Supply. The BOJ not only intervened practically on a daily basis to adjust USD/JPY to the Money Supply but volatility was out of control and trade was a disaster as seen from the difference from Nominal to Real exchange rates. Also seen is the BOJ's unyielding ability to continue with any monetary policy until it crashes.

The shining light for the BOJ was 2016 to present as the BOJ adopted negative interest rates and adjusted the YCC bands by a 25 point expansion.

Picture perfect Picasso refers to the correct positions as the Nominal rate above the Real Effective Exchange Rate. The current Nominal rate at 80.5 vs the Effective rate at 76.2 shares a 5 point difference. From December 2022 to May 2023, the Nominal rate sat 5 points higher than the Effective rate.

Most vital to Nominal and Effective Trade Weight indices is both were updated and adjusted January 2023 as all central banks adjust trade weight indices normally every 5 years.

The lower effective rate is a reflection of adjusting the Nominal rate to Inflation as Japan's trade partner nations contain higher inflation rates. Higher inflation rates increases Japan's cost of goods and must account for its exports for positive results and profitability.

The Nominal rate is factored by annual value of Japan's trade with the respective countries and regions as its weights. It is then converted into an index using a base period of 100.

The most vital BOJ economic release is the Domestic Corporate Goods Price index as the index is employed to create Nominal and Real trade weight indices factored against trade partner releases to Producer and Wholesale Prices.

USD/JPY in Red Vs the Blue Nominal Exchange Rate Index. The BOJ intervened October 22 when USD/JPY traded 151.00's and the most important Nominal Rate was below 80.0. Today, USD/JPY at 143.00's Vs the Nominal rate at 80.00's trades a far distance.

While a good argument exists to intervention, the BOJ intervened October 2022 at 151.00's when DXY traded its maximum top at 114.00's and miles above the 50 year monthly average at 99.00;s. DXY not only achieved its peak but was falling from 114.00's as was USD/JPY at 151.00's and by no other choice. Was the intervention correct or short sighted.

Author

Brian Twomey

Brian's Investment

Brian Twomey is an independent trader and a prolific writer on trading, having authored over sixty articles in Technical Analysis of Stocks & Commodities and Investopedia.