EUR/USD Current price: 1.1162

View Live Chart for the EUR/USD

The dollar found some limited demand in quite thin trading, higher against most of its rivals in the European morning with London off on holidays. Earlier in the day, European PMIs come out mixed, with German and EU ones beating expectations, but showing an increased slowdown in France, Spain and Greece. Ahead of the US opening, the EUR/USD trades near a daily low set at 1.1122, and the 1 hour chart shows that the price stands below its 20 SMA but bouncing from a bullish 100 SMA, the immediate support around 1.1120. In the same chart, the technical indicators are aiming north well below their mid-lines, and far from suggesting additional gains at the time being. In the 4 hours chart, the pair broke below its 20 SMA, currently around 1.1200, whilst the Momentum indicator heads lower below 100 and the RSI turns flat around 54. The immediate support stands at 1.1120, and the downward risk will remain limited as long as above it, albeit a recovery above 1.1200 is required to see bulls retaking the lead.

Support levels: 1.1120 1.1085 1.1050

Resistance levels: 1.1160 1.1200 1.1245

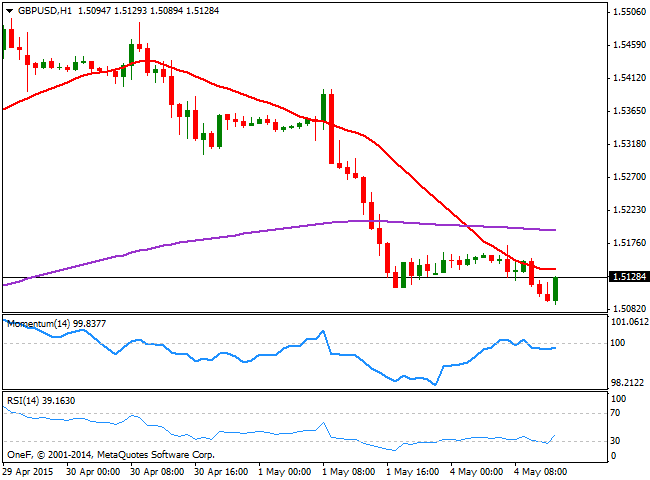

GBP/USD Current price: 1.5128

View Live Chart for the GBP/USD

The GBP/USD pair bounces from 1.5093, its daily low accumulating around 500 pips of steady decline ever since flirting with the 1.5500 level last Thursday. The technical picture continues to favor the downside, despite in the 1 hour chart, the RSI aims higher from oversold territory, as the price stands below its 20 SMA whilst the Momentum indicator heads lower 100. In the 4 hours chart the 20 SMA turned sharply lower well above the current level, whilst the technical indicators are fading its latest upward corrective movement near oversold territory.

Support levels: 1.5060 1.5020 14980

Resistance levels: 1.5130 1.5170 1.5210

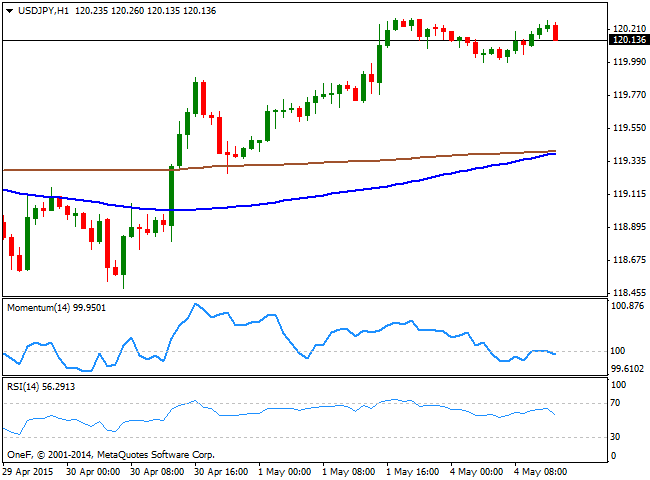

USD/JPY Current price: 120.13

View Live Chart for the USD/JPY

The USD/JPY pair retraces from the highs in the 120.30 price zone, consolidating its recent gains. Having set a daily low at 119.99, the 1 hour chart shows that the technical indicators are turning lower around their mid-lines, whilst the price stands well above its 100 and 200 SMAs, both converging in the 119.40 region. In the 4 hours chart the technical indicators are retracing from overbought territory, but far from suggesting a bearish move, whilst the price holds well above its moving averages, which lack clear directional strength at the time being. The pair needs to break above 120.45 to gain upward momentum, whilst a break below 120.00 should favor additional declines towards the 119.40/60 price zone.

Support levels: 120.00 119.65 119.30

Resistance levels: 120.45 120.85 122.10

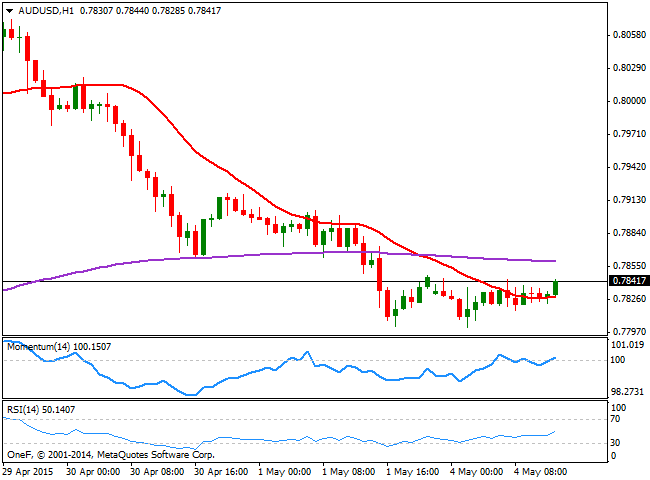

AUD/USD Current price: 0.7804

View Live Chart for the AUD/USD

The AUD/USD pair trades lower in range, consolidating around the 0.7800 figure. The RBA will have its monthly economic policy meeting, and market expects a rate cut coming from Governor Stevens. Technically, the 1 hour chart shows that the technical indicators are aiming higher around their mid-lines, whilst the price stands a few pips above a flat 20 SMA. In the 4 hours chart a mild positive tone comes from the technical indicators that aim higher below their mid-lines, albeit the price stands well below a bearish 20 SMA, currently around the 0.7900 figure.

Support levels: 0.7800 0.7770 70.7730

Resistance levels: 0.7860 0.7900 0.7940

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.