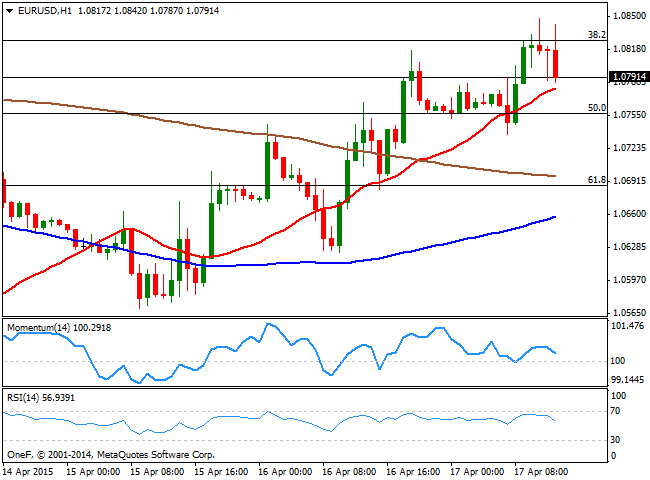

EUR/USD Current price: 1.0780

View Live Chart for the EUR/USD

The EUR/USD pair retraces from a daily high at 1.0847, reached early Europe as investors are still in favor of dumping the American currency. The US inflation readings resulted at -0.1% in March compared to an year before, albeit the core reading ticked higher, up to 1.8%, triggering a dollar short term rally that is yet to prove its duration. Nevertheless, the EUR/USD 1 hour chart shows that the price is finding some buying interest around its 20 SMA around 1.0770, whilst the technical indicators have turned lower in positive territory. In the 4 hours chart indicators are also losing upward strength above their mid-lines, although the price stands above its moving averages, with the 20 SMA heading strongly up around 1.0700.

Support levels: 1.0770 1.0745 1.0710

Resistance levels: 1.0825 1.0870 1.0910

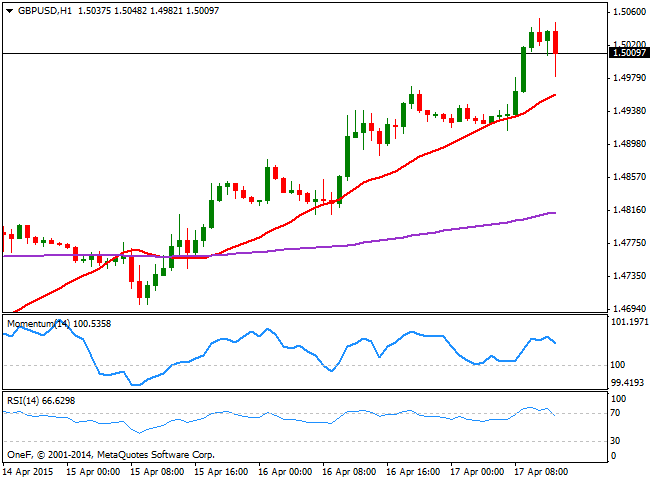

GBP/USD Current price: 1.5009

View Live Chart for the GBP/USD

The British Pound surged above the 1.5000 figure for the first time in a month, as UK's employment data showed that the unemployment rate fell to its lowest in almost seven years, while wages ticked higher, and the number of people in employment rose by 248K in the 3 months ending February. Having set a daily high at 1.5053, the pair is now hovering around the 1.5000 figure on the back of US's inflation readings, and with the 1 hour chart showing that the technical indicators are correcting lower from overbought levels, albeit the price remains well above a bullish 20 SMA, limiting chances of a strong decline. In the 4 hours chart the price stands well above its 200 EMA, currently at 1.4910, while the technical indicators are beginning to look exhausted near overbought levels, all of which supports a limited at least some consolidation above 1.4950, ahead of a new leg up.

Support levels: 1.4950 1.4910 1.4880

Resistance levels: 1.5000 1.5040 1.5085

USD/JPY Current price: 119.07

View Live Chart for the USD/JPY

The USD/JPY pair fell down to 118.56 as stocks trade quite negatively across the world, although improved inflationary readings in the US have boosted the pair above the 119.00 ahead of the US opening. The 1 hour chart shows that the technical indicators are crossing their midlines to the upside as the price approaches its daily highs, albeit the 100 SMA heads strongly lower in the 119.40, providing a strong dynamic resistance level in the case of additional advances. In the 4 hours chart, the price is still well below its moving averages, whilst the technical indicators aim higher in negative territory, suggesting the upside is still limited.

Support levels: 118.75 118.35 118.00

Resistance levels: 119.40 119.80 120.10

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.