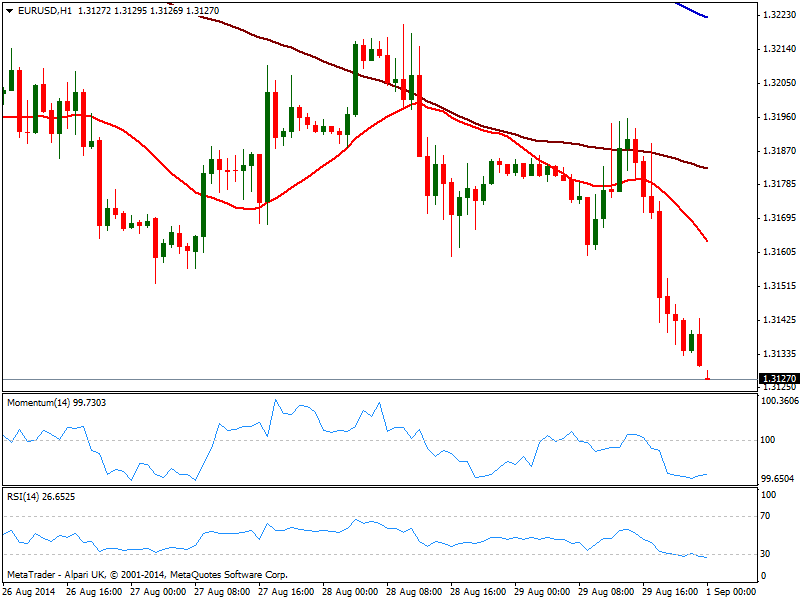

EUR/USD Current price: 1.3127

View Live Chart for the EUR/USD

USD dollar continues to be the leader of the forex board, starting the week maintaining its strong foot particularly against weaker EUR and JPY. The common currency trades at its lowest level in 11-month, with September last year low at 1.3105, immediate support. Ahead of a quite busy week that will include ECB meeting, local GDP and Services PMI readings, not much action should be expected Monday, with US on holidays due to Labor Day.

Technically the hourly chart shows price at fresh lows, with momentum flat in negative territory, and RSI entering oversold levels, while 20 SMA heads lower above current price, all of which supports a steady decline. In the 4 hours chart momentum heads strongly south with RSI also in oversold territory and 20 SMA offering dynamic resistance around 1.3180 in case of a recovery, supporting the shorter term view.

Support levels: 1.3105 1.3090 1.3050

Resistance levels: 1.3145 1.3180 1.3215

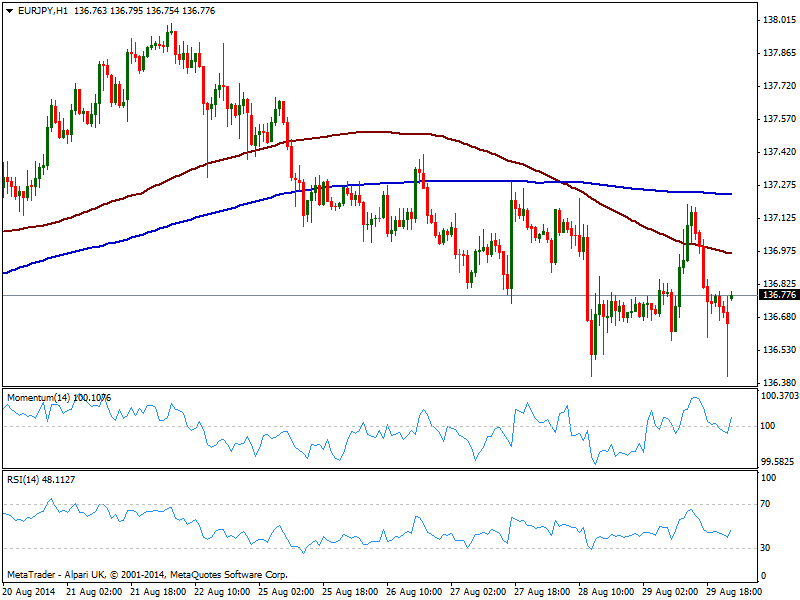

EUR/JPY Current price: 136.77

View Live Chart for the EUR/JPY

Despite both being weak against the greenback, JPY outperforms EUR, with the pair presenting an overall bearish stance, having established past August a year low of 135.72. The short technical picture however, shows the pair gapping slightly higher at the opening, with the hourly indicators crossing their midlines to the upside, yet price well below 100 SMA currently around 136.90, while 200 one stands above it, at 137.30, both acting as intraday resistances. In the 4 hours chart however indicators remain below their midlines, while moving averages converge in the 137.00/10 area suggesting upward movements will remain limited: price needs to establish at least above the 136.90 level to be able to extend its gains, quite unlikely at the time being.

Support levels: 136.40 136.00 135.70

Resistance levels: 136.90 137.30 137.60

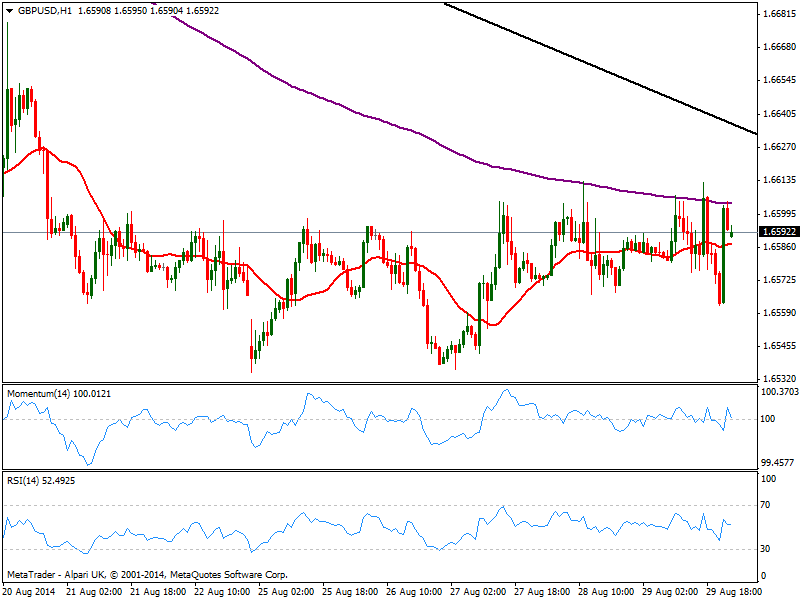

GBP/USD Current price: 1.6592

View Live Chart for the GBP/USD

The GBP/USD shows little change from latest updates, trading steadily below the 1.6600 level. Late Friday the pair surged around 40 pips up to the level, probably on some Pound demand coming from EUR/GBP that trades barely above 0.7900. As for the GBP/USD hourly chart, price stands right above a flat 20 SMA while indicators turned south above their midlines, holding in neutral territory. In the 4 hours chart the technical picture is also strongly neutral, with the daily descendant trend line coming from this year high today at 1.6630: it will be only above this last the pair will be able to advance further, while the risk of a bearish move increases on a break below 1.6540 strong support.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6650

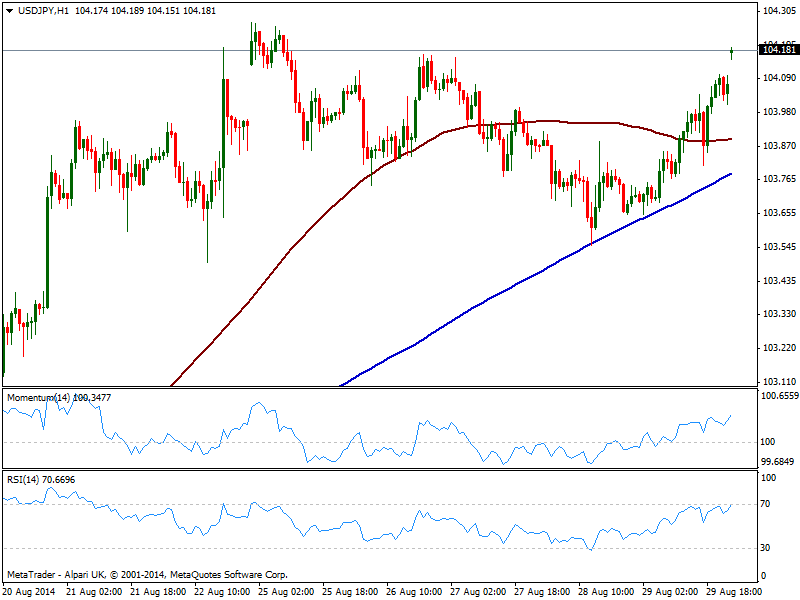

USD/JPY Current price: 104.18

View Live Chart for the USD/JPY

Dollar gaps higher against the yen trading a few pips below past week high of 104.26, and with the hourly chart showing a strong upward momentum coming from technical indicators, as price extends above moving averages, supporting a continued advance. In the 4 hours chart indicators also aim higher above their midlines as price develops well above moving averages, supporting the shorter term view. Dips down to 103.50/60 area will likely attract buyers rather than signal a downward continuation, with a break above 104.50 required to confirm a stronger upward momentum.

Support levels: 103.55 103.20 102.85

Resistance levels: 104.20 104.50 104.80

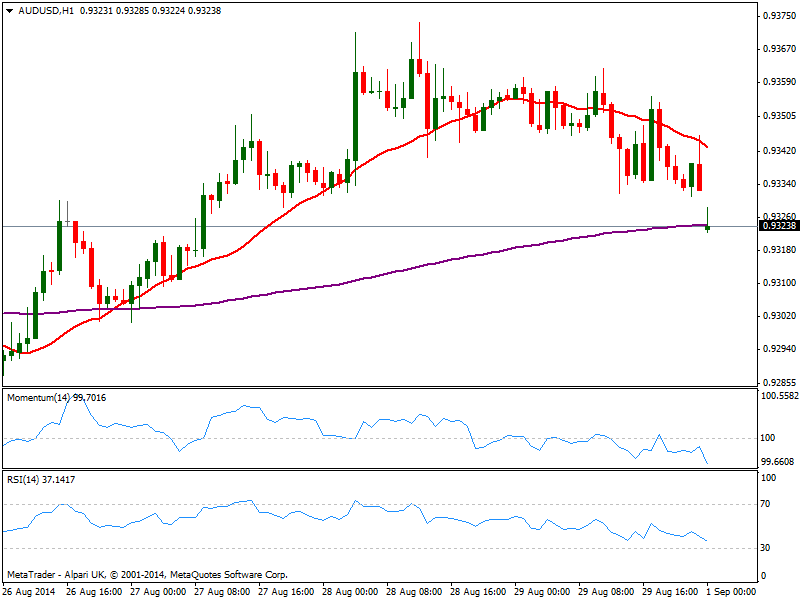

AUD/USD Current price: 0.9323

View Live Chart of the AUD/USD

It will be a busy week in Australia with loads of first line local data, including RBA meeting on Tuesday. For today, the calendar includes inflation and manufacturing indexes, not to mention Chinese manufacturing PMI also meant to weight on the Aussie. Gapping lower with the weekly opening, the hourly chart shows price below the 0.9330 mark, as 20 SMA gains bearish slope a few pips above it, and indicators gain bearish tone below their midlines. In the 4 hours chart the technical picture is also bearish, albeit a break below 0.9300 is required to confirm a continued decline for this Monday.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9410 0.9450

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.