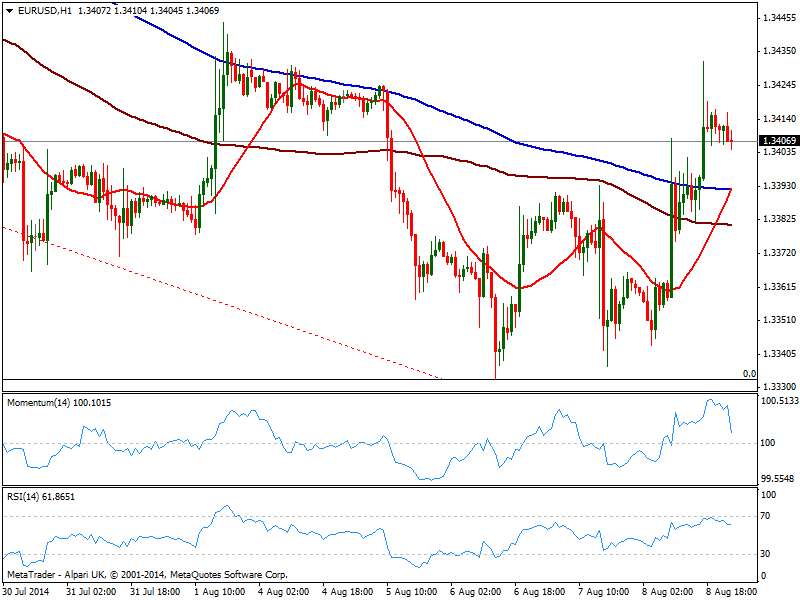

EUR/USD Current price: 1.3407

View Live Chart for the EUR/USD

Dollar bulls grew substantially over the past few days, the largest over a year according to latest reports, with bearish sentiment higher for the EUR, which was probably the main reason of dollar short squeeze on Friday: dollar needs to go back, to take a better jump. As a new week starts, the EUR/USD trades a few pips below last one close, hovering around the 1.3400 level and with the short term picture pointing for a downward move: the hourly chart shows indicators easing from overbought readings towards their midlines, albeit moving averages are all below current price, suggesting further slides are required to confirm a move lower. In the 4 hours chart momentum heads higher as price moves lower, drawing the beginning of a bearish divergence, also yet to be confirmed. The 1.3440 area is key to the upside, as only above it the pair could advance higher, while a clear break below 1.3380 should trigger the expected downward continuation.

Support levels: 1.3370 1.3335 1.3295

Resistance levels: 1.3450 1.3475 1.3500

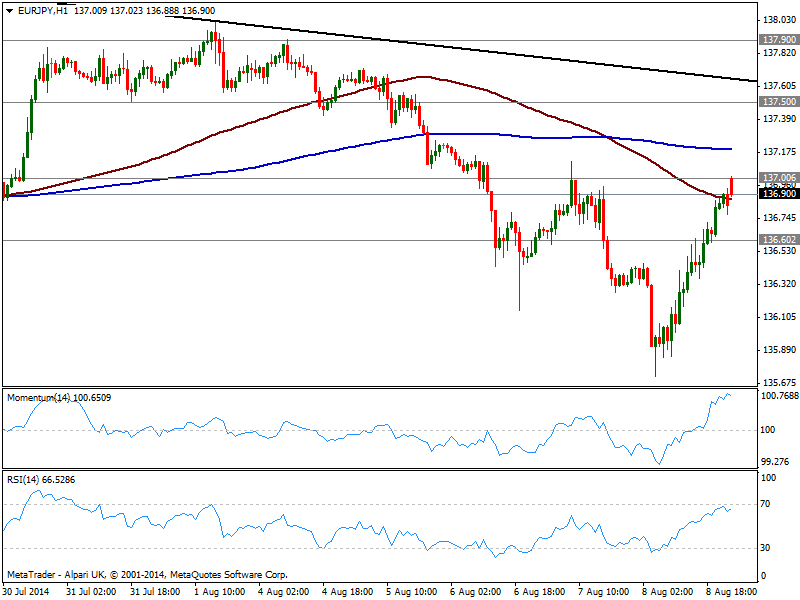

EUR/JPY Current price: 136.90

View Live Chart for the EUR/JPY

Yen posted a strong comeback last Friday all across the board, following the recovery in indexes after a long week of losses. As for the EUR/JPY the pair has started the week gapping up to 137.00, but quickly easing some from the level and filling that gap. The hourly chart shows indicators looking slightly exhausted in overbought levels as price struggles around a still bearish 100 SMA. In the 4 hours chart however, indicators maintain a strong upward tone, with 100 SMA around the critical figure. A daily high from last week at 1.3711 is the level to overcome to confirm an upward extension, yet if price falls back above 136.60, the risk will remain to the downside this Monday.

Support levels: 136.60 136.20 135.80

Resistance levels: 137.10 137.50 137.90

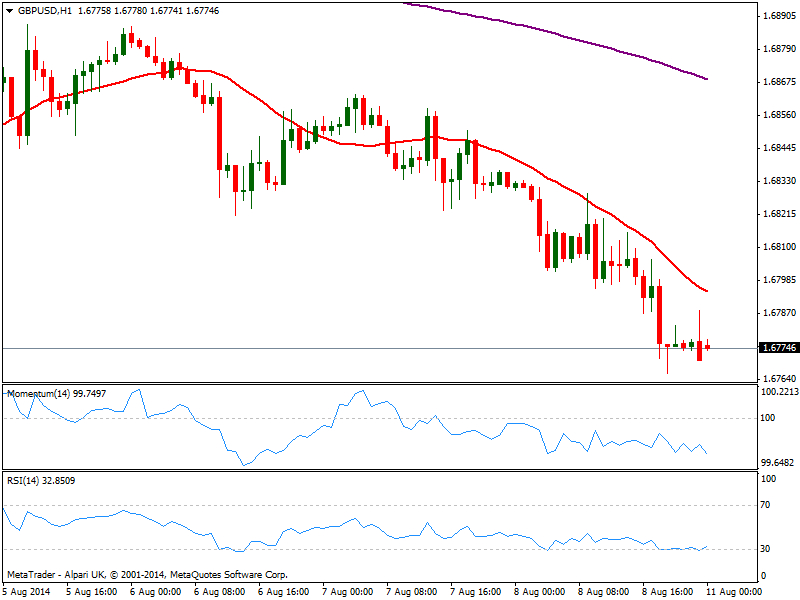

GBP/USD Current price: 1.6774

View Live Chart for the GBP/USD

The GBP/USD extends its slide, still unable to find a bottom. During the upcoming days, UK Inflation Report Hearings, Mark Carney and GDP data may well define it current bearish trend is ready to extend in term, expecting therefore some range trading ahead of the news. Anyway, the short term picture is quite bearish, with the 1 hour chart showing momentum heading south in negative territory, RSI flat around 30 and the 20 SMA heading lower above current price. In the 4 hours chart technical readings are also biased lower, with a price acceleration below 1.6770 pointing for a test of 1.6690/1.6700 strong static support level.

Support levels: 1.6770 1.6730 1.6695

Resistance levels: 1.6820 1.6860 1.6895

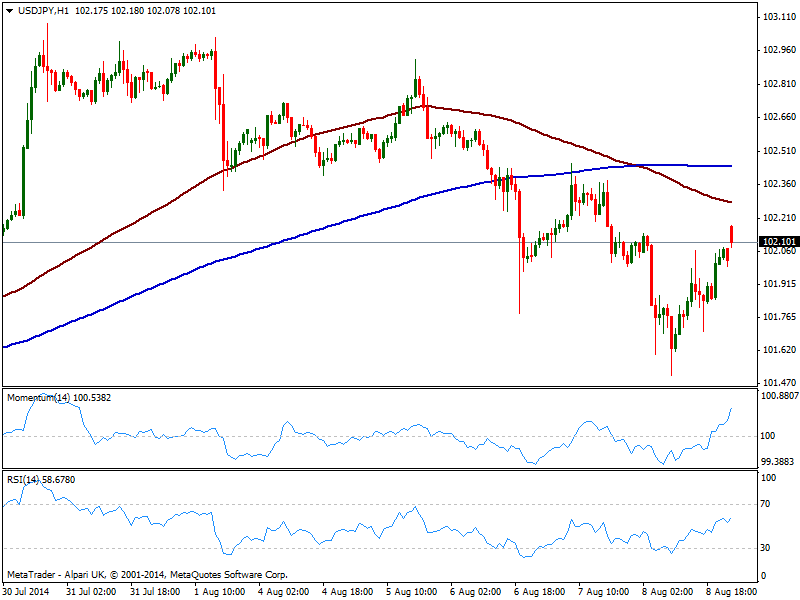

USD/JPY Current price: 102.10

View Live Chart for the USD/JPY

Standing above the 102.00 mark, the USD/JPY has recovered nicely by the end of last week, albeit remains trading in tight, familiar ranges. Short term, the outlook is mild bullish, with indicators strongly up in positive territory, but 100 SMA with a strong bearish slope above current price, acting as dynamic resistance in the 102.30 price zone. In the 4 hours chart indicators bounced strongly from oversold levels and approach their midlines, still below them, reinforcing the need of a break higher to confirm more advances.

Support levels: 101.95 101.60 101.20

Resistance levels: 102.35 102.80 103.10

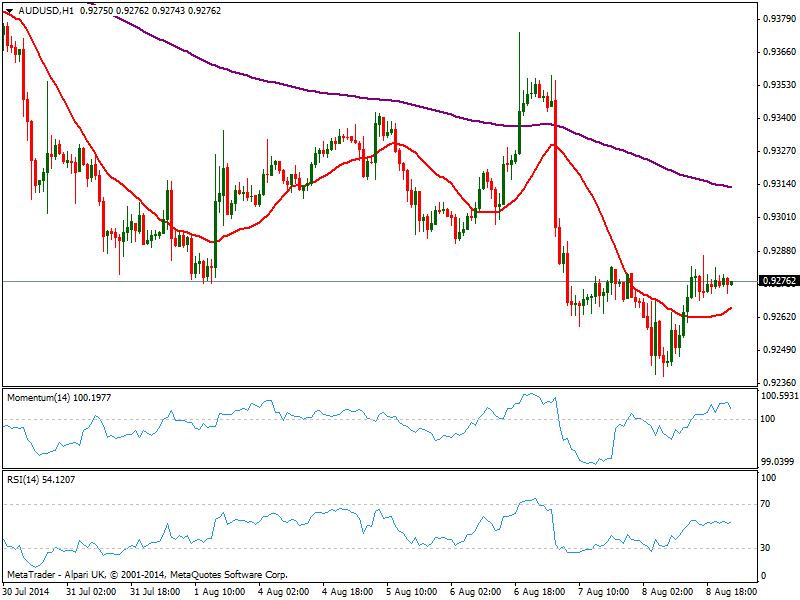

AUD/USD Current price: 0.9276

View Live Chart for the AUD/USD

Australian dollar maintains a weak stance against the greenback, with the pair trading below the 0.9300 figure. The hourly chart shows indicators turning south above their midlines and price holding above a flat 20 SMA, limiting the downside at the moment. In the 4 hours chart however technical readings present a clearer bearish tone, suggesting a new leg lower is still possible. Critical support stands at 0.9260 with a break below it anticipating a probable test of the 0.9180/0.9200 price zone.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9290 .9330 0.9370

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.