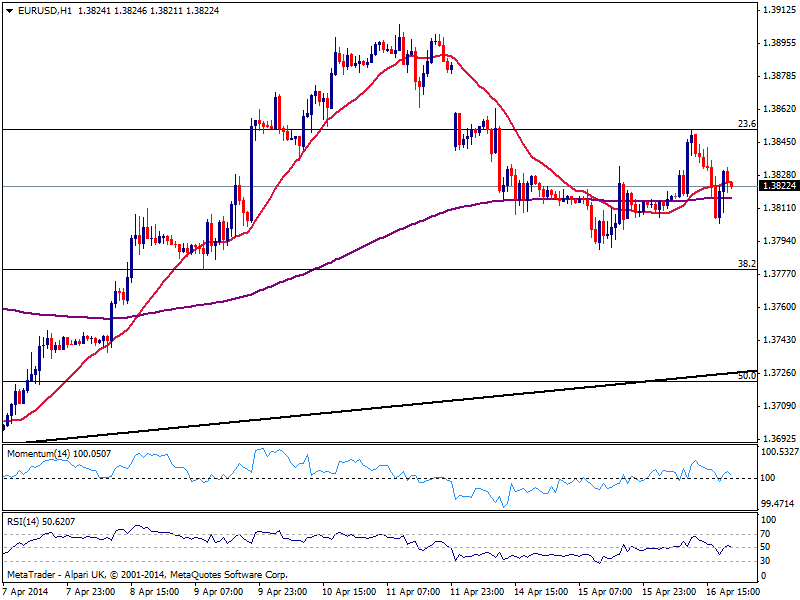

EUR/USD Current price: 1.3818

View Live Chart for the EUR/USD

Moving back and forth, the EUR edged higher against the greenback this Wednesday, having recovered some ground after 2 days of steady losses. The pair rose up to 1.3850 with the European opening in a stocks driven movement and despite the ECB latest threats of taking action against low inflation and a high currency. The US session saw indexes extending their recovery, albeit forex market has shown little reaction in the past few hours.

As for the technical picture, the EUR/USD presents a mild bearish tone ahead of Asian opening, with the pair barely above past Asian session opening and the hourly chart showing price below its 20 SMA and indicators heading lower around their midlines. In the 4 hours chart the pair also present a slightly bearish tone, with price contained below a bearish 20 SMA, currently around 1.3830. Risk to the downside however, remains limited by the strong static support around 1.3780 and only below this level the pair will likely resume early week bearish momentum.

Support levels: 1.3780 1.3750 1.3725

Resistance levels: 1.3850 1.3890 1.3925

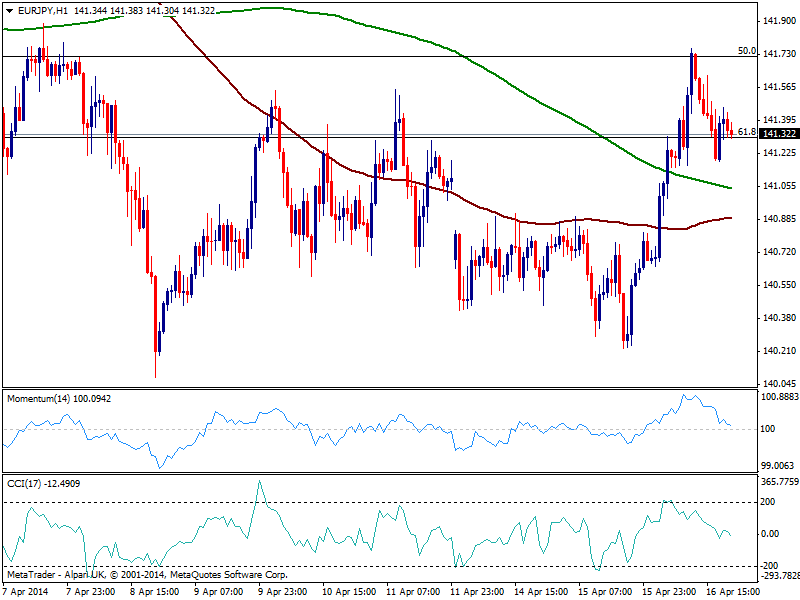

EUR/JPY Current price: 141.32

View Live Chart for the EUR/JPY

Yen capitulated to Nikkei’s gains ever since the day started, easing against most of its rivals to fresh weekly highs. The EUR/JPY not only filled the weekly opening gap, yet extended up to 141.76 halting around a strong Fibonacci resistance. The hourly chart presents a short term bearish bias, with indicators heading lower and approaching their midlines, albeit price holds for now above moving averages. In the 4 hours chart technical readings hold in positive territory, but latest retracement takes out the strength of previous recovery: either a break above mentioned high of below 141.00, will probably set a clearer intraday picture for the pair.

Support levels: 140.90 140.40 139.90

Resistance levels: 141.70 142.20 142.60

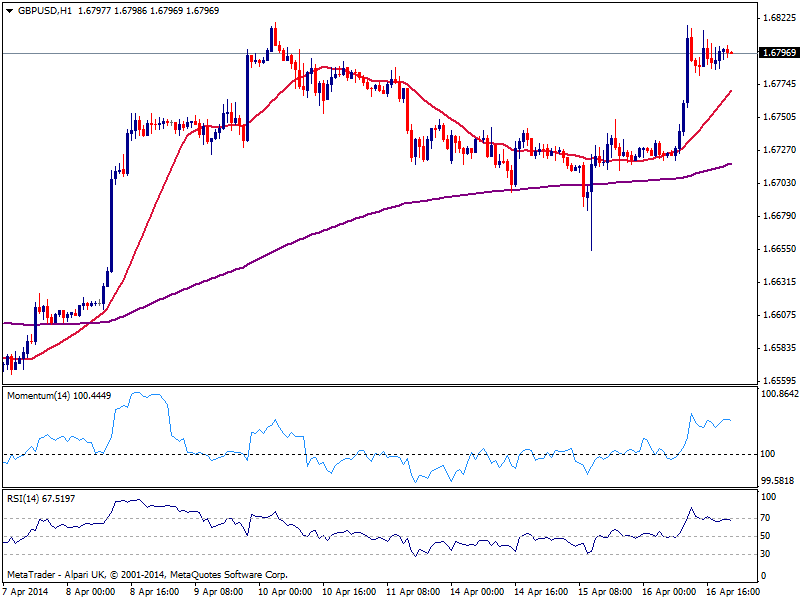

GBP/USD Current price: 1.6792

View Live Chart for the GBP/USD

Quite disappointing, the GBP/USD was unable to extend its run during US hours, spending most of the session consolidating around the 1.6800 figure. The hourly chart shows price consolidating inside a tiny triangle, usually a continuation figure so as long as above 1.6780 risk to the downside remains limited, moreover as technical indicators maintain the positive tone. In the 4 hours chart technical readings present also a positive tone, with a break above 1.6820 year high favoring a quick advance up to 1.6870 next static resistance area, in route to 1.7000.

Support levels: 1.6780 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

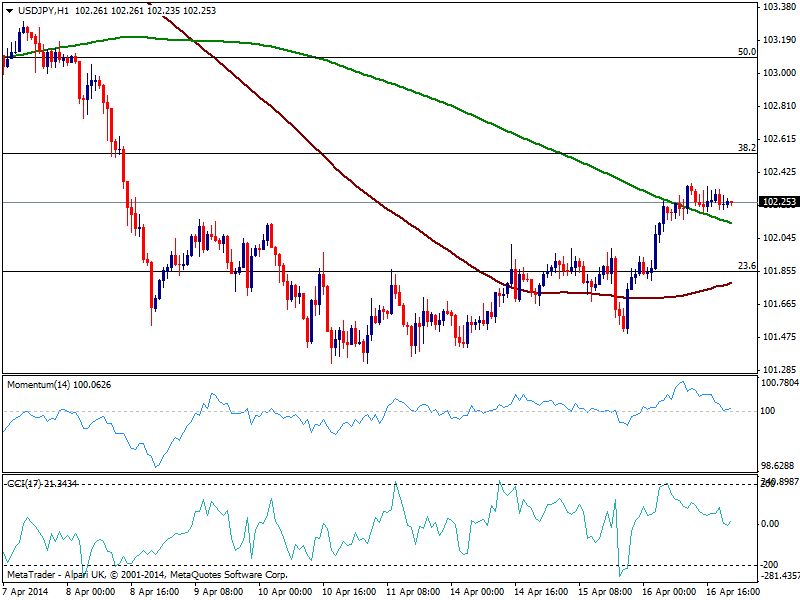

USD/JPY Current price: 102.25

View Live Chart for the USD/JPY

The USD/JPY maintains its gains, trading near its daily high of 102.36 and with the hourly chart showing indicators turning slightly higher around their midlines, suggesting limited bearish interest in the short term. An educated guess would say that traders await Nikkei opening, as another day of gains in the index would be a good reason to keep on buying the pair. A key resistance stands around 102.50/60 strong Fibonacci level, and only above it the upward potential will be clearer, eyeing then the 103.00 area.

Support levels: 102.00 101.55 101.20

Resistance levels: 102.35 102.60 102.95

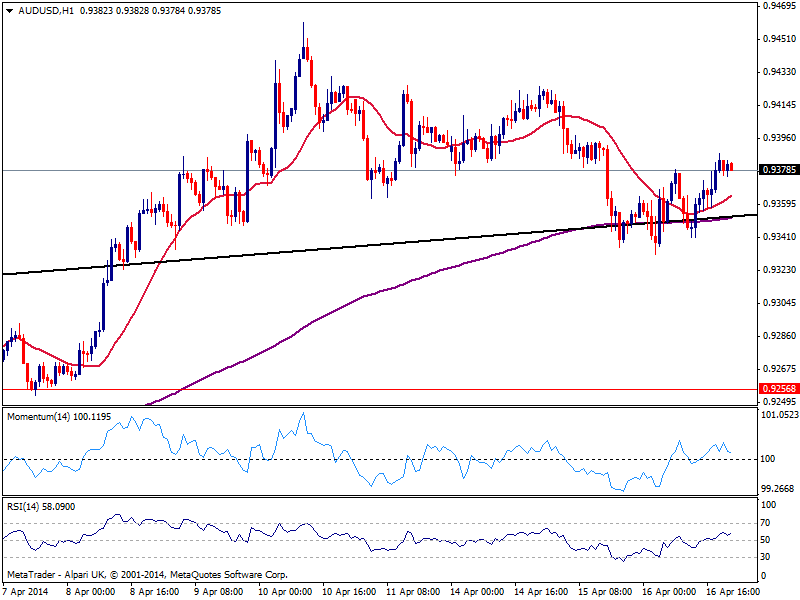

AUD/USD Current price: 0.9378

View Live Chart for the AUD/USD

Aussie extended its recovery albeit was unable to advance beyond 0.9400 against the greenback. The hourly chart shows price above a bullish 20 SMA while indicators hold in positive territory, although lacking upward strength. In the 4 hours chart however, the picture is still bearish as price is being capped by a flat 20 SMA and indicators hold below their midlines.

Support levels: 0.9330 0.9290 0.9260

Resistance levels: 0.9390 0.9445 0.9485

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.