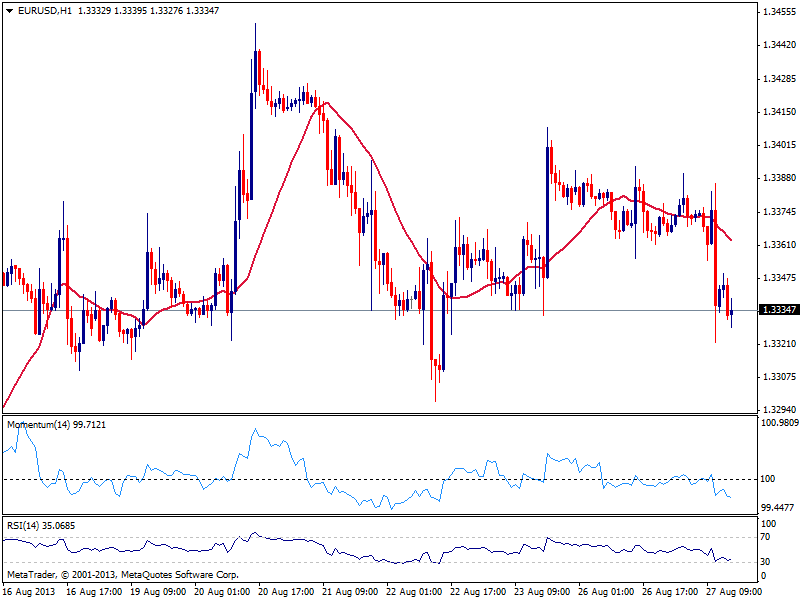

EUR/USD Current price: 1.3334

View Live Chart for the EUR/USD

Safe havens continue to rule the forex board ahead of US opening, with dollar strongly up against most rivals, exception made by yen that at the time being remains the strongest currency of the board. The EUR/USD flirted with 1.3390 amid better than expected IFO survey, but quickly retraced its gains, approaching quickly to the 1.3300 figure. The hourly chart shows price steady near its lows, with 20 SMA gaining bearish slope above it and indicators heading south in negative territory. In the 4 hours chart indicators are biased lower despite in neutral territory: price needs to breach the 1.3300 level to gain bearish track, eyeing the 1.3240 in the short term.

Support levels: 1.3300 1.3240 1.3200

Resistance levels: 1.3350 1.3390 1.3430

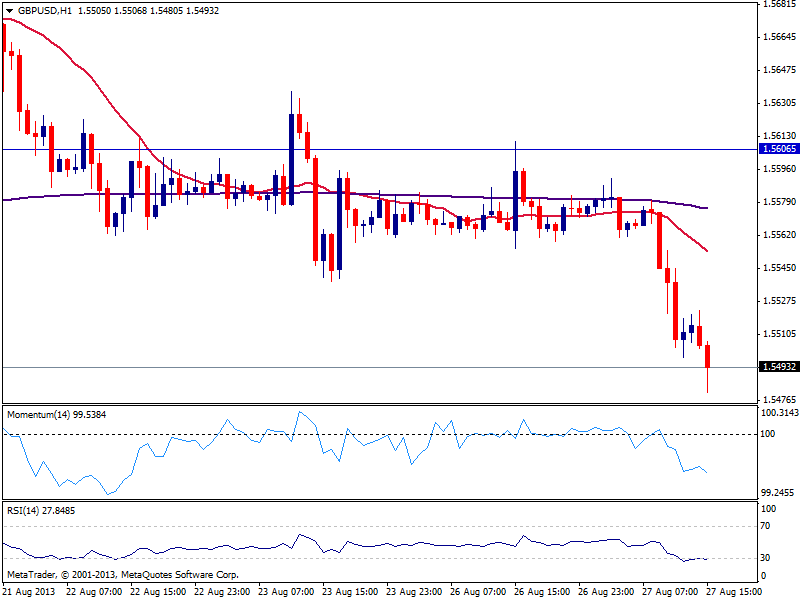

GBP/USD Current price: 1.5493

View Live Chart for the GBP/USD

The GBP/USD accelerates south, trading below 1.5500 for the first time in two weeks. The hourly chart shows indicators still heading lower despite in oversold territory, while the 4 hours chart finally got rid of the neutral look and presents also a strong bearish tone. 200 EMA in this last time frame is located at 1.5440, and some bounce from the level should be expected if reached. The length and strength of such bounce, should provide further information on the longer term perspective as a shy recovery should signal bears remain in control and further falls will follow.

Support levels: 1.5480 1.5440 1.5400

Resistance levels: 1.5520 1.5550 1.5595

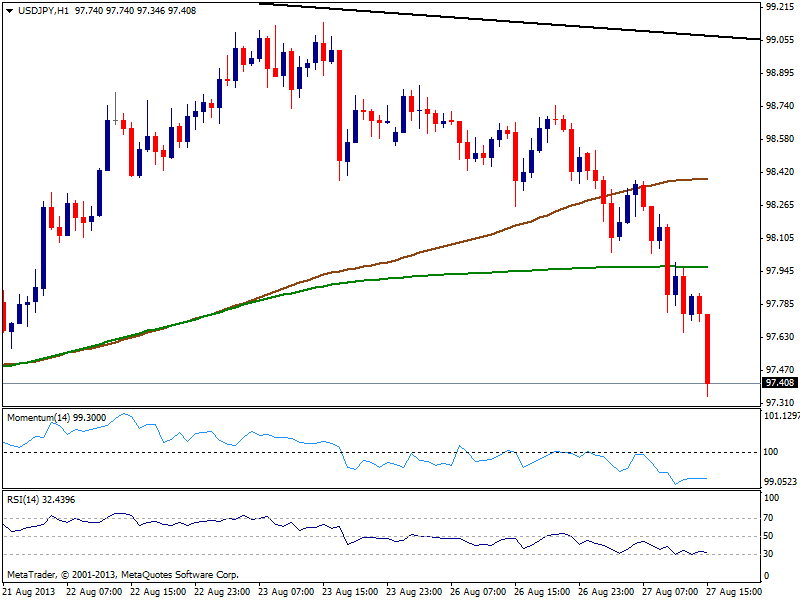

USD/JPY Current price: 97.40

View Live Chart for the USD/JPY

Accumulating over 100 pips down, the USD/JPY presents a strong bearish outlook, with stocks down, gold up, and investors flying to safety. The hourly chart shows indicators heading south in oversold readings, while price breached below 100 and 200 SMAs, this last around 98.00 and offering strong resistance in case of recoveries. Bigger time frames also present a strong bearish tone, eyeing now 96.90 in the short term.

Support levels: 07.20 96.90 96.50

Resistance levels: 97.50 97.90 98.20

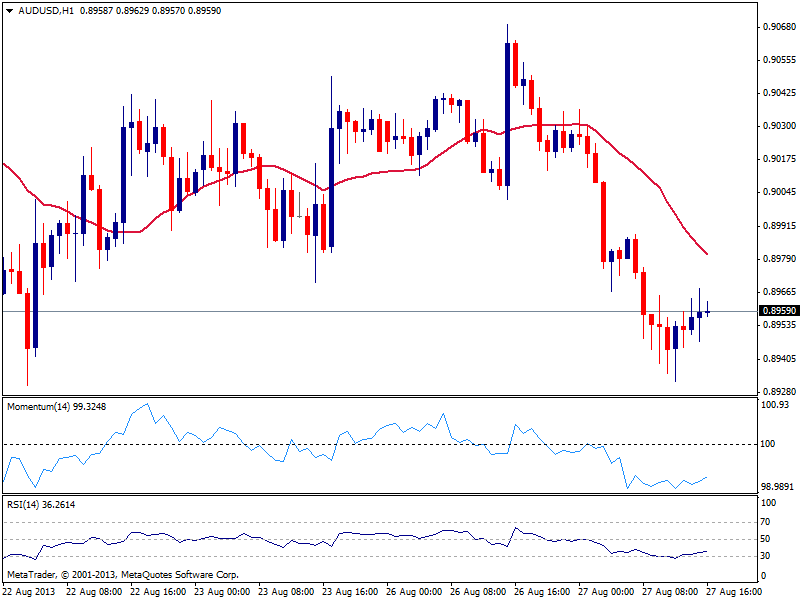

AUD/USD Current price: 0.8959

View Live Chart for the AUD/USD

Aussie resumed its slide against major rivals, reaching a daily low of 0.8932 against the greenback, and holding sub 0.9000. The hourly chart shows price well below a bearish 20 SMA, although indicators correct higher from oversold levels. The 4 hours chart shows indicators flat in negative territory, supporting a short term upward correction before a new leg down. Immediate resistance stands around 0.9010 and as long as below it, the downside is favored.

Support levels: 0.8955 0.8920 0.8870

Resistance levels: 0.9010 0.9050 0.9080

Recommended Content

Editors’ Picks

EUR/USD remains heavy below 1.0550 as focus shifts to US ISM PMI

EUR/USD remians under heavy selling pressure below 1.0550 in early European session on Monday. The pair is dragged down by dovish ECB-speak and a firmer US Dollar following Trump tariffs threat on BRICS-fuelled flight to safety. Investors now look forward to US ISM Manufacturing PMI data due later in the day.

GBP/USD holds losses near 1.2700 on stronger US Dollar

GBP/USD consolidates losses near 1.2700 early Monday, reversing a major part of Friday's positive move. The slide is sponsored by a goodish pickup in the haven demand for the US Dollar, as traders remain wary over the latest Trump tariffs threat on BRICS nations. US ISM PMI is next in focus.

Gold price remains heavily offered amid renewed USD buying interest

Gold price meets with heavy supply on Monday and snaps a four-day winning streak. Rebounding US bond yields help revive the USD demand and weigh on the commodity. Trade war concerns and geopolitical risks do little to lend support to the XAU/USD.

Bitcoin consolidates while ETH, XRP rallies

Bitcoin consolidated on Monday following its recovery from last week's pullback. At the same time, Ethereum and Ripple extended their rallies, driven by investors reallocating capital from BTC to altcoins, signaling the potential for continued upward momentum.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.