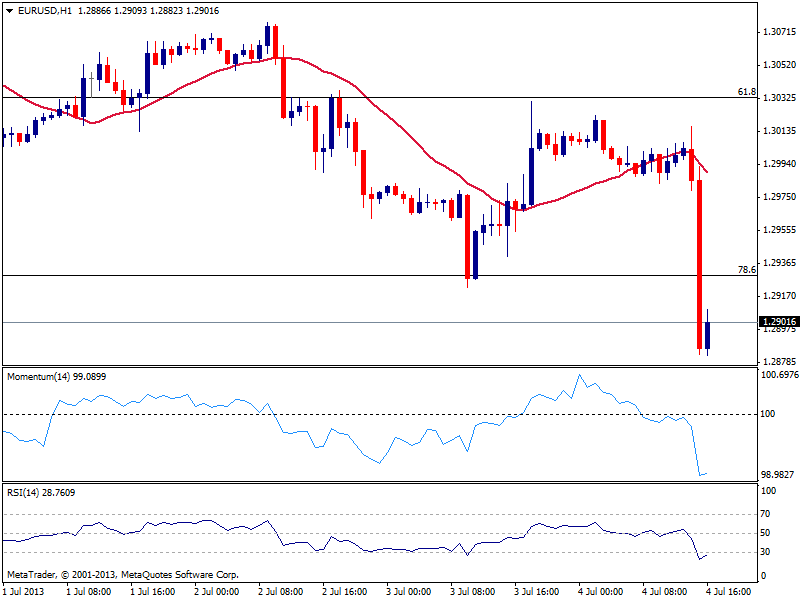

EUR/USD Current price: 1.2904

View Live Chart for the EUR/USD

Not a good day in Europe, as both Central Banks, the BOE and the ECB, came with a dovish stance that sent local currencies strongly down against their American rival. The EUR/USD fell down to 1.2883 so far, finding as expected some buying interest around the strong static support level, yet unable so far to regain ground beyond 1.2920, former low and immediate resistance. With the US market closed on holiday, there’s a chance we lack volume enough to trigger another strong rally, but the downside remains favored with a break to fresh lows opening doors for attest of the 1.2800 area.

Support levels: 1.2880 1.2840 1.2800

Resistance levels: 1.2920 1.2950 1.2985

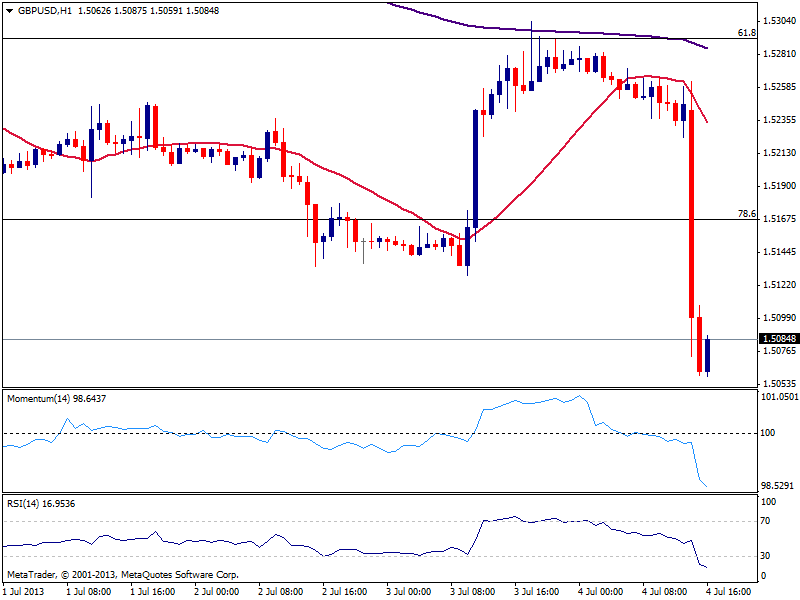

GBP/USD Current price: 1.5085

View Live Chart for the GBP/USD

Extremely oversold in the hourly chart, the GBP/USD was hit hard for an unexpected, also dovish statement from the BOE. The pair reached a daily low of 1.5059 before managing to bounce some, still unable to recover the 1.5100 mark. The 4 hours chart shows a strong bearish momentum that supports further slides once buying interest around 1.5050 gets overcome. The key 1.50 figure should contain the downside, at least today ahead of US employment figures tomorrow.

Support levels: 1.5050 1.5010 1.4970

Resistance levels: 1.5130 1.5160 1.5200

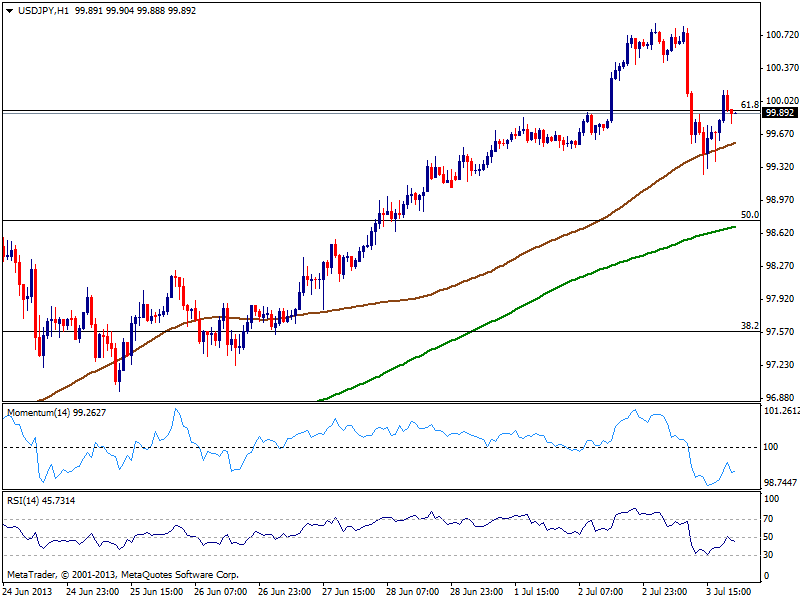

USD/JPY Current price: 100.06

View Live Chart for the USD/JPY

Dollar momentum is helping USD/JPY recover the 100.00 mark, although there has been little reaction in the pair that remains range bound. The hourly chart shows price barely above its 100 SMA currently around 99.80, while indicators stand in neutral territory. In bigger time frames, the pair presents a slightly bullish tone, but limited as long as price stands below 100.30.

Support levels: 99.80 99.50 99.25

Resistance levels: 100.30 100.70 101.10

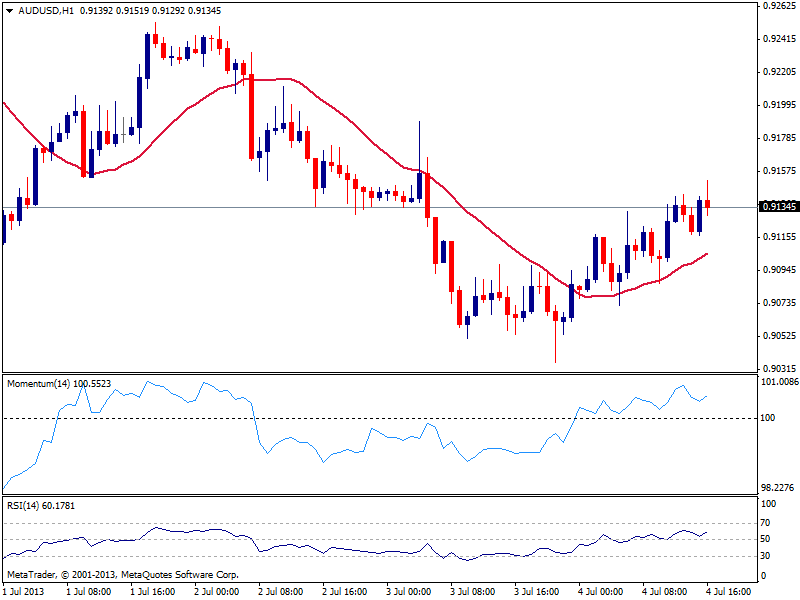

AUD/USD: Current price: 0.9134

View Live Chart for the AUD/USD

The AUD/USD is barely changed after the news, holding near 0.9150 resistance after recovering some ground during past Asian session. The hourly chart shows price heading higher above a bullish 20 SMA that offers dynamic support currently around 0.9105, while indicators head north above their midlines, which supports some gains in the pair. In the 4 hours chart price struggles right below 20 SMA, while indicators head higher still below their midlines: a price acceleration above 0.9150 is now required to confirm an advance up to 0.9200/20 area.

Support levels: 0.9195 0.9060 0.9020

Resistance levels: 0.9150 0.9190 0.9220

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.