RBI policy meet

RBI governor has declared that he's done with raising interest rates since any price spike in farm products would now be seasonal, and is ready to lower them if there are signs of the accelerated easing of price pressures. SLR cut of 0.50 percent and increasing the limits on foreign remittances is an indication of the trend towards normalcy for Indian currency markets.

Our View: It is upto the government to control prices of living essentials. Higher base price effect of last year will bring down headline inflation. It is the inflation outlook which will determine interest rate. The Budget will be the key for the short term.

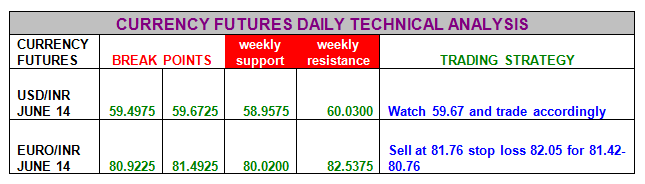

Usd/inr June 2014: A break of 59.67 will result in 60.10 and 60.36. Initial support is at 59.49 and there will be sellers only below 59.67

Euro/inr June 2014: It needs to trade over 80.90 to target 81.36-81.76. Initial support is at 80.90 and there will be sellers as long as euro/inr trades below 8090

Gbp/Inr June 2014: It needs to trade over 100.05 to target 100.20-100.75. Initial support 99.61 and there will be another wave of selling only below 99.61

Jpy/Inr June 2014: It needs t0 trade over 58.05 to target 58.56-58.88. There will be sellers only below 58.05 today.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.