Abenomics is fast proving a bad word in Japan as the overnight moves in the Nikkei put the stock average beyond the 20% drop that qualifies as a bear market while USDJPY pushed down through the recent lows of 95.00 and to the lowest level since the day of announcement of Kuroda’s new BoJ policy on April 4. No surprise to see reports showing Japanese investors repatriating funds from overseas investments for the fourth week in a row. That’s a deep source of further potential gains in the JPY in the nearest term if Japanese investors remain panicky.

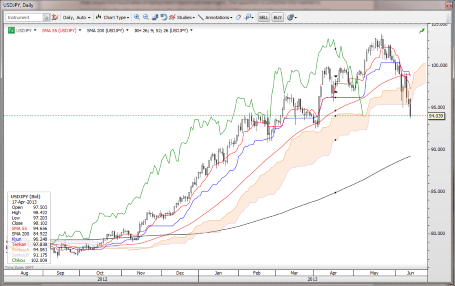

Chart: USDJPY

As for how far this move can go, I would not be one to jump in front of an onrushing train, but with the kind of momentum we’ve seen develop here and assuming global risk appetite remains firmly in the off position, I don’t think 90 (close to the 200-day moving average) is out of the question. Sure, in the longer term perspective, we could be finding great levels to get long the pair again soon, but the current market action should remind us that picking bottoms in a high momentum market is hazardous to your health and that it is best to wait for signs that buyers are arriving and doing so persistently over time before getting involved.

Elsewhere, we see that the US dollar remains broadly under pressure from the USDJPY onslaught, and seems to have thoroughly lost its safe haven status when we see the likes of a USDZAR and USDPLN watching passively from the sideline (the latter even dropping heavily) over the last couple of days. This is really astounding stuff, but at some point, if the general risk off/deleveraging becomes significant enough (watch equities and bonds), investors are going to begin to prefer the liquidity of the US dollar.

The Euro is finding an additional boost this morning after the ECB’s Asmussen was out in a radio interview saying that the ECB can’t solve Europe’s problems and that structural reforms are the way to go, underlining the theme of Euro resilience due to the ECB’s inability to engage in the competitive devaluation game. At these levels above 1.3300 in EURUSD and especially with the single currency arching stronger elsewhere (EURAUD up almost 2,000 pips this quarter anyone?), the risk of rhetorical intervention begins to rise drastically – but it will be real policy signals from the ECB or the US Fed and/or a change in the JPY situation that will put a top in this EURUSD – until then, the bears need to stay patient.

At the RBNZ overnight, governor Wheeler continued to express concern that the currency remains overvalued: “ Despite having fallen over the past few weeks, the New Zealand dollar remains overvalued and continues to be a headwind for the tradables sector.“ The bank also downgraded the growth expectations through March 2014 to 3.00% from the previous 3.30%. The reaction in markets was a bit muted. I though the market was positioned for a more hawkish meeting than what we got, but the reaction in rates markets was practically nil. If we look at the interest rate differentials, AUDNZD should be trading even lower still – perhaps to 1.1700 or so – though the pair got some support on the better than expected Australian employment report out overnight. The question is whether the market is happy to buy the illiquid kiwi when the JPY is trampling all over the market at the moment. Stay tuned.

Looking ahead

Watch out for US Retail Sales as the major highlight of the day and signal for the whether the markets remain in a funk or try to pivot. Keep in mind that EURCHF is also getting dragged lower by the general JPY sell-off theme and that there now seem to be zero expectations surrounding next Thursday’s SNB meeting – perhaps an opportunity to express an upside view with still relatively cheap optionality.Economic Data Highlights

- New Zealand RBNZ Cash Rate kept unchanged at 2.50% as expected

- Australia May Employment Change out at +1.1k vs. -10k expected and +45.0k in Apr.

- Australia May Unemployment Rate out at 5.5% vs. 5.6% expected and 5.6% in Apr.

Upcoming Economic Calendar Highlights (all times GMT)

- Sweden May Average House Prices (0730)

- Canada Apr. New Housing Price Index (1230)

- US May Advance Retail Sales (1230)

- US Weekly Initial Jobless Claims (1230)

- US Weekly Bloomberg Consumer Comfort Survey (1345)

- Sweden Riksbank Governor Ingves to Speak (2200)

- New Zealand May Business NZ PMI (2230)

- Japan BoJ May meeting minutes (2350)

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.