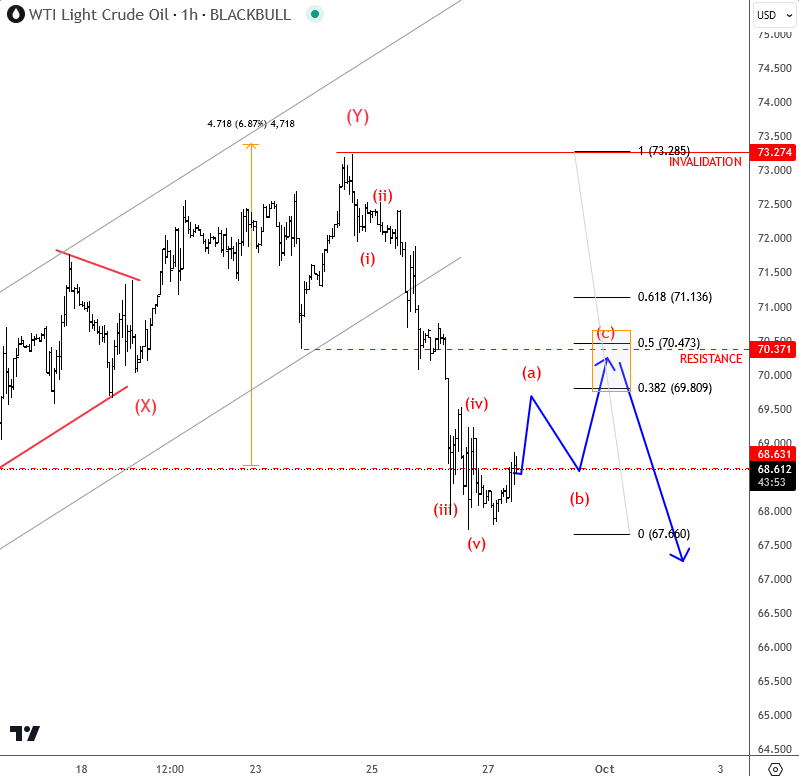

Crude sell-off after a triangle retest

Crude oil is moving sharply to the downside in an impulsive fashion from the 73.27 level, indicating that more weakness is likely ahead. However, we may first see an a-b-c corrective rise, with strong resistance around $70 to $71 per barrel, where the 61.8% Fibonacci level also lies. Our intraday bearish view remains unchanged as long as the market trades below 73.27, where bulls got rejected after retested the triangle resistance line, visible on a daily chart

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.