Crude oil prices eye $100 ahead of Russia sanctions

Global stocks were relatively mixed after Russia’s Vladimir Putin ordered his troops to move to two Ukrainian regions for “peacemaking.” He said that after he agreed to recognize the two regions, which are led by Russian-backed officials. In response to the new events, the United States and other western countries are expected to unveil new sanctions on Russia later today. In Europe, most indices initially dropped after the events and then bounced back since these events were already priced in. In the United States, futures tied to the Dow Jones and the Nasdaq 100 indices retreated slightly.

The S&P 500 index also declined as many short-sellers bet that the index will continue falling in the coming months. According to the WSJ, short bets on the SPDR S&P 500 Trust have risen at the fastest pace in almost a year. They allocated about $8.6 billion to their short positions in the four weeks to Thursday last week. The index has already fallen by about 8.8% this year thanks to a hawkish Federal Reserve. The bank is expected to implement at least three rate hikes this year. Other challenges are the rising costs of doing business and fear that the index is overvalued.

The price of crude oil continued its remarkable rally as investors waited for the upcoming sanctions on Russia. Brent, the global benchmark, moved above $96 for the first time in over 7 years while West Texas Intermediate (WT) soared to $95. Therefore, investors have started positioning themselves for a $100 oil. Another reason why prices are rising is the overall view that global demand is rising as economic strength resumes. For example, data from Europe published on Monday showed that the flash manufacturing and services PMIs increased in February. And today, data by the Ifo Institute revealed that the German current assessment and business climate increased in February.

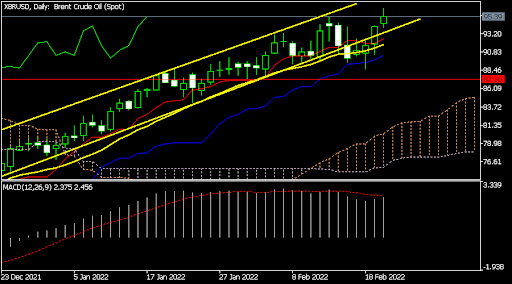

XBR/USD

The XBRUSD pair rose to 96.50, which is a multi-year high. This is an excellent performance since it declined below 15 in 2020. On the daily chart, the pair approached the upper side of the ascending channel. It also moved above the 25-day and 50-day moving averages and the Ichimoku cloud. Oscillators are at elevated levels. Therefore, while the bullish trend is set to continue, there is a likelihood that the price will retreat when the sanctions are unveiled.

EUR/USD

The EURUSD pair rose after the latest sentiment data from Germany. It is trading at 1.1352, which was the highest point since Monday. On the four-hour chart, the pair is between the key support and resistance levels at 1.1300 and 1.1386. It has moved slightly above the 25-day moving average while the DeMarker indicator has moved above the oversold level. Therefore, the pair will likely remain in this range during the American session.

XAU/USD

The XAUUSD pair retreated to a low of 1,895 even as tensions in Ukraine increased. This price was slightly lower than the weekly high of 1,915. It has moved above the short and long-term moving averages while the Relative Strength Index (RSI) has moved below the overbought level. The pair will likely be a bit volatile later today.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.