Crude Oil Price Surges as the UK Bans Fracking

It was a sea of green in the world’s stock market as traders continued to cheer the possibility of a trade deal between the United States and China. The two countries were expected to sign a far-reaching trade agreement in Chile but it was canceled. They are now looking for a neutral country where they will sign the deal. A deal between the two countries will go a long way to calming the global economy, which has declined significantly due to the current uncertainties. The market is also cheering the calm situation after the risks of a no-deal Brexit reduced. In Europe, the DAX, FTSE, and CAC rose by 145, 80, and 60 points respectively. In the United States, the Dow and S&P500 futures rose by 130 and 15 points respectively.

The euro declined today even after some positive numbers from Europe. In the European Union, manufacturing PMI rose to 45.9 from the previous 45.7. The market was expecting the PMI to have remained unchanged. The Sentix investor confidence declined by -4.5. This was better than the previous decline of -16.8. In the United Kingdom, construction PMI rose to 44.2 from the previous 43.3. In Germany, the PMI increased from 41.7 to 42.1 and in France, it increased from 50.1 to 50.7. These numbers show that the EU economy is seeing some improvements.

The Australian dollar declined today after the country released its retail sales data. In September, retail sales growth declined to 0.2% from the previous 0.4%. The market was expecting sales to grow by 0.5%. In the third quarter, retail sales growth contracted by -0.1% from the previous increase of 0.2%. Meanwhile, job advertisements in September declined by -1.0%. These numbers came a day before the RBA is expected to release its interest rates decision. The bank is expected to leave rates unchanged at 0.75%. It also came a day when the second-biggest Australian bank, Westpac, announced a fresh bid to raise $1.7 billion in new capital. In recent months, Australian banks have struggled because of low interest rates, public inquiries, and slow growth.

AUD/USD

The AUD/USD pair declined from a high of 0.6925 to a low of 0.6900. On the 30-minute chart, the pair is trading below the 14-day and 28-day moving averages. It is also under the lower line of the ascending triangle pattern shown in the chart below. The RSI has declined from an important resistance of 63 to a low of 42. The pair may drop further during the American session as markets await a dovish RBA.

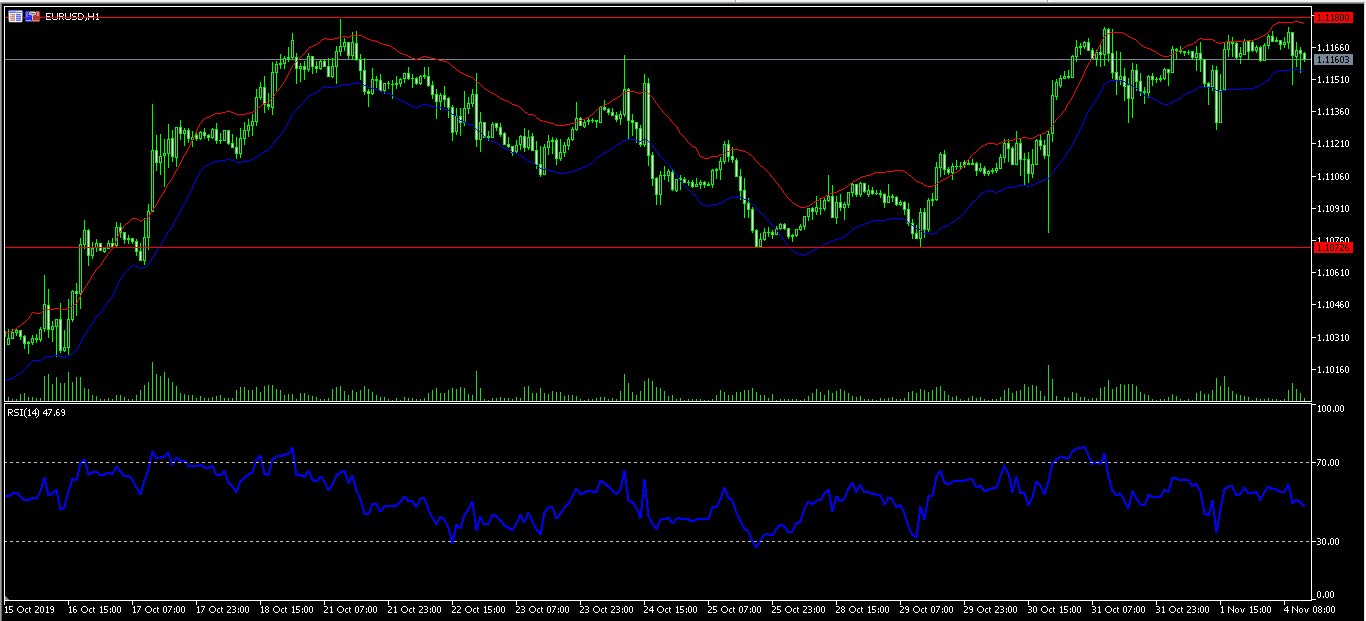

EUR/USD

The EUR/USD pair declined slightly even after the better-than-expected PMI data from Europe. The pair is trading at 1.1160, which is slightly below Friday’s close of 1.1175. On the hourly chart, the pair’s envelopes indicator has widened and the price is along the lower line of the bands. The pair also appears to have formed a cup and handle pattern. As expected, the RSI is at the neutral level of 50. The pair may remain along the current level before making a major breakout.

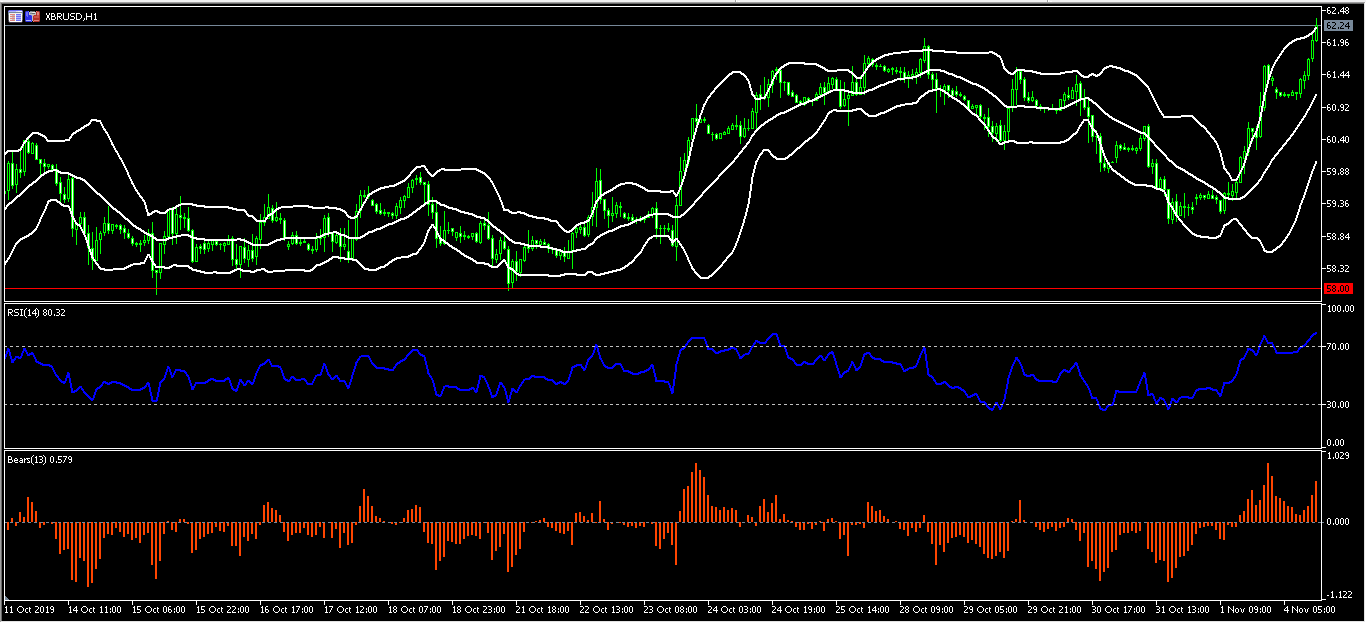

XBR/USD

The price of crude oil jumped after Saudi Aramco launched its process to become a listed company. The price also reacted to a new directive by the UK government banning fracking. The XBR/USD pair reached a high of 62.30, which is the highest level since September 25. On the hourly chart, the pair is trading along the upper line of Bollinger Bands. The RSI has moved to the overbought zone while the Bears Power has been gaining. While the pair may continue rising, there is a possibility that it will have a minor pullback.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.