Crude Oil plunges on weak demand outlook: WTI could be in a steep wave ((iii)) decline

Oil sinks on renewed demand concerns and geopolitical friction

Crude oil prices began the week under pressure, falling sharply on Monday amid a resurgence of macroeconomic and geopolitical headwinds. Brent crude settled near $65.80, while WTI crude fell to $62.02, down nearly 2% on the day. The market’s downward reaction reflects a potent mix of bearish fundamentals:

- Weakening demand outlook from key consumer China, as economic activity shows signs of deceleration.

- Escalating U.S.-China tariff tensions, dampening the broader commodity sentiment.

- Progress in Iran nuclear talks, which raises the possibility of Iranian crude returning to the global market, potentially tipping the supply-demand balance into surplus.

The sell-off reinforces oil’s vulnerability to demand-side shocks, especially when paired with rising geopolitical uncertainty. The fear is simple but significant: a wave of new Iranian supply hitting a market already worried about consumption softness could lead to excess inventory and further price erosion.

Elliott Wave analysis: Wave ((iii)) could be unfolding with strong downside potential

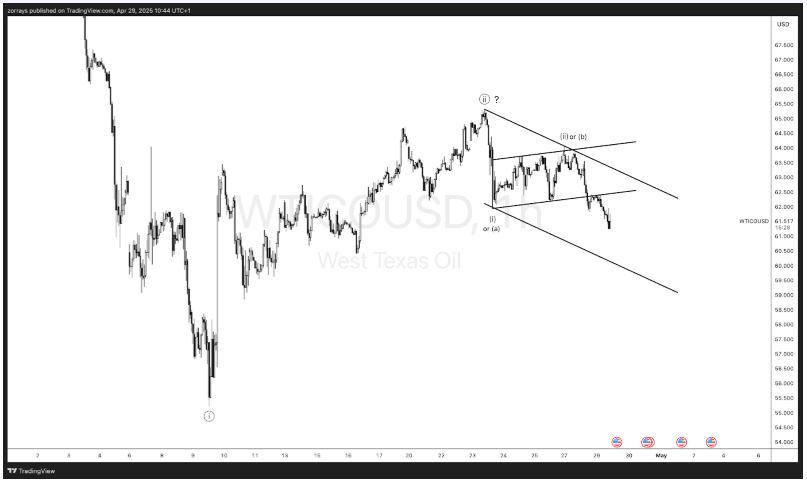

The recent technical structure supports the bearish sentiment as well. Using the attached Elliott Wave count, we can dissect where WTI may currently stand in its correction.

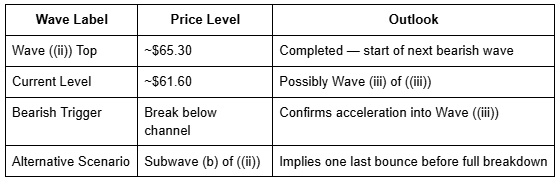

Wave ((ii)) completed at $65.30—The start of a new leg down?

From a wave perspective, it's likely that Wave ((ii)) completed at around $65.30 per barrel, marking the top of a corrective recovery. Since then, price has dropped sharply, falling through key support levels and approaching $61.60, which could potentially mark Wave (iii) of ((iii)).

This structure is significant. Wave ((iii)) is typically the most powerful in motive sequences, and Wave (iii) within it is often the steepest and most impulsive. The price now appears to be respecting a descending channel, but if this interpretation is correct, we may soon see a break below the channel, in line with Elliott Wave channeling guidelines. Such a move would confirm the strength of the bearish trend.

What if we’re still in wave ((ii))?

However, it's important to keep in mind the alternative scenario. If we don’t see an aggressive follow-through to the downside, there is still a possibility that WTI is in a subwave (b) of Wave ((ii)), meaning one more push upward could materialize before the full decline unfolds. This alternate view allows for another upward corrective leg before the main bearish trend resumes.

Technical summary

Conclusion

Crude oil’s current decline is fueled by a potent cocktail of macroeconomic fears and technical weakness. The combination of slowing demand, geopolitical uncertainty, and technical pressure could drive prices even lower, particularly if the Elliott Wave count proves accurate.

Investors should watch closely for a decisive break below the descending channel. If it occurs, it would strongly support the view that we are in the middle of Wave (iii) of ((iii)), which typically brings aggressive selling and high momentum.

On the other hand, patience is required if the market stalls here, as the alternative count leaves room for one last corrective bounce. Either way, volatility seems poised to remain high, and short-term positioning will require careful risk management.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.